Real-time expense recognition records costs immediately as they occur, enhancing accuracy in financial reporting and cash flow management. Capitalization, in contrast, defers expense recognition by recording costs as assets, spreading them over an asset's useful life to match revenues. Explore deeper insights into how choosing between these methods impacts financial statements and tax strategies.

Why it is important

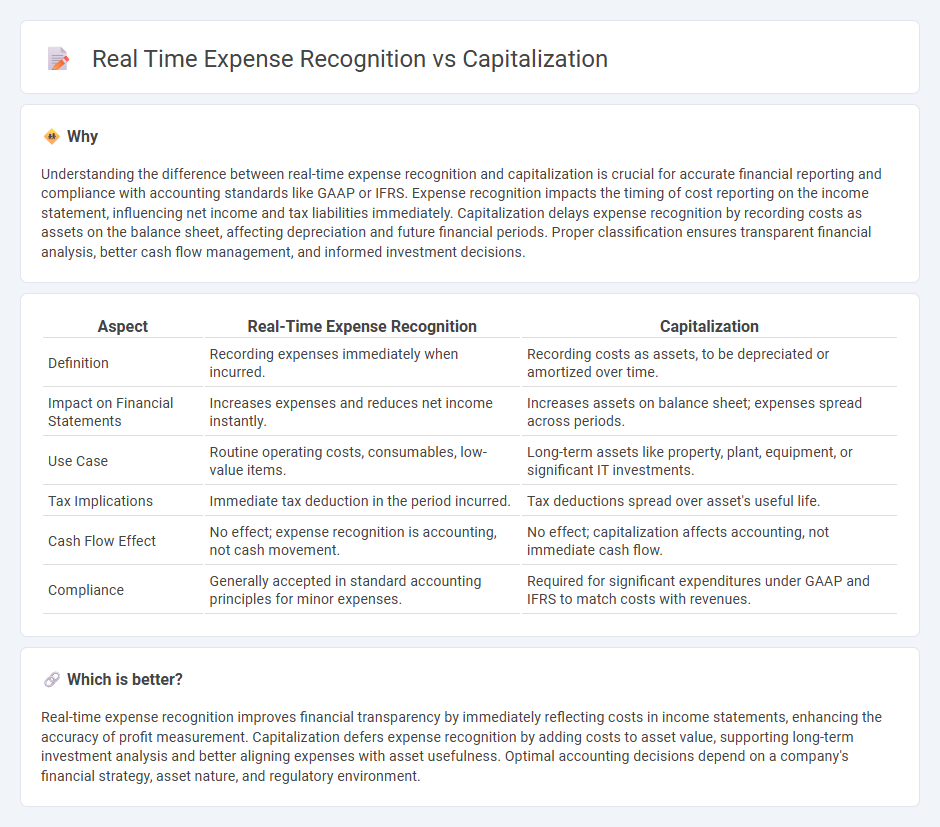

Understanding the difference between real-time expense recognition and capitalization is crucial for accurate financial reporting and compliance with accounting standards like GAAP or IFRS. Expense recognition impacts the timing of cost reporting on the income statement, influencing net income and tax liabilities immediately. Capitalization delays expense recognition by recording costs as assets on the balance sheet, affecting depreciation and future financial periods. Proper classification ensures transparent financial analysis, better cash flow management, and informed investment decisions.

Comparison Table

| Aspect | Real-Time Expense Recognition | Capitalization |

|---|---|---|

| Definition | Recording expenses immediately when incurred. | Recording costs as assets, to be depreciated or amortized over time. |

| Impact on Financial Statements | Increases expenses and reduces net income instantly. | Increases assets on balance sheet; expenses spread across periods. |

| Use Case | Routine operating costs, consumables, low-value items. | Long-term assets like property, plant, equipment, or significant IT investments. |

| Tax Implications | Immediate tax deduction in the period incurred. | Tax deductions spread over asset's useful life. |

| Cash Flow Effect | No effect; expense recognition is accounting, not cash movement. | No effect; capitalization affects accounting, not immediate cash flow. |

| Compliance | Generally accepted in standard accounting principles for minor expenses. | Required for significant expenditures under GAAP and IFRS to match costs with revenues. |

Which is better?

Real-time expense recognition improves financial transparency by immediately reflecting costs in income statements, enhancing the accuracy of profit measurement. Capitalization defers expense recognition by adding costs to asset value, supporting long-term investment analysis and better aligning expenses with asset usefulness. Optimal accounting decisions depend on a company's financial strategy, asset nature, and regulatory environment.

Connection

Real-time expense recognition and capitalization are interconnected through their impact on financial reporting accuracy and asset management. Immediate recording of expenses ensures timely reflection of costs, while capitalization defers expenses by converting qualifying costs into assets, affecting depreciation and financial statements. Together, these processes optimize cash flow analysis, tax planning, and compliance with accounting standards such as IFRS and GAAP.

Key Terms

Asset

Capitalization involves recording costs as an asset on the balance sheet, allowing for depreciation over time, while real-time expense recognition immediately charges costs to the income statement. Assets recognized through capitalization typically include property, equipment, or intellectual property, which provide future economic benefits. Discover more about how these accounting methods impact financial reporting and asset management.

Expense

Expense recognition directly impacts financial statements by reporting costs as incurred, ensuring accurate matching of expenses with revenues. Unlike capitalization, which defers expense recognition by treating costs as assets, real-time expense recognition improves transparency and provides a more immediate reflection of operational performance. Explore how prioritizing real-time expense recognition can enhance financial accuracy and compliance.

Depreciation

Capitalization involves recording an asset's cost on the balance sheet, then allocating its expense over the asset's useful life through depreciation. Real-time expense recognition, by contrast, immediately records the entire cost as an expense, avoiding depreciation schedules. Explore the detailed impacts of each approach on financial statements and tax implications to optimize your accounting strategy.

Source and External Links

Capitalization - Explains the concept of capitalization in various languages, including conventions and historical changes in English capitalization rules.

Capitalization Rules and Examples - Provides guidelines on when to capitalize words in English, including proper nouns and the first word of a sentence.

Title Case Converter - Offers a tool for converting text to different title cases, based on various style guides like AMA, AP, APA, MLA, and Chicago.

dowidth.com

dowidth.com