Lease accounting software automates compliance with ASC 842 and IFRS 16 standards, managing lease agreements, payment schedules, and reporting requirements efficiently. Revenue recognition software ensures accurate application of ASC 606 principles by tracking contract modifications, performance obligations, and revenue timing. Explore the key differences and benefits of these specialized accounting tools to optimize your financial processes.

Why it is important

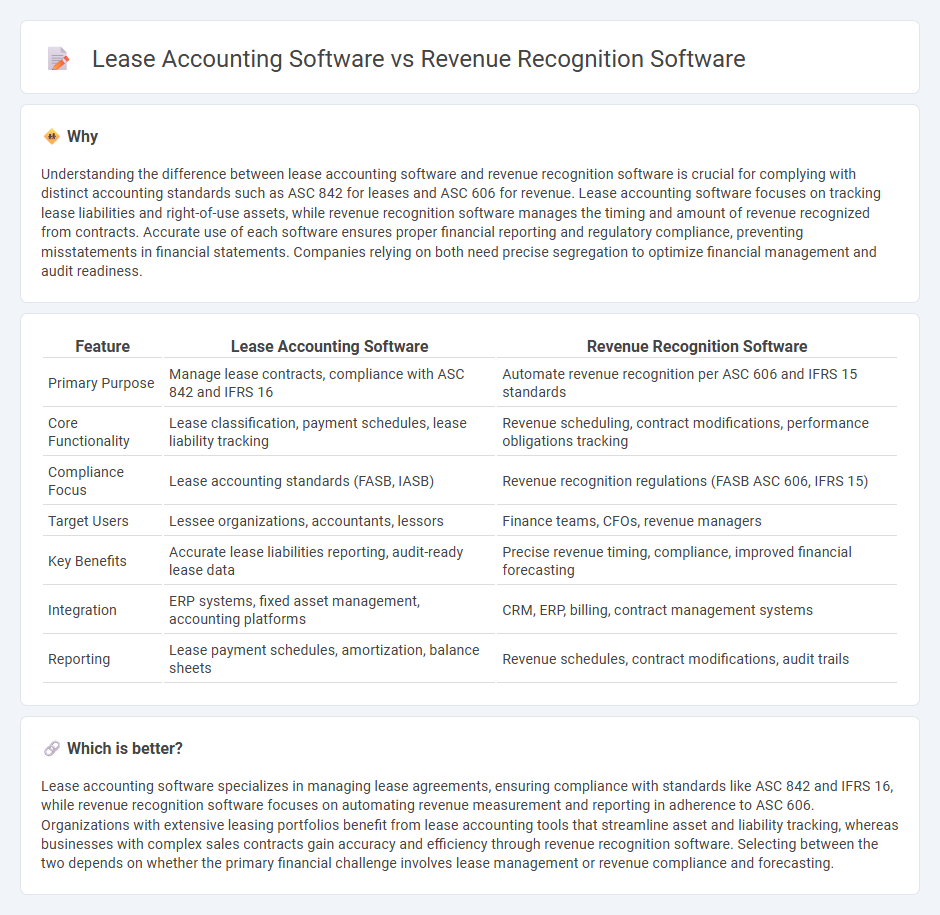

Understanding the difference between lease accounting software and revenue recognition software is crucial for complying with distinct accounting standards such as ASC 842 for leases and ASC 606 for revenue. Lease accounting software focuses on tracking lease liabilities and right-of-use assets, while revenue recognition software manages the timing and amount of revenue recognized from contracts. Accurate use of each software ensures proper financial reporting and regulatory compliance, preventing misstatements in financial statements. Companies relying on both need precise segregation to optimize financial management and audit readiness.

Comparison Table

| Feature | Lease Accounting Software | Revenue Recognition Software |

|---|---|---|

| Primary Purpose | Manage lease contracts, compliance with ASC 842 and IFRS 16 | Automate revenue recognition per ASC 606 and IFRS 15 standards |

| Core Functionality | Lease classification, payment schedules, lease liability tracking | Revenue scheduling, contract modifications, performance obligations tracking |

| Compliance Focus | Lease accounting standards (FASB, IASB) | Revenue recognition regulations (FASB ASC 606, IFRS 15) |

| Target Users | Lessee organizations, accountants, lessors | Finance teams, CFOs, revenue managers |

| Key Benefits | Accurate lease liabilities reporting, audit-ready lease data | Precise revenue timing, compliance, improved financial forecasting |

| Integration | ERP systems, fixed asset management, accounting platforms | CRM, ERP, billing, contract management systems |

| Reporting | Lease payment schedules, amortization, balance sheets | Revenue schedules, contract modifications, audit trails |

Which is better?

Lease accounting software specializes in managing lease agreements, ensuring compliance with standards like ASC 842 and IFRS 16, while revenue recognition software focuses on automating revenue measurement and reporting in adherence to ASC 606. Organizations with extensive leasing portfolios benefit from lease accounting tools that streamline asset and liability tracking, whereas businesses with complex sales contracts gain accuracy and efficiency through revenue recognition software. Selecting between the two depends on whether the primary financial challenge involves lease management or revenue compliance and forecasting.

Connection

Lease accounting software automates the tracking and management of lease contracts, ensuring compliance with accounting standards such as ASC 842 and IFRS 16, while revenue recognition software accurately records when revenue from these leases is realized according to ASC 606. Both systems integrate to provide a comprehensive financial overview, aligning lease expenses with recognized revenue for precise financial reporting. This connection enhances transparency and accuracy in financial statements, facilitating regulatory compliance and better business decision-making.

Key Terms

ASC 606 (Revenue Recognition)

Revenue recognition software streamlines compliance with ASC 606 by automating the identification, measurement, and reporting of revenue from contracts with customers, ensuring accurate recognition aligned with performance obligations. Lease accounting software primarily addresses ASC 842 requirements, managing lease assets, liabilities, and expense recognition rather than revenue recognition processes. Explore the key distinctions and use cases of both software types to optimize your accounting practices effectively.

ASC 842 (Lease Accounting)

Revenue recognition software streamlines the process of recording income in compliance with ASC 606, ensuring accurate timing and classification of revenue from contracts, whereas lease accounting software specializes in managing lease portfolios according to ASC 842, addressing lease identification, measurement, and reporting requirements. ASC 842 mandates lessees to recognize right-of-use assets and lease liabilities on the balance sheet, creating complex lease data management needs that lease accounting software efficiently handles through detailed lease tracking and compliance reporting. Explore the features and benefits of both software types to optimize your financial reporting and ensure ASC 842 compliance.

Deferred Revenue

Revenue recognition software automates the tracking and reporting of deferred revenue to ensure compliance with ASC 606 standards, improving accuracy in financial statements. Lease accounting software manages deferred rent and lease liabilities under ASC 842, providing transparency in lease-related deferred revenue and expense recognition. Explore their distinct functionalities to optimize your approach to deferred revenue management.

Source and External Links

Zuora Revenue - Automates complex revenue recognition for subscription, one-time, and usage-based offers, ensuring compliance, real-time analytics, and seamless integration with major financial systems.

Maxio Revenue Recognition - Streamlines ASC 606/IFRS 15 compliance with automated schedules, audit-ready reporting, and eliminates manual spreadsheet work for accurate, provable revenue tracking.

SAP Revenue Accounting and Reporting (RAR) - Delivers global revenue recognition, contract management, and unified financial reporting within SAP's suite, tailored for multinational compliance needs.

dowidth.com

dowidth.com