Taxonomy alignment in accounting ensures consistent classification and organization of financial data, facilitating accurate reporting and regulatory compliance. Fair value measurement determines the estimated market value of assets and liabilities, reflecting current economic conditions and enhancing transparency in financial statements. Explore the distinctions and implications of these concepts for improved financial analysis and decision-making.

Why it is important

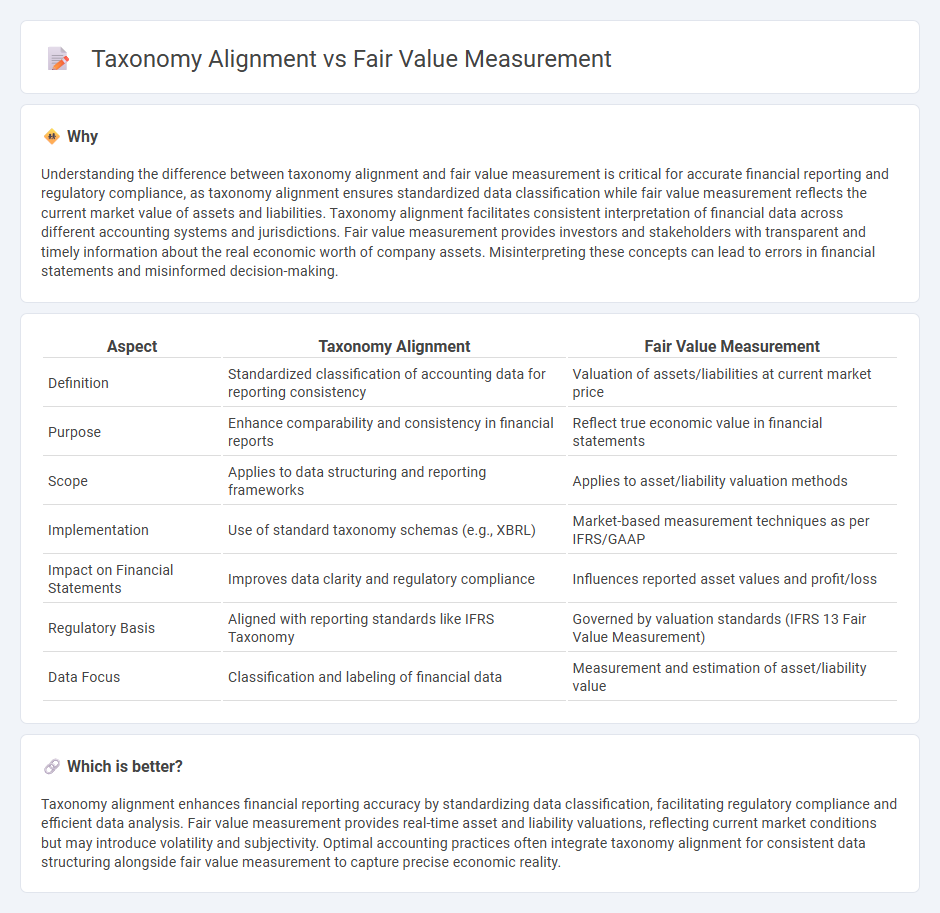

Understanding the difference between taxonomy alignment and fair value measurement is critical for accurate financial reporting and regulatory compliance, as taxonomy alignment ensures standardized data classification while fair value measurement reflects the current market value of assets and liabilities. Taxonomy alignment facilitates consistent interpretation of financial data across different accounting systems and jurisdictions. Fair value measurement provides investors and stakeholders with transparent and timely information about the real economic worth of company assets. Misinterpreting these concepts can lead to errors in financial statements and misinformed decision-making.

Comparison Table

| Aspect | Taxonomy Alignment | Fair Value Measurement |

|---|---|---|

| Definition | Standardized classification of accounting data for reporting consistency | Valuation of assets/liabilities at current market price |

| Purpose | Enhance comparability and consistency in financial reports | Reflect true economic value in financial statements |

| Scope | Applies to data structuring and reporting frameworks | Applies to asset/liability valuation methods |

| Implementation | Use of standard taxonomy schemas (e.g., XBRL) | Market-based measurement techniques as per IFRS/GAAP |

| Impact on Financial Statements | Improves data clarity and regulatory compliance | Influences reported asset values and profit/loss |

| Regulatory Basis | Aligned with reporting standards like IFRS Taxonomy | Governed by valuation standards (IFRS 13 Fair Value Measurement) |

| Data Focus | Classification and labeling of financial data | Measurement and estimation of asset/liability value |

Which is better?

Taxonomy alignment enhances financial reporting accuracy by standardizing data classification, facilitating regulatory compliance and efficient data analysis. Fair value measurement provides real-time asset and liability valuations, reflecting current market conditions but may introduce volatility and subjectivity. Optimal accounting practices often integrate taxonomy alignment for consistent data structuring alongside fair value measurement to capture precise economic reality.

Connection

Taxonomy alignment in accounting ensures consistent categorization of financial data, which enhances the accuracy of fair value measurement by providing standardized criteria for asset and liability valuation. Accurate taxonomy alignment reduces discrepancies in financial reporting, enabling fair value assessments to reflect true market conditions more reliably. This connection supports transparent and comparable financial statements for investors and regulatory authorities.

Key Terms

Market Value

Fair value measurement assesses asset prices based on current market conditions, reflecting the estimated amount obtainable in an orderly transaction between market participants. Taxonomy alignment ensures consistency with standardized classification systems, facilitating uniform reporting and comparability across financial statements. Explore how integrating fair value measurement with taxonomy alignment enhances transparency and accuracy in market value reporting.

IFRS 13

IFRS 13 provides a comprehensive framework for fair value measurement, emphasizing a market-based approach and prioritizing exit prices in active markets for accurate asset valuation. Taxonomy alignment ensures consistent reporting by mapping financial data to standardized classifications, facilitating comparability and regulatory compliance in financial disclosures. Explore how integrating IFRS 13 with taxonomy frameworks enhances transparency and decision-making accuracy in financial reporting.

EU Taxonomy

Fair value measurement involves determining the market-based value of assets or liabilities, reflecting current economic conditions, while taxonomy alignment, especially within the EU Taxonomy framework, assesses an entity's activities against specific sustainability criteria to promote green investments. The EU Taxonomy provides a classification system for environmentally sustainable economic activities, enabling investors to identify and prioritize entities aligned with climate and environmental goals, contrasting with the financial-centric focus of fair value measurement. Explore how integrating fair value assessments with EU Taxonomy alignment enhances sustainable finance strategies and regulatory compliance.

Source and External Links

ASC 820-10 Fair Value Measurement - Defines fair value as the price received for an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

IFRS 13 Fair Value Measurement - Outlines a framework for measuring fair value, defining it as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants.

Deloitte Fair Value Measurements and Disclosures - Offers guidance on applying fair value measurements under ASC 820, providing a framework for preparation and disclosure.

dowidth.com

dowidth.com