Forensic accounting software specializes in detecting fraud and analyzing financial discrepancies by employing data mining and anomaly detection tools tailored for investigative purposes. Auditing software focuses on ensuring compliance, accuracy, and efficiency in financial statement audits through automated sampling, risk assessment, and reporting features. Discover how these distinct software solutions can enhance your financial oversight and integrity.

Why it is important

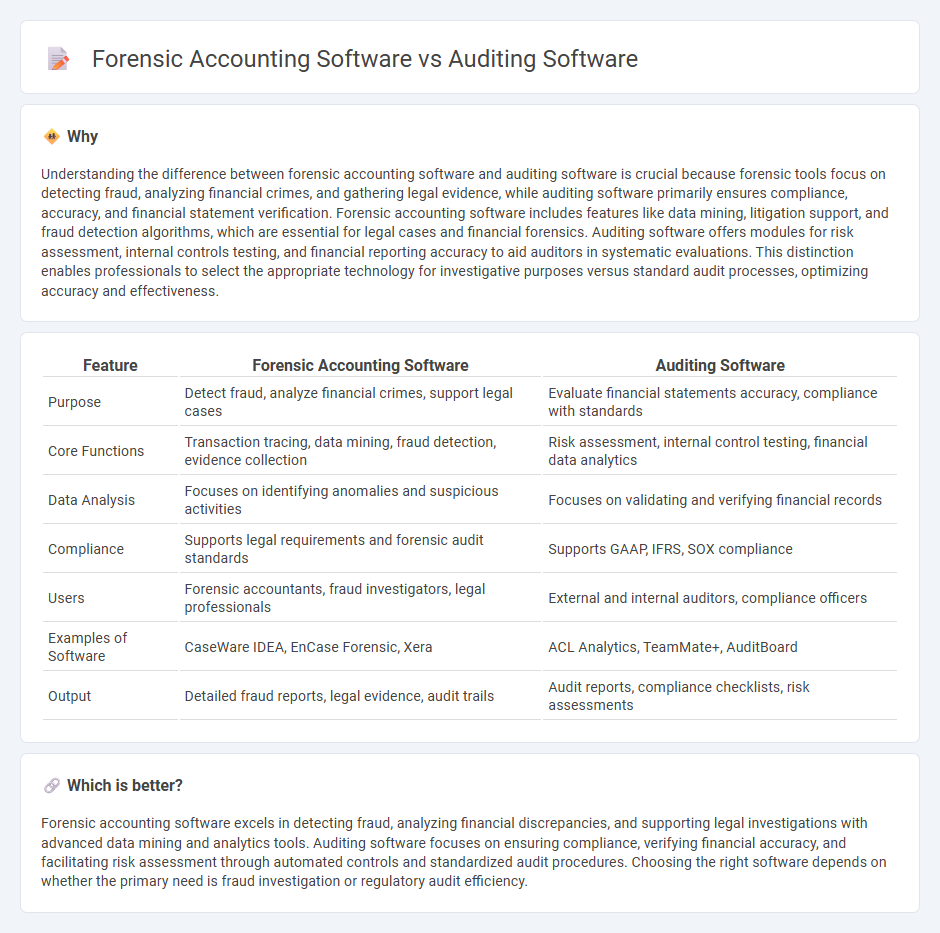

Understanding the difference between forensic accounting software and auditing software is crucial because forensic tools focus on detecting fraud, analyzing financial crimes, and gathering legal evidence, while auditing software primarily ensures compliance, accuracy, and financial statement verification. Forensic accounting software includes features like data mining, litigation support, and fraud detection algorithms, which are essential for legal cases and financial forensics. Auditing software offers modules for risk assessment, internal controls testing, and financial reporting accuracy to aid auditors in systematic evaluations. This distinction enables professionals to select the appropriate technology for investigative purposes versus standard audit processes, optimizing accuracy and effectiveness.

Comparison Table

| Feature | Forensic Accounting Software | Auditing Software |

|---|---|---|

| Purpose | Detect fraud, analyze financial crimes, support legal cases | Evaluate financial statements accuracy, compliance with standards |

| Core Functions | Transaction tracing, data mining, fraud detection, evidence collection | Risk assessment, internal control testing, financial data analytics |

| Data Analysis | Focuses on identifying anomalies and suspicious activities | Focuses on validating and verifying financial records |

| Compliance | Supports legal requirements and forensic audit standards | Supports GAAP, IFRS, SOX compliance |

| Users | Forensic accountants, fraud investigators, legal professionals | External and internal auditors, compliance officers |

| Examples of Software | CaseWare IDEA, EnCase Forensic, Xera | ACL Analytics, TeamMate+, AuditBoard |

| Output | Detailed fraud reports, legal evidence, audit trails | Audit reports, compliance checklists, risk assessments |

Which is better?

Forensic accounting software excels in detecting fraud, analyzing financial discrepancies, and supporting legal investigations with advanced data mining and analytics tools. Auditing software focuses on ensuring compliance, verifying financial accuracy, and facilitating risk assessment through automated controls and standardized audit procedures. Choosing the right software depends on whether the primary need is fraud investigation or regulatory audit efficiency.

Connection

Forensic accounting software and auditing software are interconnected tools designed to enhance financial investigation and compliance processes. Forensic accounting software focuses on detecting fraud, analyzing complex transactions, and tracing financial discrepancies, while auditing software streamlines the systematic examination of financial records, ensuring accuracy and regulatory adherence. Integrating these technologies enables organizations to improve risk assessment, uncover suspicious activities efficiently, and maintain robust internal controls.

Key Terms

Data Analysis

Auditing software primarily concentrates on validating financial records for accuracy and compliance through automated data analysis techniques like trend identification and anomaly detection. Forensic accounting software emphasizes detecting fraud and uncovering financial discrepancies using advanced data mining, pattern recognition, and forensic data analysis tools. Explore how integrating both software types enhances financial investigation and assurance capabilities.

Fraud Detection

Auditing software primarily assists in systematically reviewing financial records to ensure accuracy and compliance, while forensic accounting software specializes in detecting and analyzing fraudulent activities through detailed data analysis and anomaly detection. Fraud detection capabilities in forensic tools often include advanced algorithms for transaction pattern recognition, data mining, and electronic evidence gathering, which surpass traditional auditing functions. Explore the unique features and benefits of both to enhance your organization's fraud prevention strategies.

Compliance Testing

Auditing software is designed primarily to streamline compliance testing by automating risk assessments and transaction verifications, ensuring adherence to regulatory standards such as SOX and IFRS. Forensic accounting software, however, specializes in detecting financial fraud and anomalies through in-depth data analysis and investigative tools tailored for legal evidence collection. Discover how each software type enhances compliance testing and financial integrity by exploring their unique features and applications.

Source and External Links

10 Best Audit Software & Apps of 2025 | SafetyCulture - SafetyCulture lists top auditing software like Onspring, which offers process automation and analytics, and Intellect, a no-code platform for customizable audit workflows with mobile support, suitable for businesses of varied sizes and industries in 2025.

AuditFile | Secure, Cloud-Based Audit Software for CPAs - AuditFile provides a secure, cloud-based platform designed specifically for accountants to streamline audits, reviews, compilations, and integrate methodology with risk assessment and reporting, recognized as a top audit engagement tool.

Internal Audit Software Solution | Ncontracts - Ncontracts offers advanced internal audit software focused on automating processes, reducing risks and operational costs, and enhancing transparency, notably used by thousands of financial institutions for efficient, risk-based auditing.

dowidth.com

dowidth.com