Fractional CFOs provide part-time financial leadership tailored to small and mid-sized businesses seeking expert guidance without the cost of a full-time executive, focusing on strategic financial planning, cash flow management, and performance analysis. CFO advisory services offer specialized consulting in areas such as risk management, capital structure optimization, and financial reporting to enhance overall business decision-making. Discover how fractional CFO and CFO advisory services can elevate your company's financial strategy and operational efficiency.

Why it is important

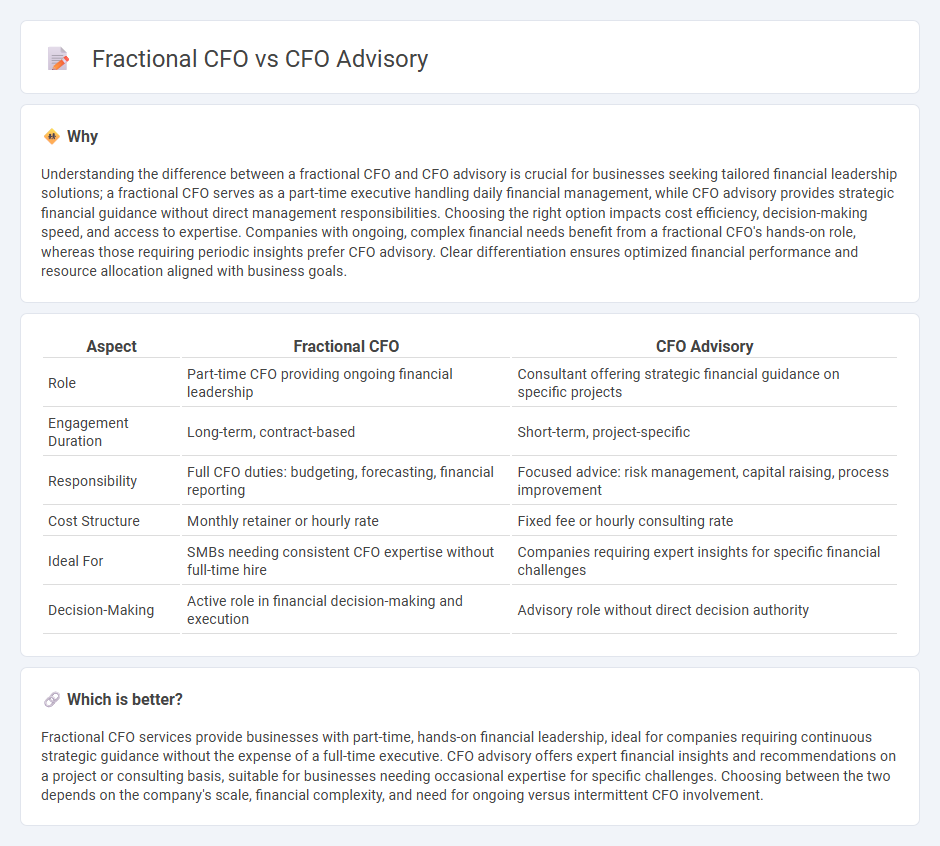

Understanding the difference between a fractional CFO and CFO advisory is crucial for businesses seeking tailored financial leadership solutions; a fractional CFO serves as a part-time executive handling daily financial management, while CFO advisory provides strategic financial guidance without direct management responsibilities. Choosing the right option impacts cost efficiency, decision-making speed, and access to expertise. Companies with ongoing, complex financial needs benefit from a fractional CFO's hands-on role, whereas those requiring periodic insights prefer CFO advisory. Clear differentiation ensures optimized financial performance and resource allocation aligned with business goals.

Comparison Table

| Aspect | Fractional CFO | CFO Advisory |

|---|---|---|

| Role | Part-time CFO providing ongoing financial leadership | Consultant offering strategic financial guidance on specific projects |

| Engagement Duration | Long-term, contract-based | Short-term, project-specific |

| Responsibility | Full CFO duties: budgeting, forecasting, financial reporting | Focused advice: risk management, capital raising, process improvement |

| Cost Structure | Monthly retainer or hourly rate | Fixed fee or hourly consulting rate |

| Ideal For | SMBs needing consistent CFO expertise without full-time hire | Companies requiring expert insights for specific financial challenges |

| Decision-Making | Active role in financial decision-making and execution | Advisory role without direct decision authority |

Which is better?

Fractional CFO services provide businesses with part-time, hands-on financial leadership, ideal for companies requiring continuous strategic guidance without the expense of a full-time executive. CFO advisory offers expert financial insights and recommendations on a project or consulting basis, suitable for businesses needing occasional expertise for specific challenges. Choosing between the two depends on the company's scale, financial complexity, and need for ongoing versus intermittent CFO involvement.

Connection

Fractional CFO services provide businesses with part-time financial leadership, delivering expert CFO advisory to optimize strategic planning, cash flow management, and financial reporting. CFO advisory leverages the expertise of fractional CFOs to offer tailored guidance on budgeting, risk assessment, and growth strategies without the overhead of a full-time executive. This partnership enhances financial decision-making and scalability for startups, small businesses, and mid-sized companies.

Key Terms

**CFO Advisory:**

CFO advisory services provide strategic financial guidance tailored to enhance business performance, focusing on areas such as financial planning, risk management, and capital structure optimization. Unlike fractional CFOs who typically take an interim executive role, CFO advisors offer expert recommendations without full-time operational responsibilities. Discover how CFO advisory can drive your company's financial success and long-term growth.

Strategic Planning

CFO advisory provides expert guidance on strategic planning by analyzing financial data and market trends to support long-term business growth without direct management involvement. Fractional CFOs take on the hands-on role of implementing strategic plans, managing financial operations, and driving decision-making on a part-time or contract basis. Explore how each approach can enhance your company's financial strategy and operational execution.

Financial Analysis

Financial analysis in CFO advisory centers on providing tailored strategic insights and long-term financial planning to optimize business performance. Fractional CFOs conduct hands-on financial management and real-time reporting to support day-to-day decision-making in small to mid-sized companies. Explore how each approach enhances your financial strategy and operational efficiency.

Source and External Links

CFO Advisory Consultants: What They Do & How They Help - This webpage discusses the role and benefits of hiring CFO advisory consultants for strategic financial support and operational efficiency.

CFO Consulting Services - This service provides strategic financial guidance and on-demand C-suite leadership to help businesses achieve their growth goals through customized plans and expert advice.

CFO Advisory | Deloitte UK - Deloitte's CFO Advisory practice supports CFOs across various aspects of their role, offering comprehensive financial consulting services.

dowidth.com

dowidth.com