Forensic analytics involves in-depth examination of financial data to detect and investigate fraud, focusing on uncovering hidden patterns and anomalies after suspicious activities occur. Transaction monitoring continuously analyzes real-time financial transactions to identify and prevent potentially fraudulent behavior before it impacts the organization. Explore the detailed differences and applications of forensic analytics and transaction monitoring to enhance your financial security strategies.

Why it is important

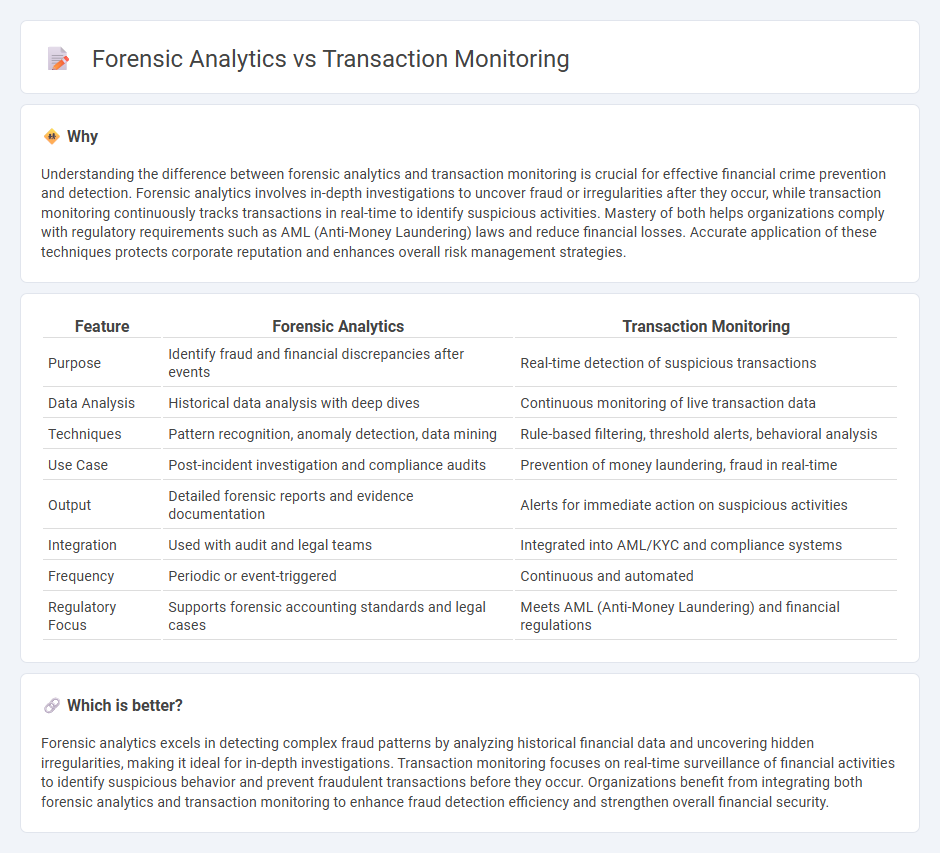

Understanding the difference between forensic analytics and transaction monitoring is crucial for effective financial crime prevention and detection. Forensic analytics involves in-depth investigations to uncover fraud or irregularities after they occur, while transaction monitoring continuously tracks transactions in real-time to identify suspicious activities. Mastery of both helps organizations comply with regulatory requirements such as AML (Anti-Money Laundering) laws and reduce financial losses. Accurate application of these techniques protects corporate reputation and enhances overall risk management strategies.

Comparison Table

| Feature | Forensic Analytics | Transaction Monitoring |

|---|---|---|

| Purpose | Identify fraud and financial discrepancies after events | Real-time detection of suspicious transactions |

| Data Analysis | Historical data analysis with deep dives | Continuous monitoring of live transaction data |

| Techniques | Pattern recognition, anomaly detection, data mining | Rule-based filtering, threshold alerts, behavioral analysis |

| Use Case | Post-incident investigation and compliance audits | Prevention of money laundering, fraud in real-time |

| Output | Detailed forensic reports and evidence documentation | Alerts for immediate action on suspicious activities |

| Integration | Used with audit and legal teams | Integrated into AML/KYC and compliance systems |

| Frequency | Periodic or event-triggered | Continuous and automated |

| Regulatory Focus | Supports forensic accounting standards and legal cases | Meets AML (Anti-Money Laundering) and financial regulations |

Which is better?

Forensic analytics excels in detecting complex fraud patterns by analyzing historical financial data and uncovering hidden irregularities, making it ideal for in-depth investigations. Transaction monitoring focuses on real-time surveillance of financial activities to identify suspicious behavior and prevent fraudulent transactions before they occur. Organizations benefit from integrating both forensic analytics and transaction monitoring to enhance fraud detection efficiency and strengthen overall financial security.

Connection

Forensic analytics and transaction monitoring are interconnected through their shared goal of detecting fraudulent activities within financial systems. Forensic analytics utilizes advanced data analysis techniques to investigate and uncover suspicious patterns, while transaction monitoring continuously analyzes financial transactions in real-time to identify anomalies indicative of fraud. Together, they enhance the accuracy and efficiency of identifying illegal activities, ensuring compliance with regulatory standards and safeguarding organizational assets.

Key Terms

**Transaction monitoring:**

Transaction monitoring involves real-time analysis of financial transactions to detect suspicious activities such as money laundering or fraud by applying predefined rules and behavioral patterns. This process relies heavily on automated systems that flag anomalies based on transaction size, frequency, and origin to ensure compliance with anti-money laundering (AML) regulations. Discover how advanced transaction monitoring can enhance fraud prevention and regulatory compliance in financial institutions.

Real-time alerts

Transaction monitoring uses real-time alerts to identify suspicious activities by continuously analyzing financial transactions against predefined rules and thresholds. Forensic analytics, while also detecting anomalies, primarily focuses on deep data analysis after an event to uncover complex fraud patterns and historical trends. Explore how integrating both approaches enhances compliance and fraud prevention strategies effectively.

Suspicious activity detection

Transaction monitoring continuously analyzes real-time financial data to identify patterns indicative of suspicious activities such as money laundering or fraud. Forensic analytics dives deeper into historical transaction records, using advanced data mining and statistical techniques to uncover hidden anomalies or complex schemes. Explore how combining both approaches strengthens compliance and enhances suspicious activity detection capabilities.

Source and External Links

What is Transaction Monitoring? - IBM - Transaction monitoring is a specialized software-driven process used by financial institutions to automatically track, analyze, and assess financial transactions for signs of suspicious or unusual activity, helping detect and prevent financial crime while ensuring regulatory compliance.

The guide to effective transaction monitoring - Salv - Transaction monitoring refers to the real-time or post-event tracking of transfers, deposits, and withdrawals to identify and stop suspicious payments, detect fraud, and uncover money laundering patterns, and is a mandatory requirement for regulated organizations.

A Complete Guide to Transaction Monitoring in 2025 - AML Watcher - Transaction monitoring involves collecting, cleaning, and analyzing customer transaction data against predefined rules to identify anomalies, generate alerts, and support case management for investigating suspicious activities and meeting regulatory obligations.

dowidth.com

dowidth.com