Embedded finance accounting integrates financial services directly into non-financial platforms, streamlining transactions and financial reporting through seamless API connections and real-time data. Cryptocurrency accounting involves managing blockchain-based assets, focusing on tracking digital currency transactions, valuation challenges, and regulatory compliance within decentralized ledgers. Explore the key differences and implications of these evolving accounting practices to enhance your financial management strategies.

Why it is important

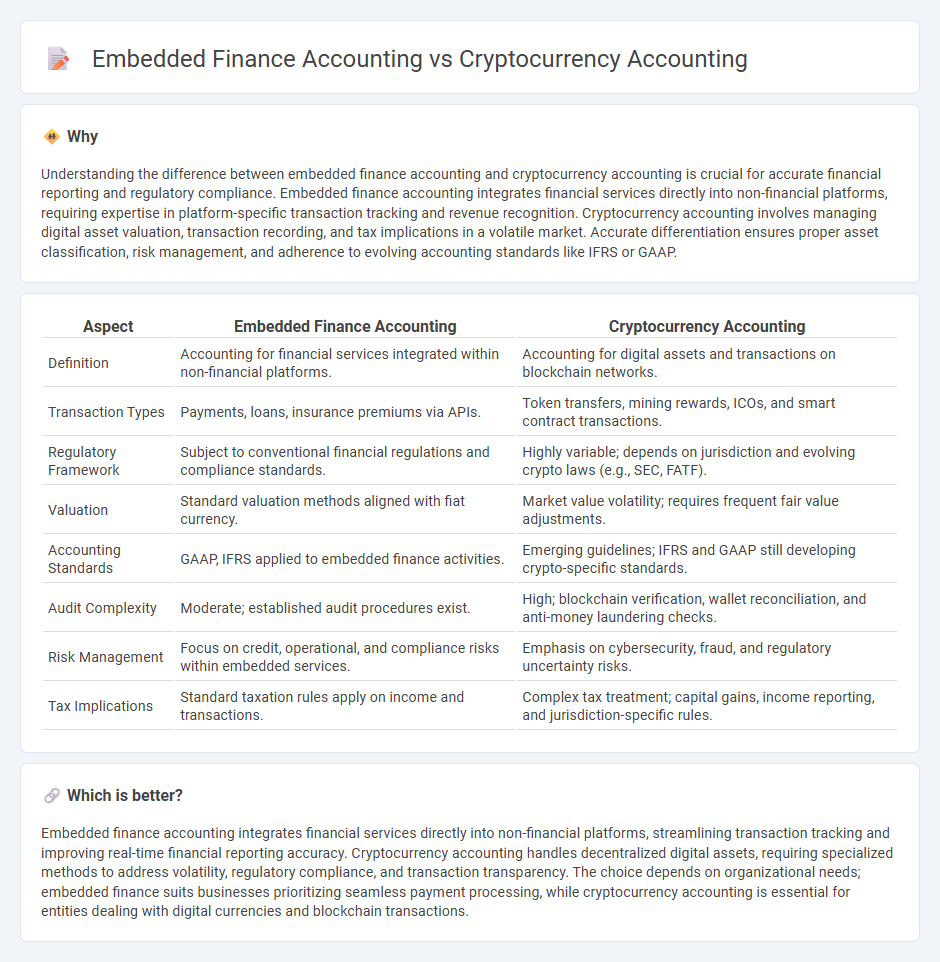

Understanding the difference between embedded finance accounting and cryptocurrency accounting is crucial for accurate financial reporting and regulatory compliance. Embedded finance accounting integrates financial services directly into non-financial platforms, requiring expertise in platform-specific transaction tracking and revenue recognition. Cryptocurrency accounting involves managing digital asset valuation, transaction recording, and tax implications in a volatile market. Accurate differentiation ensures proper asset classification, risk management, and adherence to evolving accounting standards like IFRS or GAAP.

Comparison Table

| Aspect | Embedded Finance Accounting | Cryptocurrency Accounting |

|---|---|---|

| Definition | Accounting for financial services integrated within non-financial platforms. | Accounting for digital assets and transactions on blockchain networks. |

| Transaction Types | Payments, loans, insurance premiums via APIs. | Token transfers, mining rewards, ICOs, and smart contract transactions. |

| Regulatory Framework | Subject to conventional financial regulations and compliance standards. | Highly variable; depends on jurisdiction and evolving crypto laws (e.g., SEC, FATF). |

| Valuation | Standard valuation methods aligned with fiat currency. | Market value volatility; requires frequent fair value adjustments. |

| Accounting Standards | GAAP, IFRS applied to embedded finance activities. | Emerging guidelines; IFRS and GAAP still developing crypto-specific standards. |

| Audit Complexity | Moderate; established audit procedures exist. | High; blockchain verification, wallet reconciliation, and anti-money laundering checks. |

| Risk Management | Focus on credit, operational, and compliance risks within embedded services. | Emphasis on cybersecurity, fraud, and regulatory uncertainty risks. |

| Tax Implications | Standard taxation rules apply on income and transactions. | Complex tax treatment; capital gains, income reporting, and jurisdiction-specific rules. |

Which is better?

Embedded finance accounting integrates financial services directly into non-financial platforms, streamlining transaction tracking and improving real-time financial reporting accuracy. Cryptocurrency accounting handles decentralized digital assets, requiring specialized methods to address volatility, regulatory compliance, and transaction transparency. The choice depends on organizational needs; embedded finance suits businesses prioritizing seamless payment processing, while cryptocurrency accounting is essential for entities dealing with digital currencies and blockchain transactions.

Connection

Embedded finance accounting integrates financial services directly into non-financial platforms, requiring specialized accounting to track seamless transactions and revenue streams, while cryptocurrency accounting manages digital asset valuation, transaction recording, and regulatory compliance. Both fields necessitate advanced ledger technologies and real-time transaction monitoring to ensure accuracy and transparency in financial reporting. Their connection lies in the shared need for innovative accounting systems that handle complex, decentralized financial data within evolving digital ecosystems.

Key Terms

Fair Value Measurement

Cryptocurrency accounting requires frequent fair value measurement due to market volatility, complicating financial reporting and asset valuation. Embedded finance accounting integrates financial services within non-financial platforms, demanding precise fair value assessment to reflect embedded derivatives accurately. Explore comprehensive insights to understand the distinct challenges and methodologies in fair value measurement for both accounting areas.

Revenue Recognition

Cryptocurrency accounting involves recognizing revenue based on the fair value of digital assets at the transaction date, often requiring detailed tracking of volatile market prices and compliance with evolving financial standards like IFRS 9. Embedded finance accounting integrates financial services within non-financial platforms, with revenue recognition centered on commission fees, interest income, or service charges, following ASC 606 guidelines for contract-based revenue. Explore detailed accounting frameworks and best practices to master revenue recognition in both sectors.

Regulatory Compliance

Cryptocurrency accounting requires strict adherence to evolving regulations such as AML and KYC standards enforced by authorities like the SEC and FinCEN, while embedded finance accounting demands compliance with financial regulations including PSD2 and the FCA guidelines for seamless integration of financial services. Both fields necessitate robust audit trails, transparent reporting, and rigorous anti-fraud measures to maintain regulatory compliance. Explore detailed regulatory frameworks and best practices to enhance your accounting strategies in these innovative financial sectors.

Source and External Links

Cryptio: Accounting Software for Digital Assets - Cryptio offers enterprise-grade accounting, audit, and tax software specifically for digital assets, featuring automated transaction categorization, cost-basis computation, GAAP/IFRS compliance, SOC certifications, and robust audit trails.

FASB's New Guidance on Accounting for Crypto Assets - The FASB now requires entities to measure eligible crypto assets at fair value and recognize changes in fair value directly in net income, with mining income recorded at acquisition fair value and related costs expensed as incurred.

Accounting for Cryptocurrency and Digital Assets - Cryptocurrency transactions should be recorded at fair value upon receipt and disposal, reported as income when converted to cash, and tracked separately as investment capital assets for tax purposes, with compliance to IRS payroll and reporting rules when crypto is used for payments.

dowidth.com

dowidth.com