Taxonomy alignment organizes financial data categories to enhance consistency and comparability across accounting systems, improving reporting accuracy and regulatory compliance. Cost allocation distributes expenses to specific departments or projects, ensuring precise financial performance measurement and budget management. Explore more to understand how combining taxonomy alignment with cost allocation optimizes accounting practices and decision-making.

Why it is important

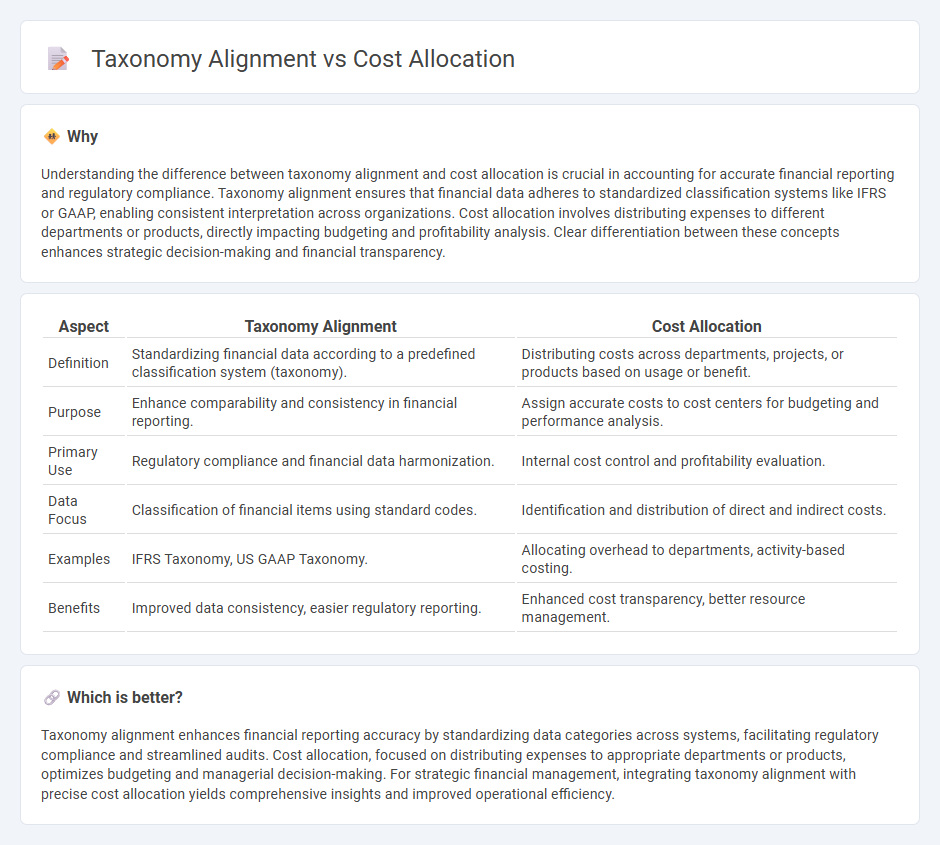

Understanding the difference between taxonomy alignment and cost allocation is crucial in accounting for accurate financial reporting and regulatory compliance. Taxonomy alignment ensures that financial data adheres to standardized classification systems like IFRS or GAAP, enabling consistent interpretation across organizations. Cost allocation involves distributing expenses to different departments or products, directly impacting budgeting and profitability analysis. Clear differentiation between these concepts enhances strategic decision-making and financial transparency.

Comparison Table

| Aspect | Taxonomy Alignment | Cost Allocation |

|---|---|---|

| Definition | Standardizing financial data according to a predefined classification system (taxonomy). | Distributing costs across departments, projects, or products based on usage or benefit. |

| Purpose | Enhance comparability and consistency in financial reporting. | Assign accurate costs to cost centers for budgeting and performance analysis. |

| Primary Use | Regulatory compliance and financial data harmonization. | Internal cost control and profitability evaluation. |

| Data Focus | Classification of financial items using standard codes. | Identification and distribution of direct and indirect costs. |

| Examples | IFRS Taxonomy, US GAAP Taxonomy. | Allocating overhead to departments, activity-based costing. |

| Benefits | Improved data consistency, easier regulatory reporting. | Enhanced cost transparency, better resource management. |

Which is better?

Taxonomy alignment enhances financial reporting accuracy by standardizing data categories across systems, facilitating regulatory compliance and streamlined audits. Cost allocation, focused on distributing expenses to appropriate departments or products, optimizes budgeting and managerial decision-making. For strategic financial management, integrating taxonomy alignment with precise cost allocation yields comprehensive insights and improved operational efficiency.

Connection

Taxonomy alignment in accounting ensures consistent classification of financial data across frameworks, enabling accurate cost allocation by mapping expenses to appropriate categories. Proper taxonomy alignment enhances transparency and comparability, facilitating precise tracking of costs within organizational units or projects. This connection optimizes financial reporting and budgeting by providing a standardized approach to distributing costs according to predefined taxonomic criteria.

Key Terms

**Cost Allocation:**

Cost allocation involves systematically assigning costs to departments, products, or projects to ensure accurate financial reporting and budget management within an organization. This process enhances transparency and cost control by linking expenses directly to their sources, enabling better decision-making and resource optimization. Explore more about cost allocation strategies to improve your organization's financial efficiency.

Overhead

Cost allocation in overhead involves distributing indirect expenses like utilities and administrative salaries to various departments or projects based on usage or benefit. Taxonomy alignment organizes overhead costs into a structured classification system, enhancing clarity and consistency in financial reporting and analysis. Explore deeper insights on optimizing overhead management through effective cost allocation and taxonomy strategies.

Cost Drivers

Cost allocation identifies and assigns expenses to specific cost drivers such as labor hours, machine usage, or materials consumed, enabling precise tracking of financial resources. Taxonomy alignment categorizes these cost drivers into standardized groups or classifications, enhancing consistency and comparability across departments or projects. Explore detailed strategies to optimize cost management through effective cost drivers and taxonomy alignment.

Source and External Links

Cost Allocation - Meaning, Types, Methods & Examples - This article provides an in-depth look at cost allocation, including its definition, types, methods, and examples to help businesses manage their costs effectively.

Cost allocation - Cost allocation is a process used by organizations to distribute shared service costs to internal clients based on consumption, enhancing financial management and decision-making.

What is Cost Allocation? Definition, Methods, and Examples - This resource explains cost allocation as a process to understand the true cost of products, services, projects, or departments, outlining key steps and methods.

dowidth.com

dowidth.com