Dynamic discounting leverages early payment discounts by allowing buyers to pay suppliers before invoice due dates in exchange for reduced prices, improving cash flow for both parties. Reverse factoring, also known as supply chain finance, involves a third-party financier who pays the supplier immediately while the buyer settles the invoice later, enhancing liquidity without straining buyer capital. Explore in-depth comparisons of dynamic discounting and reverse factoring to optimize your company's working capital strategy.

Why it is important

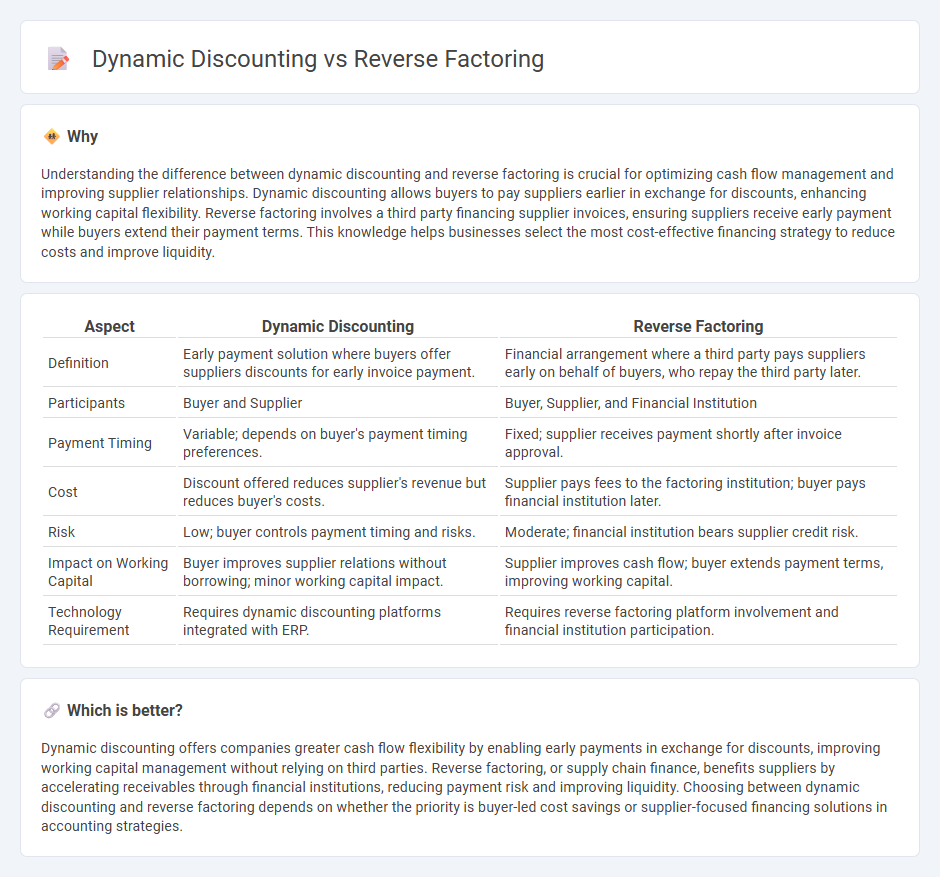

Understanding the difference between dynamic discounting and reverse factoring is crucial for optimizing cash flow management and improving supplier relationships. Dynamic discounting allows buyers to pay suppliers earlier in exchange for discounts, enhancing working capital flexibility. Reverse factoring involves a third party financing supplier invoices, ensuring suppliers receive early payment while buyers extend their payment terms. This knowledge helps businesses select the most cost-effective financing strategy to reduce costs and improve liquidity.

Comparison Table

| Aspect | Dynamic Discounting | Reverse Factoring |

|---|---|---|

| Definition | Early payment solution where buyers offer suppliers discounts for early invoice payment. | Financial arrangement where a third party pays suppliers early on behalf of buyers, who repay the third party later. |

| Participants | Buyer and Supplier | Buyer, Supplier, and Financial Institution |

| Payment Timing | Variable; depends on buyer's payment timing preferences. | Fixed; supplier receives payment shortly after invoice approval. |

| Cost | Discount offered reduces supplier's revenue but reduces buyer's costs. | Supplier pays fees to the factoring institution; buyer pays financial institution later. |

| Risk | Low; buyer controls payment timing and risks. | Moderate; financial institution bears supplier credit risk. |

| Impact on Working Capital | Buyer improves supplier relations without borrowing; minor working capital impact. | Supplier improves cash flow; buyer extends payment terms, improving working capital. |

| Technology Requirement | Requires dynamic discounting platforms integrated with ERP. | Requires reverse factoring platform involvement and financial institution participation. |

Which is better?

Dynamic discounting offers companies greater cash flow flexibility by enabling early payments in exchange for discounts, improving working capital management without relying on third parties. Reverse factoring, or supply chain finance, benefits suppliers by accelerating receivables through financial institutions, reducing payment risk and improving liquidity. Choosing between dynamic discounting and reverse factoring depends on whether the priority is buyer-led cost savings or supplier-focused financing solutions in accounting strategies.

Connection

Dynamic discounting and reverse factoring both enhance cash flow management by optimizing early payment processes between buyers and suppliers. Dynamic discounting allows buyers to receive discounts for early invoice payments, improving liquidity, while reverse factoring involves a financial institution paying suppliers promptly and collecting from buyers later, reducing suppliers' credit risk. Integrating these methods fosters efficient working capital optimization and strengthens supply chain financial stability.

Key Terms

Supply Chain Finance

Reverse factoring accelerates supplier payments by involving a financial institution that pays invoices on behalf of the buyer, improving cash flow and reducing supplier risk within supply chain finance. Dynamic discounting allows buyers to leverage early payment discounts by utilizing their own funds, offering flexibility to optimize working capital and supplier relationships. Discover the strategic advantages and implementation methods of both solutions to enhance your supply chain finance strategy.

Accounts Payable

Reverse factoring improves accounts payable by involving a third-party financer who pays suppliers early, optimizing cash flow and strengthening supplier relationships. Dynamic discounting uses early payment discounts directly between buyers and suppliers, providing flexible, cost-saving options without third-party involvement. Explore detailed comparisons to understand which approach best enhances your accounts payable strategy.

Early Payment Discount

Reverse factoring allows suppliers to receive early payment through a third-party financier based on approved invoices, optimizing cash flow without altering payment terms between buyers and suppliers. Dynamic discounting enables buyers to offer early payment discounts directly to suppliers, adjusting discount rates based on the actual payment date, which improves working capital efficiency. Explore how early payment discount strategies in reverse factoring and dynamic discounting can enhance supplier relationships and financial performance.

Source and External Links

What Is Reverse Factoring? - NetSuite - Reverse factoring is a financing method that enhances cash flow for both buyers and suppliers by utilizing a third-party financier to pay suppliers early.

Invoice Factoring vs Reverse Factoring - This webpage compares invoice factoring and reverse factoring, highlighting their differences and suitability for different business needs.

What is reverse factoring? - Reverse factoring is a supplier finance solution that allows buyers to offer early payments to suppliers based on approved invoices, improving cash flow for both parties.

dowidth.com

dowidth.com