Real-time expense reconciliation streamlines financial management by instantly verifying transactions against budgeted amounts, reducing errors and enhancing cash flow visibility. Transaction matching focuses on pairing individual payments with corresponding invoices or receipts, ensuring accuracy in accounts payable and receivable. Explore the differences and benefits of these processes to optimize your accounting practices.

Why it is important

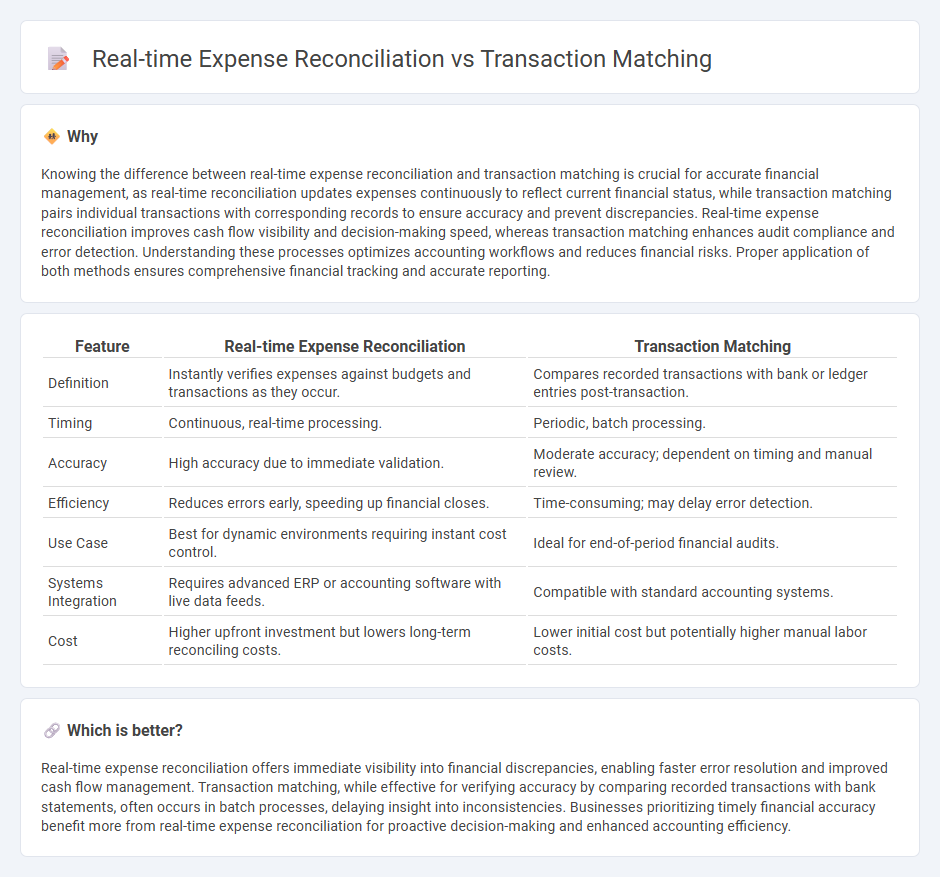

Knowing the difference between real-time expense reconciliation and transaction matching is crucial for accurate financial management, as real-time reconciliation updates expenses continuously to reflect current financial status, while transaction matching pairs individual transactions with corresponding records to ensure accuracy and prevent discrepancies. Real-time expense reconciliation improves cash flow visibility and decision-making speed, whereas transaction matching enhances audit compliance and error detection. Understanding these processes optimizes accounting workflows and reduces financial risks. Proper application of both methods ensures comprehensive financial tracking and accurate reporting.

Comparison Table

| Feature | Real-time Expense Reconciliation | Transaction Matching |

|---|---|---|

| Definition | Instantly verifies expenses against budgets and transactions as they occur. | Compares recorded transactions with bank or ledger entries post-transaction. |

| Timing | Continuous, real-time processing. | Periodic, batch processing. |

| Accuracy | High accuracy due to immediate validation. | Moderate accuracy; dependent on timing and manual review. |

| Efficiency | Reduces errors early, speeding up financial closes. | Time-consuming; may delay error detection. |

| Use Case | Best for dynamic environments requiring instant cost control. | Ideal for end-of-period financial audits. |

| Systems Integration | Requires advanced ERP or accounting software with live data feeds. | Compatible with standard accounting systems. |

| Cost | Higher upfront investment but lowers long-term reconciling costs. | Lower initial cost but potentially higher manual labor costs. |

Which is better?

Real-time expense reconciliation offers immediate visibility into financial discrepancies, enabling faster error resolution and improved cash flow management. Transaction matching, while effective for verifying accuracy by comparing recorded transactions with bank statements, often occurs in batch processes, delaying insight into inconsistencies. Businesses prioritizing timely financial accuracy benefit more from real-time expense reconciliation for proactive decision-making and enhanced accounting efficiency.

Connection

Real-time expense reconciliation enhances financial accuracy by instantly matching transactions against recorded expenses, reducing errors and fraud risks. This process leverages automated algorithms and data integration, ensuring that every transaction aligns with accounting records promptly. Efficient transaction matching streamlines bookkeeping, accelerates financial reporting, and improves cash flow management for businesses.

Key Terms

Transaction Matching

Transaction matching involves systematically pairing transactions from different sources to ensure accuracy and consistency in financial records, significantly reducing discrepancies and errors. This process enhances financial reporting by verifying that all transactions align with internal records or external statements, streamlining audits and compliance checks. Discover more about how transaction matching optimizes financial workflows and improves data integrity.

Real-time Data Integration

Transaction matching aligns payments with invoices, while real-time expense reconciliation integrates data instantly from multiple sources to provide up-to-date financial insights. Real-time data integration enables automatic updating of expense records, reducing errors and improving cash flow management. Discover how leveraging real-time data integration transforms financial accuracy and operational efficiency.

Expense Reconciliation

Expense reconciliation involves systematically comparing expense reports against transaction records to ensure accuracy and prevent fraud. Real-time expense reconciliation enhances this process by automating data capture and immediate verification, reducing errors and accelerating financial reporting. Explore how leveraging real-time reconciliation tools can optimize your expense management workflow effectively.

Source and External Links

What is Transaction Matching? - Transaction matching systematically compares multiple data sources to ensure accurate recording of transactions across systems.

About Transaction Matching - Transaction Matching automates complex reconciliations by loading transactions from multiple sources, matching them using predefined rules, and identifying exceptions.

What is Transaction Matching? - Transaction matching involves comparing transactions from different data sources to identify discrepancies and reconcile them through automated or manual means.

dowidth.com

dowidth.com