Workflow automation in accounting streamlines repetitive tasks such as data entry, invoice processing, and reconciliations, increasing accuracy and reducing manual errors. Outsourced bookkeeping offers specialized expertise by delegating financial record management to external professionals, allowing businesses to focus on core activities while ensuring compliance and timely reporting. Explore the key differences and benefits of workflow automation versus outsourced bookkeeping to optimize your financial operations.

Why it is important

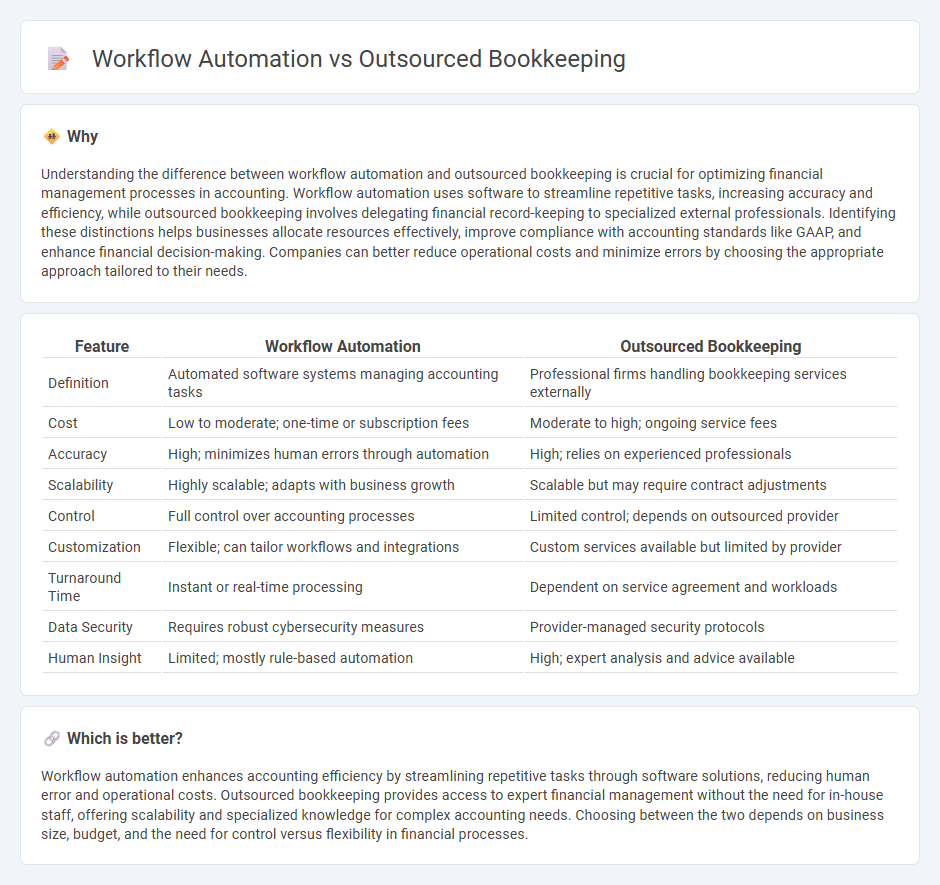

Understanding the difference between workflow automation and outsourced bookkeeping is crucial for optimizing financial management processes in accounting. Workflow automation uses software to streamline repetitive tasks, increasing accuracy and efficiency, while outsourced bookkeeping involves delegating financial record-keeping to specialized external professionals. Identifying these distinctions helps businesses allocate resources effectively, improve compliance with accounting standards like GAAP, and enhance financial decision-making. Companies can better reduce operational costs and minimize errors by choosing the appropriate approach tailored to their needs.

Comparison Table

| Feature | Workflow Automation | Outsourced Bookkeeping |

|---|---|---|

| Definition | Automated software systems managing accounting tasks | Professional firms handling bookkeeping services externally |

| Cost | Low to moderate; one-time or subscription fees | Moderate to high; ongoing service fees |

| Accuracy | High; minimizes human errors through automation | High; relies on experienced professionals |

| Scalability | Highly scalable; adapts with business growth | Scalable but may require contract adjustments |

| Control | Full control over accounting processes | Limited control; depends on outsourced provider |

| Customization | Flexible; can tailor workflows and integrations | Custom services available but limited by provider |

| Turnaround Time | Instant or real-time processing | Dependent on service agreement and workloads |

| Data Security | Requires robust cybersecurity measures | Provider-managed security protocols |

| Human Insight | Limited; mostly rule-based automation | High; expert analysis and advice available |

Which is better?

Workflow automation enhances accounting efficiency by streamlining repetitive tasks through software solutions, reducing human error and operational costs. Outsourced bookkeeping provides access to expert financial management without the need for in-house staff, offering scalability and specialized knowledge for complex accounting needs. Choosing between the two depends on business size, budget, and the need for control versus flexibility in financial processes.

Connection

Workflow automation streamlines repetitive accounting tasks such as data entry, invoice processing, and bank reconciliations, enhancing the efficiency of outsourced bookkeeping services. Outsourced bookkeeping leverages automation tools to deliver accurate financial records faster while reducing manual errors and operational costs. Integrating workflow automation with outsourced bookkeeping enables real-time financial reporting and improved compliance for businesses.

Key Terms

Cost efficiency

Outsourced bookkeeping reduces labor costs by leveraging specialized external professionals, often resulting in lower overhead compared to in-house teams. Workflow automation minimizes manual data entry errors and accelerates financial processes, enhancing cost efficiency through streamlined operations and improved accuracy. Explore further to determine which approach aligns best with your business's financial strategy.

Data accuracy

Outsourced bookkeeping leverages specialized professionals to ensure meticulous data entry, reducing human error and providing accurate financial records. Workflow automation integrates software tools that streamline data processing, instantly flag inconsistencies, and maintain consistency through rule-based checks. Discover how combining both approaches can maximize data accuracy in your financial management system.

Process scalability

Outsourced bookkeeping offers expert management of financial records, allowing businesses to handle increased transaction volumes without expanding in-house staff. Workflow automation leverages software to streamline repetitive accounting tasks, enhancing process scalability by reducing manual errors and accelerating data processing. Explore how combining outsourced bookkeeping with workflow automation can maximize scalability and efficiency for your growing business.

Source and External Links

Outsourced Bookkeeping: Key Benefits and How They Work - This article discusses the benefits of outsourcing bookkeeping, including cost savings and increased efficiency, and explains how the process works.

A Comprehensive Overview of Outsourced Bookkeeping Services - This blog post provides a comprehensive overview of outsourced bookkeeping, explaining its benefits and how it works for businesses.

Outsourced Bookkeeping Services: 5 Best Services - This article defines outsourced bookkeeping and highlights its advantages, including accessing professional expertise without in-house overhead.

dowidth.com

dowidth.com