Forensic analytics involves the detailed examination of financial data to detect fraud, uncover hidden patterns, and provide evidence for legal proceedings. Compliance review focuses on ensuring that financial reports and business practices adhere to regulatory standards and internal policies to prevent violations. Explore the key distinctions and applications of forensic analytics and compliance review to enhance your organization's financial governance.

Why it is important

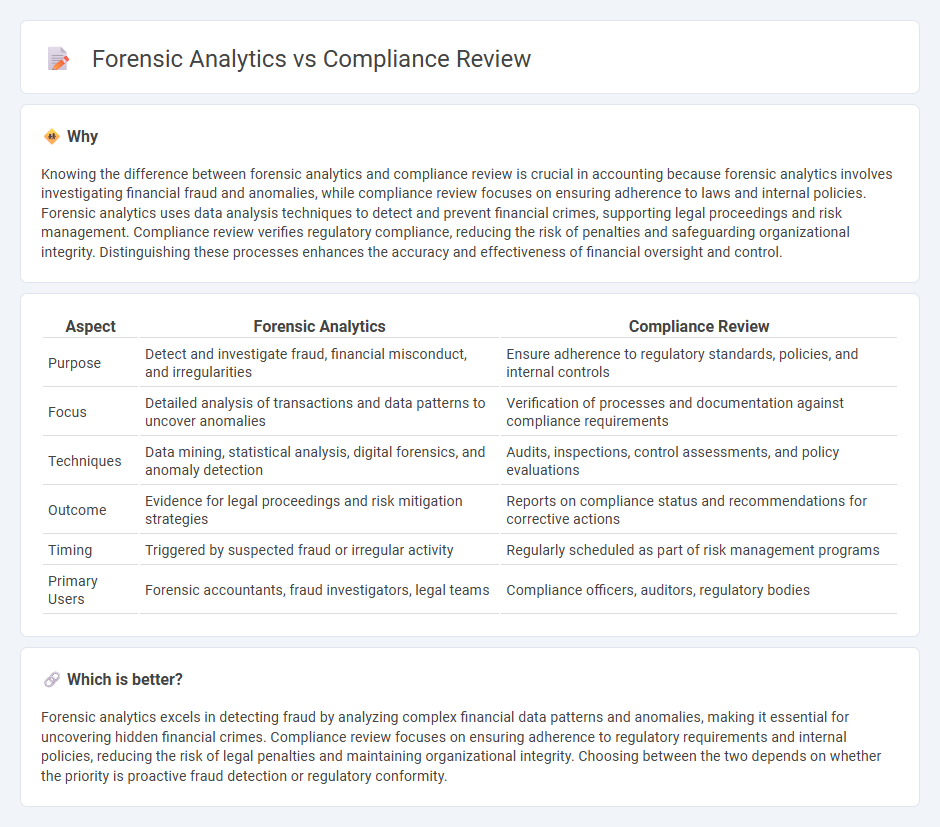

Knowing the difference between forensic analytics and compliance review is crucial in accounting because forensic analytics involves investigating financial fraud and anomalies, while compliance review focuses on ensuring adherence to laws and internal policies. Forensic analytics uses data analysis techniques to detect and prevent financial crimes, supporting legal proceedings and risk management. Compliance review verifies regulatory compliance, reducing the risk of penalties and safeguarding organizational integrity. Distinguishing these processes enhances the accuracy and effectiveness of financial oversight and control.

Comparison Table

| Aspect | Forensic Analytics | Compliance Review |

|---|---|---|

| Purpose | Detect and investigate fraud, financial misconduct, and irregularities | Ensure adherence to regulatory standards, policies, and internal controls |

| Focus | Detailed analysis of transactions and data patterns to uncover anomalies | Verification of processes and documentation against compliance requirements |

| Techniques | Data mining, statistical analysis, digital forensics, and anomaly detection | Audits, inspections, control assessments, and policy evaluations |

| Outcome | Evidence for legal proceedings and risk mitigation strategies | Reports on compliance status and recommendations for corrective actions |

| Timing | Triggered by suspected fraud or irregular activity | Regularly scheduled as part of risk management programs |

| Primary Users | Forensic accountants, fraud investigators, legal teams | Compliance officers, auditors, regulatory bodies |

Which is better?

Forensic analytics excels in detecting fraud by analyzing complex financial data patterns and anomalies, making it essential for uncovering hidden financial crimes. Compliance review focuses on ensuring adherence to regulatory requirements and internal policies, reducing the risk of legal penalties and maintaining organizational integrity. Choosing between the two depends on whether the priority is proactive fraud detection or regulatory conformity.

Connection

Forensic analytics enhances compliance review by utilizing advanced data analysis techniques to identify discrepancies, fraud, and regulatory breaches within financial records. Compliance review relies on these insights to ensure adherence to legal standards and corporate policies, reducing risks of financial misstatements. Integrating forensic analytics into compliance processes improves accuracy, efficiency, and accountability in accounting practices.

Key Terms

**Compliance review:**

Compliance review involves systematically evaluating an organization's adherence to regulatory requirements, internal policies, and industry standards to prevent legal and financial risks. This process utilizes data analysis, documentation audits, and control assessments to identify gaps or non-compliance issues that could result in fines or reputational damage. Explore more to understand how compliance reviews safeguard your business operations and ensure regulatory alignment.

Regulatory Standards

Compliance review emphasizes adherence to regulatory standards by systematically evaluating organizational policies, procedures, and controls to ensure conformity with laws such as GDPR, HIPAA, and SOX. Forensic analytics applies advanced data analysis techniques to detect, investigate, and prevent fraud or misconduct within the framework of these regulations, often uncovering hidden patterns or anomalies. Explore further to understand how these approaches enhance regulatory compliance and risk management.

Internal Controls

Compliance review systematically assesses adherence to laws, regulations, and internal policies to ensure effective internal controls and risk management. Forensic analytics employs advanced data analysis techniques to detect anomalies, fraud, and compliance violations within internal control systems. Explore how integrating these methodologies can enhance your organization's internal control framework.

Source and External Links

Signs You Need a Compliance Review and What to Expect - A compliance review involves consultation, thorough documentation assessment, risk identification, interviews, and gap analysis to ensure adherence to regulatory and industry standards, ending with actionable recommendations tailored to the firm's needs.

Internal Audit 101: Audits vs. Compliance Reviews - Compliance reviews are informal, internally conducted checks using checklists to confirm if processes follow compliance requirements, unlike formal audits by independent parties, and help adjust policies before formal audits.

Compliance Review: What It Is, Why It's Important for Financial ... - Compliance reviews cover all relevant regulatory areas within an organization, require stakeholder involvement, and increasingly leverage technology to minimize risk and strengthen compliance frameworks across functions such as AML, data privacy, and cybersecurity.

dowidth.com

dowidth.com