Integrated reporting combines financial and non-financial data to provide a holistic view of an organization's value creation over time, emphasizing connectivity between strategy, governance, and performance. Triple bottom line reporting focuses on measuring an organization's social, environmental, and economic impacts to assess sustainability and corporate responsibility. Explore detailed comparisons to understand how each framework supports strategic decision-making and stakeholder communication.

Why it is important

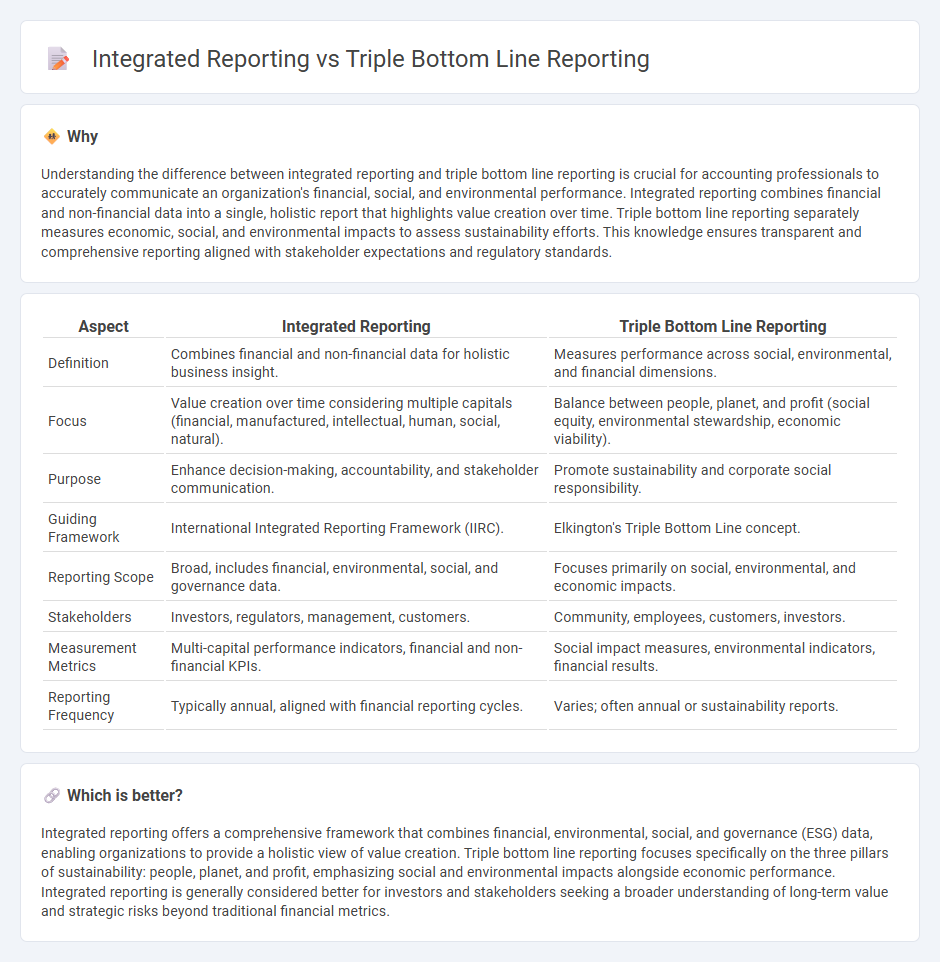

Understanding the difference between integrated reporting and triple bottom line reporting is crucial for accounting professionals to accurately communicate an organization's financial, social, and environmental performance. Integrated reporting combines financial and non-financial data into a single, holistic report that highlights value creation over time. Triple bottom line reporting separately measures economic, social, and environmental impacts to assess sustainability efforts. This knowledge ensures transparent and comprehensive reporting aligned with stakeholder expectations and regulatory standards.

Comparison Table

| Aspect | Integrated Reporting | Triple Bottom Line Reporting |

|---|---|---|

| Definition | Combines financial and non-financial data for holistic business insight. | Measures performance across social, environmental, and financial dimensions. |

| Focus | Value creation over time considering multiple capitals (financial, manufactured, intellectual, human, social, natural). | Balance between people, planet, and profit (social equity, environmental stewardship, economic viability). |

| Purpose | Enhance decision-making, accountability, and stakeholder communication. | Promote sustainability and corporate social responsibility. |

| Guiding Framework | International Integrated Reporting Framework (IIRC). | Elkington's Triple Bottom Line concept. |

| Reporting Scope | Broad, includes financial, environmental, social, and governance data. | Focuses primarily on social, environmental, and economic impacts. |

| Stakeholders | Investors, regulators, management, customers. | Community, employees, customers, investors. |

| Measurement Metrics | Multi-capital performance indicators, financial and non-financial KPIs. | Social impact measures, environmental indicators, financial results. |

| Reporting Frequency | Typically annual, aligned with financial reporting cycles. | Varies; often annual or sustainability reports. |

Which is better?

Integrated reporting offers a comprehensive framework that combines financial, environmental, social, and governance (ESG) data, enabling organizations to provide a holistic view of value creation. Triple bottom line reporting focuses specifically on the three pillars of sustainability: people, planet, and profit, emphasizing social and environmental impacts alongside economic performance. Integrated reporting is generally considered better for investors and stakeholders seeking a broader understanding of long-term value and strategic risks beyond traditional financial metrics.

Connection

Integrated reporting combines financial, environmental, social, and governance data to provide a holistic view of a company's performance, aligning closely with the principles of triple bottom line reporting, which evaluates economic, environmental, and social impacts. Both frameworks emphasize transparency and accountability in accounting by incorporating non-financial factors alongside traditional financial metrics. This connection enhances stakeholders' understanding of long-term value creation and sustainable business practices.

Key Terms

Sustainability

Triple Bottom Line (TBL) reporting emphasizes the three pillars of sustainability: social, environmental, and economic impacts, providing a broad assessment of organizational performance beyond financial metrics. Integrated Reporting (IR) synthesizes financial and non-financial data into a cohesive narrative, highlighting how sustainability factors contribute to long-term value creation and strategic goals. Explore deeper insights into how these reporting frameworks drive transparency and sustainable business practices.

Stakeholders

Triple bottom line reporting emphasizes environmental, social, and economic impacts to meet the needs of diverse stakeholders, including communities, employees, and investors. Integrated reporting combines financial and non-financial data to provide a holistic view of value creation over time for all stakeholders, aligning strategy, governance, and performance. Explore how these reporting frameworks reshape stakeholder engagement and decision-making.

Value Creation

Triple bottom line reporting centers on measuring a company's social, environmental, and economic impacts to gauge sustainability performance, emphasizing the balance among people, planet, and profit. Integrated reporting goes further by combining financial and non-financial data into a cohesive narrative, illustrating how value is created over time for multiple stakeholders. Discover how these reporting approaches drive strategic value creation in evolving business landscapes.

Source and External Links

What is the triple bottom line? - The Corporate Governance Institute - The triple bottom line (TBL) is an accounting framework expanding the traditional profit focus to include social and environmental impacts, commonly summarized as "people, planet, and profits," encouraging businesses to measure success in all three areas.

The Triple Bottom Line Advantage | Fibrenew International - The TBL framework broadens business reporting to cover ecological, social, and financial performance, promoting sustainable capitalism where companies consider their impact on communities and the environment equally with profits.

What is the triple bottom line and why is it important to your ... - Diligent - TBL advocates that companies balance profit, people, and planet simultaneously, asserting that focusing on sustainability and social responsibility can enhance business performance rather than hinder it.

dowidth.com

dowidth.com