Embedded finance compliance focuses on integrating financial services within non-financial platforms while adhering to regulatory frameworks to ensure secure transactions. Anti-Money Laundering (AML) involves a set of laws, regulations, and procedures aimed at preventing criminals from disguising illegally obtained funds as legitimate income. Explore how these two critical financial sectors intersect to enhance security and regulatory adherence.

Why it is important

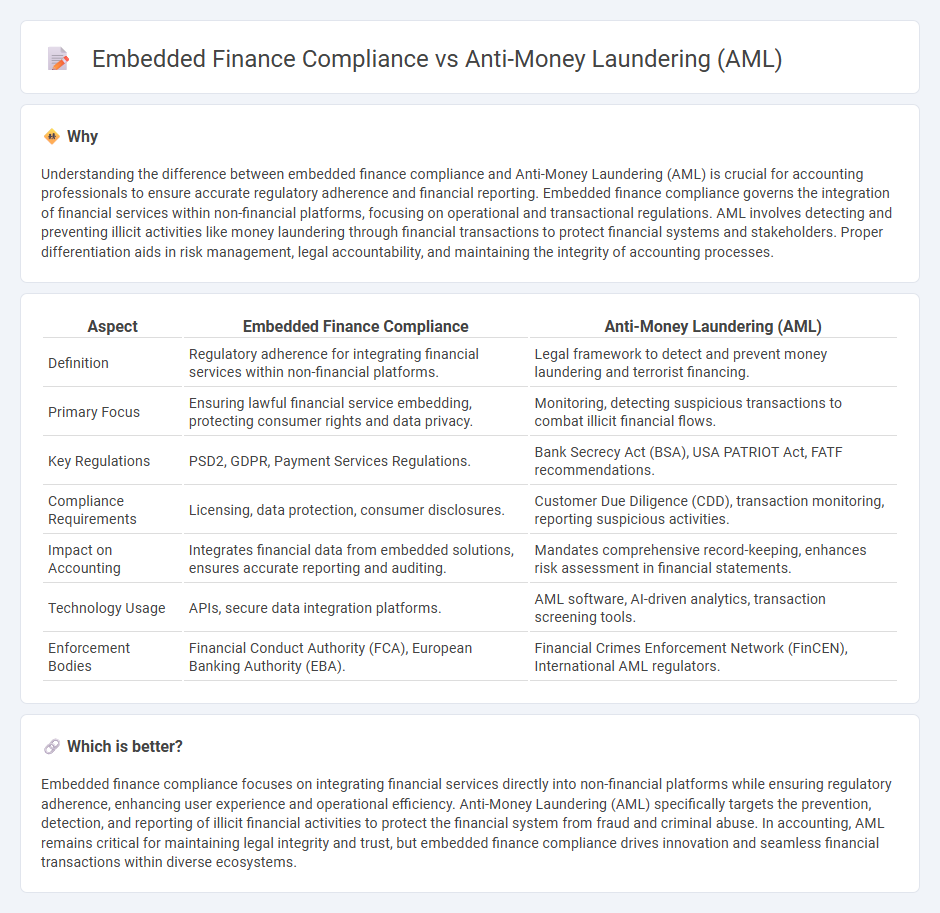

Understanding the difference between embedded finance compliance and Anti-Money Laundering (AML) is crucial for accounting professionals to ensure accurate regulatory adherence and financial reporting. Embedded finance compliance governs the integration of financial services within non-financial platforms, focusing on operational and transactional regulations. AML involves detecting and preventing illicit activities like money laundering through financial transactions to protect financial systems and stakeholders. Proper differentiation aids in risk management, legal accountability, and maintaining the integrity of accounting processes.

Comparison Table

| Aspect | Embedded Finance Compliance | Anti-Money Laundering (AML) |

|---|---|---|

| Definition | Regulatory adherence for integrating financial services within non-financial platforms. | Legal framework to detect and prevent money laundering and terrorist financing. |

| Primary Focus | Ensuring lawful financial service embedding, protecting consumer rights and data privacy. | Monitoring, detecting suspicious transactions to combat illicit financial flows. |

| Key Regulations | PSD2, GDPR, Payment Services Regulations. | Bank Secrecy Act (BSA), USA PATRIOT Act, FATF recommendations. |

| Compliance Requirements | Licensing, data protection, consumer disclosures. | Customer Due Diligence (CDD), transaction monitoring, reporting suspicious activities. |

| Impact on Accounting | Integrates financial data from embedded solutions, ensures accurate reporting and auditing. | Mandates comprehensive record-keeping, enhances risk assessment in financial statements. |

| Technology Usage | APIs, secure data integration platforms. | AML software, AI-driven analytics, transaction screening tools. |

| Enforcement Bodies | Financial Conduct Authority (FCA), European Banking Authority (EBA). | Financial Crimes Enforcement Network (FinCEN), International AML regulators. |

Which is better?

Embedded finance compliance focuses on integrating financial services directly into non-financial platforms while ensuring regulatory adherence, enhancing user experience and operational efficiency. Anti-Money Laundering (AML) specifically targets the prevention, detection, and reporting of illicit financial activities to protect the financial system from fraud and criminal abuse. In accounting, AML remains critical for maintaining legal integrity and trust, but embedded finance compliance drives innovation and seamless financial transactions within diverse ecosystems.

Connection

Embedded finance compliance integrates regulatory frameworks directly into financial products, ensuring real-time adherence to Anti-Money Laundering (AML) standards. This connection enables seamless transaction monitoring, identity verification, and risk assessment within accounting systems to prevent illicit financial activities. Aligning embedded finance solutions with AML protocols enhances transparency and fortifies fraud detection across accounting processes.

Key Terms

Customer Due Diligence (CDD)

Customer Due Diligence (CDD) is a critical component in both Anti-Money Laundering (AML) and embedded finance compliance frameworks, ensuring the verification of customer identities and the assessment of potential risks. AML regulations mandate rigorous CDD processes to prevent illicit financial activities, while embedded finance requires seamless integration of CDD within digital platforms to enhance user experience without compromising security. Explore detailed guidelines and best practices to optimize CDD for robust compliance and operational efficiency.

Transaction Monitoring

Transaction monitoring in Anti-Money Laundering (AML) involves continuous scrutiny of financial activities to detect suspicious behavior and prevent illicit money flows, utilizing advanced algorithms and real-time data analysis. Embedded finance compliance integrates AML transaction monitoring within non-financial platforms, ensuring seamless regulatory adherence while enabling enhanced user experiences and minimizing fraud risks. Explore the latest strategies and technologies transforming transaction monitoring in both AML and embedded finance compliance.

Know Your Customer (KYC)

Anti-Money Laundering (AML) regulations and embedded finance compliance both prioritize Know Your Customer (KYC) processes to prevent fraud and illicit activities, but AML mandates comprehensive ongoing monitoring and reporting, while embedded finance emphasizes seamless integration within digital platforms. AML frameworks require strict identity verification, transaction scrutiny, and risk assessment to detect suspicious activities, whereas embedded finance uses KYC to ensure user authenticity without compromising user experience. Explore detailed strategies for balancing regulatory demands with customer-centric solutions to enhance compliance effectiveness.

Source and External Links

Anti-money laundering - Wikipedia - Anti-money laundering (AML) refers to policies and practices designed to prevent, detect, and report money laundering and related financial crimes within financial institutions and regulated entities.

What is AML Compliance? - Modern Treasury - AML compliance requires adherence to regulations that combat illicit financial activities, including customer identity checks, transaction monitoring, and reporting suspicious activities to authorities.

Anti-Money Laundering (AML) | FINRA.org - Firms must maintain written AML programs approved by senior management, conduct ongoing customer due diligence, and provide regular training to staff to ensure compliance with the Bank Secrecy Act and related rules.

dowidth.com

dowidth.com