Payroll automation streamlines salary calculations, tax deductions, and compliance processes by integrating cloud-based systems that minimize manual errors and save time compared to traditional in-house payroll software. In-house payroll software requires regular updates, IT support, and can lead to inefficiencies in managing complex payroll tasks. Explore the benefits and drawbacks of each to determine the best solution for your accounting needs.

Why it is important

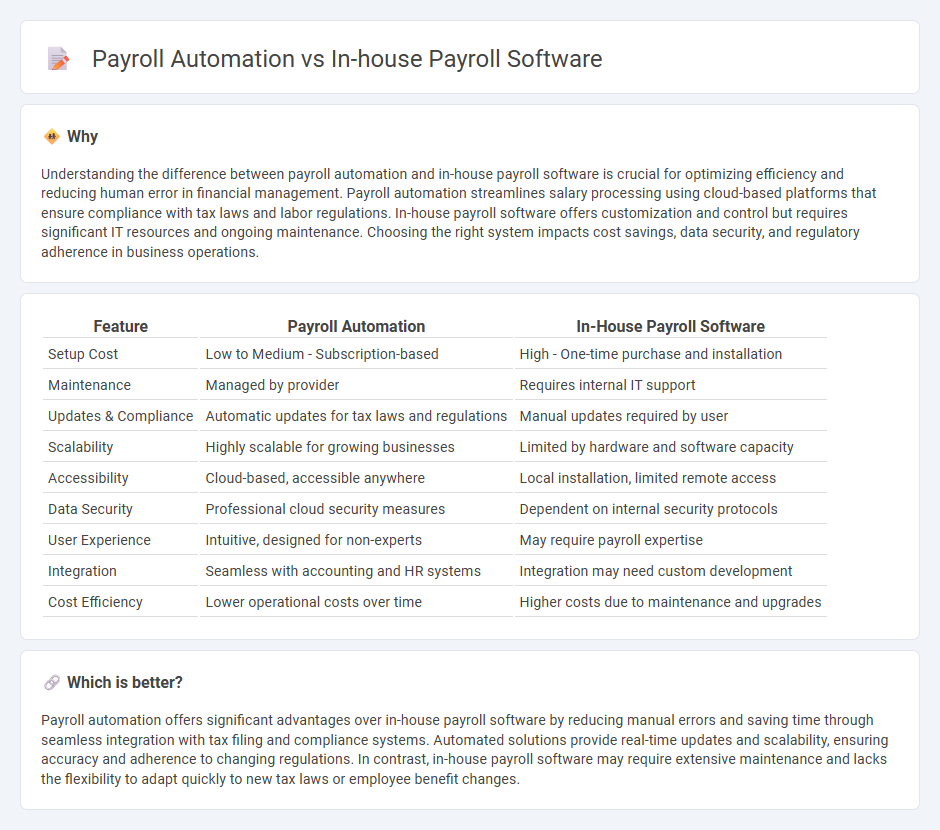

Understanding the difference between payroll automation and in-house payroll software is crucial for optimizing efficiency and reducing human error in financial management. Payroll automation streamlines salary processing using cloud-based platforms that ensure compliance with tax laws and labor regulations. In-house payroll software offers customization and control but requires significant IT resources and ongoing maintenance. Choosing the right system impacts cost savings, data security, and regulatory adherence in business operations.

Comparison Table

| Feature | Payroll Automation | In-House Payroll Software |

|---|---|---|

| Setup Cost | Low to Medium - Subscription-based | High - One-time purchase and installation |

| Maintenance | Managed by provider | Requires internal IT support |

| Updates & Compliance | Automatic updates for tax laws and regulations | Manual updates required by user |

| Scalability | Highly scalable for growing businesses | Limited by hardware and software capacity |

| Accessibility | Cloud-based, accessible anywhere | Local installation, limited remote access |

| Data Security | Professional cloud security measures | Dependent on internal security protocols |

| User Experience | Intuitive, designed for non-experts | May require payroll expertise |

| Integration | Seamless with accounting and HR systems | Integration may need custom development |

| Cost Efficiency | Lower operational costs over time | Higher costs due to maintenance and upgrades |

Which is better?

Payroll automation offers significant advantages over in-house payroll software by reducing manual errors and saving time through seamless integration with tax filing and compliance systems. Automated solutions provide real-time updates and scalability, ensuring accuracy and adherence to changing regulations. In contrast, in-house payroll software may require extensive maintenance and lacks the flexibility to adapt quickly to new tax laws or employee benefit changes.

Connection

Payroll automation streamlines the payroll process by reducing manual data entry and minimizing errors, which is effectively achieved through in-house payroll software tailored to a company's specific needs. In-house payroll software integrates various payroll functions such as tax calculations, employee deductions, and direct deposits, enhancing accuracy and compliance. This synergy between automation and custom software boosts operational efficiency and ensures timely employee compensation within accounting departments.

Key Terms

Manual Data Entry

In-house payroll software often requires manual data entry, increasing the risk of human errors and consuming valuable administrative time. Payroll automation minimizes manual input by integrating with time-tracking and HR systems, enhancing accuracy and efficiency. Discover how payroll automation can transform your payroll process and reduce manual workload.

Integration

In-house payroll software often offers limited integration capabilities, requiring manual data transfers between systems, which can increase the risk of errors and inefficiencies. Payroll automation solutions prioritize seamless integration with accounting, HR, and tax compliance platforms to streamline payroll processing and enhance data accuracy. Explore how advanced integration features in payroll automation can optimize your payroll operations.

Real-Time Processing

In-house payroll software often relies on batch processing, which can delay wage calculations and tax filings, while payroll automation enables real-time processing that updates employee earnings instantly. Real-time payroll automation enhances accuracy, reduces compliance risks, and improves cash flow management by synchronizing data across multiple financial systems immediately. Explore how real-time processing transforms payroll efficiency and compliance in modern businesses.

Source and External Links

Passport Software PBS(tm) Payroll - Offers comprehensive in-house payroll software for small to medium-sized businesses with features like ACH direct deposit and compliance with federal, state, and local taxation.

Payroll Mate - Provides an affordable desktop-based payroll solution that automatically calculates earnings, taxes, and deductions, supporting various payroll tax forms.

CheckMark Payroll - Offers an in-house payroll system with unlimited employees and payrolls for a flat annual fee, suitable for businesses of any size.

dowidth.com

dowidth.com