Integrated ESG reporting focuses specifically on environmental, social, and governance factors within a company's performance framework, emphasizing sustainability and ethical impact. In contrast, integrated reporting combines financial and non-financial data to provide a holistic view of an organization's strategy, governance, and value creation over time. Explore detailed comparisons to understand the implications for modern accounting practices.

Why it is important

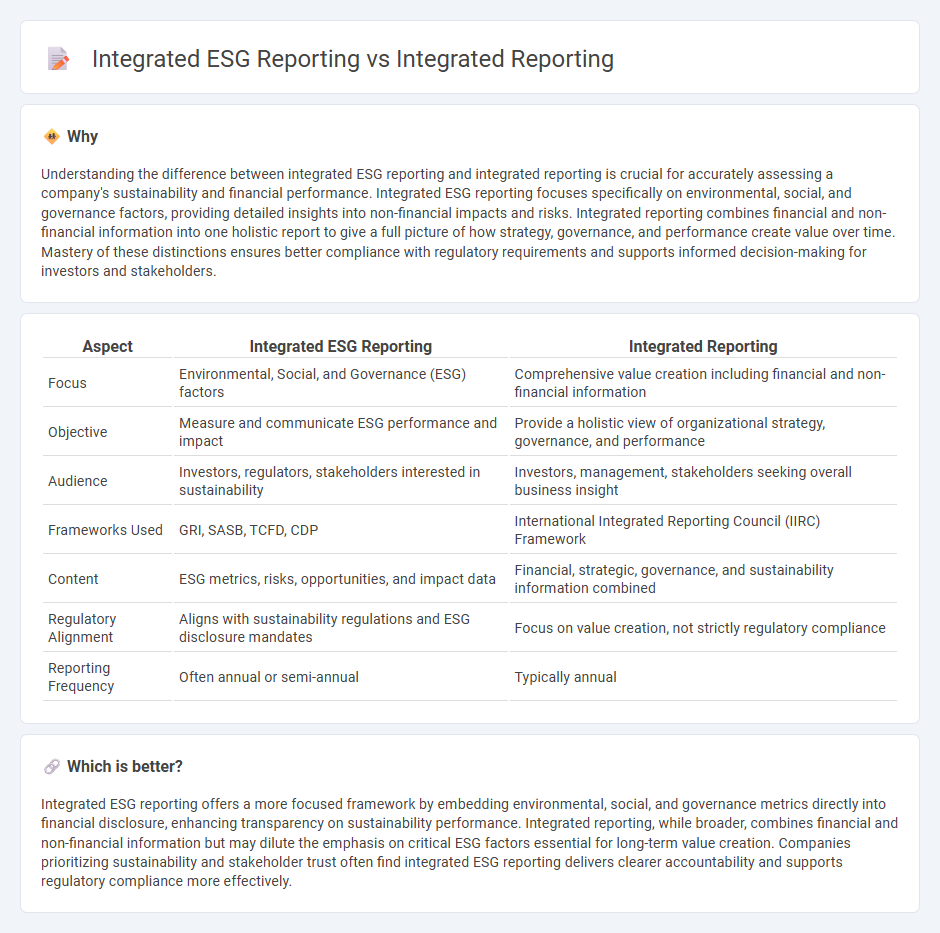

Understanding the difference between integrated ESG reporting and integrated reporting is crucial for accurately assessing a company's sustainability and financial performance. Integrated ESG reporting focuses specifically on environmental, social, and governance factors, providing detailed insights into non-financial impacts and risks. Integrated reporting combines financial and non-financial information into one holistic report to give a full picture of how strategy, governance, and performance create value over time. Mastery of these distinctions ensures better compliance with regulatory requirements and supports informed decision-making for investors and stakeholders.

Comparison Table

| Aspect | Integrated ESG Reporting | Integrated Reporting |

|---|---|---|

| Focus | Environmental, Social, and Governance (ESG) factors | Comprehensive value creation including financial and non-financial information |

| Objective | Measure and communicate ESG performance and impact | Provide a holistic view of organizational strategy, governance, and performance |

| Audience | Investors, regulators, stakeholders interested in sustainability | Investors, management, stakeholders seeking overall business insight |

| Frameworks Used | GRI, SASB, TCFD, CDP | International Integrated Reporting Council (IIRC) Framework |

| Content | ESG metrics, risks, opportunities, and impact data | Financial, strategic, governance, and sustainability information combined |

| Regulatory Alignment | Aligns with sustainability regulations and ESG disclosure mandates | Focus on value creation, not strictly regulatory compliance |

| Reporting Frequency | Often annual or semi-annual | Typically annual |

Which is better?

Integrated ESG reporting offers a more focused framework by embedding environmental, social, and governance metrics directly into financial disclosure, enhancing transparency on sustainability performance. Integrated reporting, while broader, combines financial and non-financial information but may dilute the emphasis on critical ESG factors essential for long-term value creation. Companies prioritizing sustainability and stakeholder trust often find integrated ESG reporting delivers clearer accountability and supports regulatory compliance more effectively.

Connection

Integrated ESG reporting and Integrated Reporting both emphasize the comprehensive disclosure of financial and non-financial information, enabling organizations to present a holistic view of their performance. ESG factors such as environmental impact, social responsibility, and governance practices are embedded within the Integrated Reporting framework to reflect long-term value creation. This connection enhances transparency, accountability, and strategic decision-making by aligning sustainability metrics with financial outcomes.

Key Terms

Value Creation

Integrated reporting combines financial and non-financial data to provide a holistic view of a company's overall performance and strategy, emphasizing long-term value creation for stakeholders. Integrated ESG reporting specifically highlights environmental, social, and governance factors alongside financial results to demonstrate sustainable business practices and their impact on value generation. Explore how these reporting frameworks enhance transparency and strategic decision-making in modern corporate governance.

Sustainability

Integrated reporting combines financial, environmental, social, and governance (ESG) data into a unified framework to provide a holistic view of an organization's performance and strategy. Integrated ESG reporting emphasizes sustainability by specifically highlighting ESG risks, opportunities, and management practices that drive long-term value creation and stakeholder trust. Explore how integrated ESG reporting advances sustainability goals and regulatory compliance to enhance your organization's transparency and impact.

Stakeholder Capital

Integrated reporting combines financial and non-financial data to provide a holistic view of a company's performance, emphasizing value creation over time. Integrated ESG reporting specifically incorporates environmental, social, and governance factors, aligning corporate strategy with stakeholder capital to address sustainability and ethical impacts. Explore how adopting integrated ESG reporting can enhance transparency and stakeholder engagement in your organization.

Source and External Links

Integrated reporting - Integrated reporting (IR) is a process that produces a concise communication about how an organization's strategy, governance, performance, and prospects lead to value creation over short, medium, and long term, combining financial and non-financial information primarily for providers of financial capital allocation decisions.

What is Integrated Reporting? - Integrated reporting provides a holistic view of a company's financial and non-financial factors including ESG issues, clarifying how business strategy and governance create sustainable value, and fostering stakeholder trust and accountability.

Integrated Reporting Explained - Integrated reporting connects sustainability practices to financial results and long-term value creation, emphasizing integrated thinking about the use of resources and giving a forward-looking perspective beyond traditional financial statements.

dowidth.com

dowidth.com