Invoice factoring platforms provide businesses with immediate cash flow by selling outstanding invoices to third parties, while trade credit insurance protects companies from losses due to customer payment defaults. Factoring offers quick liquidity and improved working capital, whereas trade credit insurance minimizes financial risk by safeguarding accounts receivable against non-payment. Explore how these financial solutions can optimize your business's cash management and risk mitigation strategies.

Why it is important

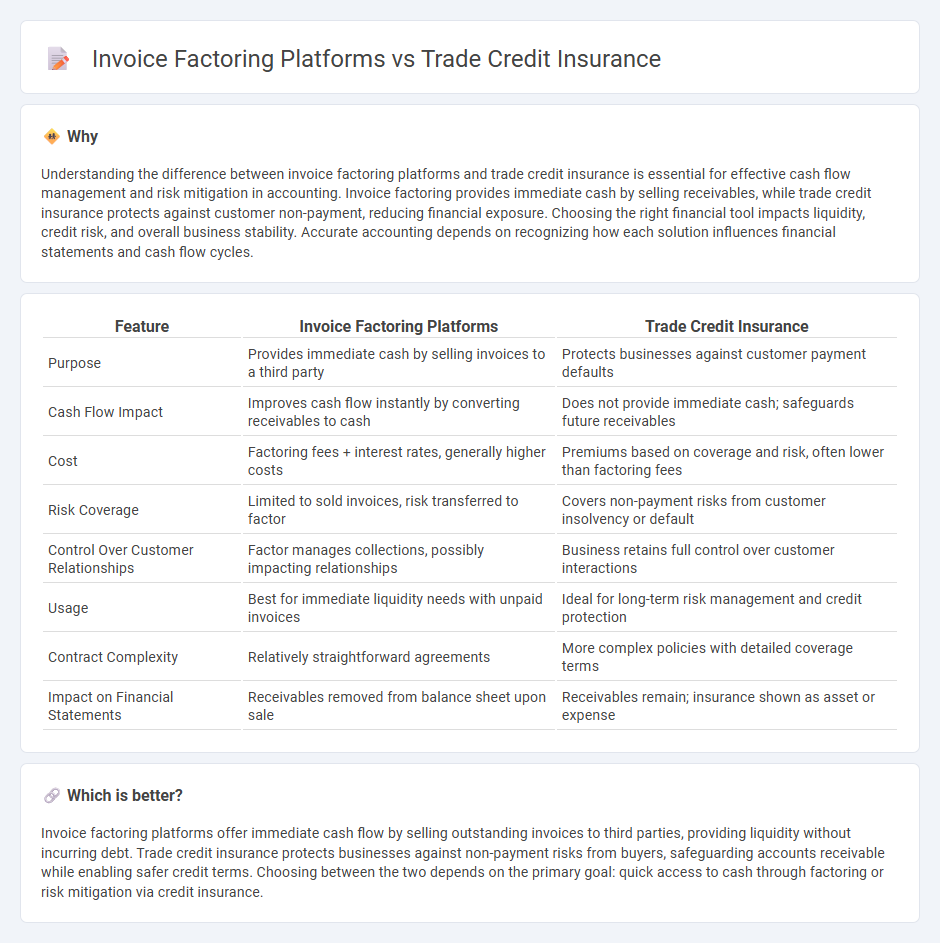

Understanding the difference between invoice factoring platforms and trade credit insurance is essential for effective cash flow management and risk mitigation in accounting. Invoice factoring provides immediate cash by selling receivables, while trade credit insurance protects against customer non-payment, reducing financial exposure. Choosing the right financial tool impacts liquidity, credit risk, and overall business stability. Accurate accounting depends on recognizing how each solution influences financial statements and cash flow cycles.

Comparison Table

| Feature | Invoice Factoring Platforms | Trade Credit Insurance |

|---|---|---|

| Purpose | Provides immediate cash by selling invoices to a third party | Protects businesses against customer payment defaults |

| Cash Flow Impact | Improves cash flow instantly by converting receivables to cash | Does not provide immediate cash; safeguards future receivables |

| Cost | Factoring fees + interest rates, generally higher costs | Premiums based on coverage and risk, often lower than factoring fees |

| Risk Coverage | Limited to sold invoices, risk transferred to factor | Covers non-payment risks from customer insolvency or default |

| Control Over Customer Relationships | Factor manages collections, possibly impacting relationships | Business retains full control over customer interactions |

| Usage | Best for immediate liquidity needs with unpaid invoices | Ideal for long-term risk management and credit protection |

| Contract Complexity | Relatively straightforward agreements | More complex policies with detailed coverage terms |

| Impact on Financial Statements | Receivables removed from balance sheet upon sale | Receivables remain; insurance shown as asset or expense |

Which is better?

Invoice factoring platforms offer immediate cash flow by selling outstanding invoices to third parties, providing liquidity without incurring debt. Trade credit insurance protects businesses against non-payment risks from buyers, safeguarding accounts receivable while enabling safer credit terms. Choosing between the two depends on the primary goal: quick access to cash through factoring or risk mitigation via credit insurance.

Connection

Invoice factoring platforms and trade credit insurance are interconnected financial solutions that enhance cash flow management for businesses by mitigating credit risk. Invoice factoring platforms provide immediate liquidity by purchasing outstanding invoices, while trade credit insurance protects against potential losses from customer non-payment, creating a safety net that encourages more confident credit sales. Together, they optimize working capital and support business growth by reducing payment uncertainties and improving access to financing.

Key Terms

Risk Mitigation

Trade credit insurance mitigates financial risk by protecting businesses against customer non-payment and insolvency, ensuring steady cash flow and safeguarding profit margins. Invoice factoring platforms reduce risk by providing immediate liquidity through selling receivables, but shift credit risk to the factoring company which assumes the collection responsibility. Explore detailed comparisons and risk management strategies to choose the best financial safeguard for your business.

Accounts Receivable

Trade credit insurance protects accounts receivable by covering losses from customer non-payment, enhancing cash flow stability and credit risk management. Invoice factoring platforms convert receivables into immediate cash by selling invoices to third parties, improving liquidity but potentially involving higher fees. Explore the detailed benefits and comparisons to optimize your accounts receivable strategy.

Cash Flow

Trade credit insurance safeguards businesses against non-payment risks, ensuring steady cash flow by protecting accounts receivable from customer defaults. Invoice factoring platforms accelerate cash flow by converting outstanding invoices into immediate funds, offering quicker liquidity but at a discount fee. Explore in-depth comparisons and benefits of trade credit insurance and invoice factoring platforms to optimize your cash flow strategy.

Source and External Links

Everything You Need to Know About Trade Credit Insurance - Trade credit insurance protects businesses from losses if their customers fail to pay invoices, with coverage amounts and premiums based on the risk profile of the buyer and the size of receivables.

Trade Credit Insurance in a nutshell - Coface - Trade credit insurance helps businesses manage credit risk by covering losses from unpaid invoices, customer insolvency, and even political risks that may prevent payment.

Trade Credit Insurance | Allianz Trade US - Trade credit insurance safeguards a company's accounts receivable, allowing businesses to extend credit and expand with confidence, knowing they are protected against customer defaults and insolvency.

dowidth.com

dowidth.com