Zero trust accounting emphasizes strict verification processes and continuous monitoring to prevent fraud and ensure data integrity, contrasting with traditional accounting that relies more heavily on established trust and periodic audits. This modern approach leverages advanced cybersecurity measures and real-time data validation to minimize risks in financial reporting. Discover how zero trust accounting can transform your financial security and accuracy.

Why it is important

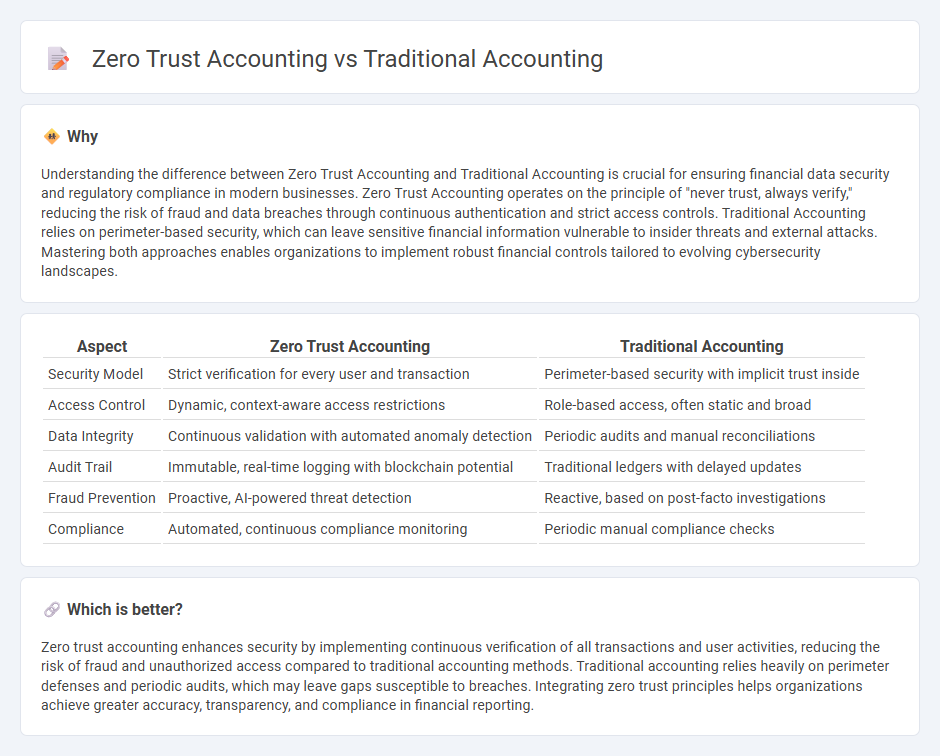

Understanding the difference between Zero Trust Accounting and Traditional Accounting is crucial for ensuring financial data security and regulatory compliance in modern businesses. Zero Trust Accounting operates on the principle of "never trust, always verify," reducing the risk of fraud and data breaches through continuous authentication and strict access controls. Traditional Accounting relies on perimeter-based security, which can leave sensitive financial information vulnerable to insider threats and external attacks. Mastering both approaches enables organizations to implement robust financial controls tailored to evolving cybersecurity landscapes.

Comparison Table

| Aspect | Zero Trust Accounting | Traditional Accounting |

|---|---|---|

| Security Model | Strict verification for every user and transaction | Perimeter-based security with implicit trust inside |

| Access Control | Dynamic, context-aware access restrictions | Role-based access, often static and broad |

| Data Integrity | Continuous validation with automated anomaly detection | Periodic audits and manual reconciliations |

| Audit Trail | Immutable, real-time logging with blockchain potential | Traditional ledgers with delayed updates |

| Fraud Prevention | Proactive, AI-powered threat detection | Reactive, based on post-facto investigations |

| Compliance | Automated, continuous compliance monitoring | Periodic manual compliance checks |

Which is better?

Zero trust accounting enhances security by implementing continuous verification of all transactions and user activities, reducing the risk of fraud and unauthorized access compared to traditional accounting methods. Traditional accounting relies heavily on perimeter defenses and periodic audits, which may leave gaps susceptible to breaches. Integrating zero trust principles helps organizations achieve greater accuracy, transparency, and compliance in financial reporting.

Connection

Zero trust accounting and traditional accounting intersect through their shared focus on ensuring accuracy and security in financial records. While traditional accounting relies on established controls and periodic audits, zero trust accounting implements continuous verification protocols and strict access controls to minimize fraud risks. Both approaches aim to enhance financial integrity by managing risks and safeguarding sensitive information.

Key Terms

Double-entry bookkeeping

Traditional accounting relies heavily on double-entry bookkeeping, ensuring every financial transaction is recorded as both a debit and a credit to maintain balanced ledgers and accurate financial records. Zero trust accounting incorporates the same double-entry principles but enhances security by continuously verifying users and transactions, minimizing the risk of fraud and unauthorized access. Explore how zero trust models transform financial integrity and control for modern businesses.

Access control

Traditional accounting relies heavily on perimeter defenses and predefined user roles to manage access control, often leading to potential vulnerabilities due to implicit trust within networks. Zero trust accounting enforces strict, continuous verification of every access request, regardless of the user's location or device, minimizing unauthorized access risks by applying granular access controls. Explore the detailed advantages and implementation strategies of zero trust access control in accounting systems to enhance your organization's security posture.

Continuous verification

Traditional accounting systems rely on periodic audits and fixed access controls, which can leave gaps in security between evaluations. Zero trust accounting emphasizes continuous verification of user identities and transaction authenticity, ensuring real-time monitoring and reducing the risk of fraud or unauthorized access. Discover how zero trust accounting transforms financial security with ongoing validation protocols.

Source and External Links

Cash Basis vs Traditional Accounting for Inventory - Traditional accounting, also known as accrual accounting, records revenue and expenses when they are earned or incurred, not when cash is exchanged, offering a more accurate picture of financial health but is more complex and costly to implement.

The Pros and Cons of Traditional vs. Digital Accounting for ... - Traditional accounting uses manual methods like physical ledgers and journals to track financial transactions with double-entry bookkeeping, in contrast to automated digital accounting systems.

What is Traditional Accounting? And Why It's Failing You - Traditional accounting refers broadly to an outdated, fragmented system characterized by manual processes and multiple disconnected tools, which many businesses still accept despite inefficiencies and high costs.

dowidth.com

dowidth.com