Fractional CFO services provide businesses with part-time, strategic financial leadership tailored to their specific needs, focusing on budgeting, forecasting, and financial planning. Financial Advisory services offer expert guidance on investments, risk management, and mergers or acquisitions to optimize financial outcomes. Discover how these specialized services can elevate your company's financial strategy by exploring their key differences and benefits.

Why it is important

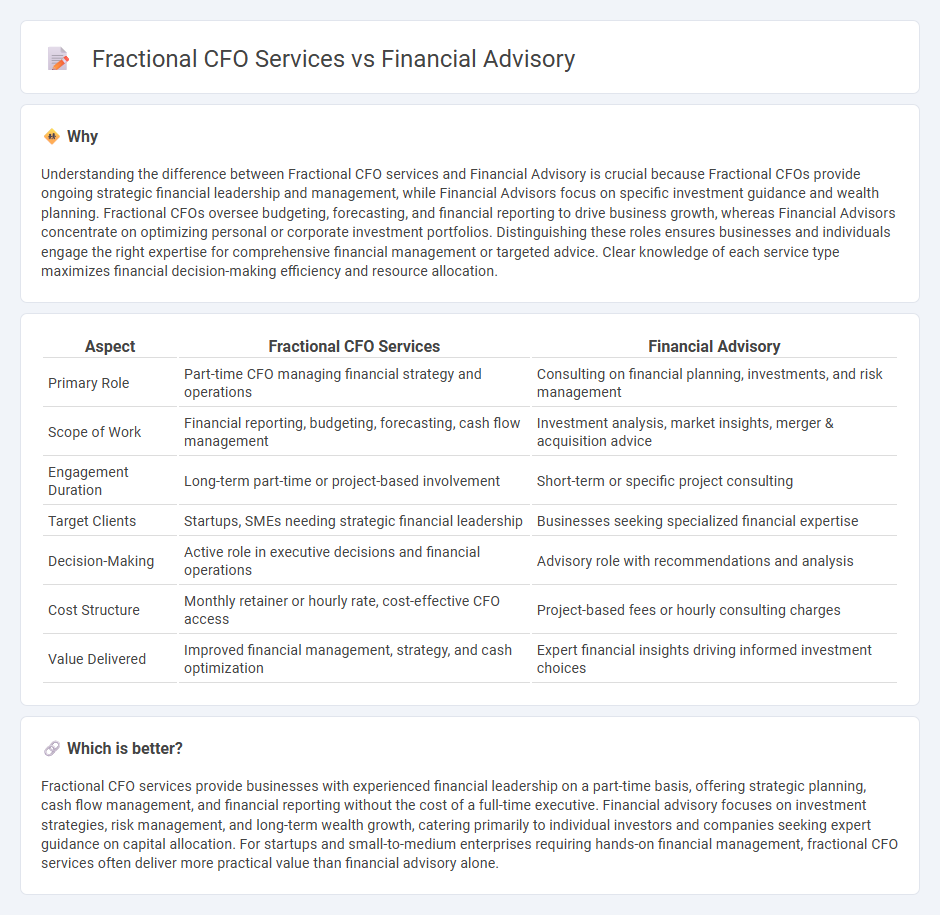

Understanding the difference between Fractional CFO services and Financial Advisory is crucial because Fractional CFOs provide ongoing strategic financial leadership and management, while Financial Advisors focus on specific investment guidance and wealth planning. Fractional CFOs oversee budgeting, forecasting, and financial reporting to drive business growth, whereas Financial Advisors concentrate on optimizing personal or corporate investment portfolios. Distinguishing these roles ensures businesses and individuals engage the right expertise for comprehensive financial management or targeted advice. Clear knowledge of each service type maximizes financial decision-making efficiency and resource allocation.

Comparison Table

| Aspect | Fractional CFO Services | Financial Advisory |

|---|---|---|

| Primary Role | Part-time CFO managing financial strategy and operations | Consulting on financial planning, investments, and risk management |

| Scope of Work | Financial reporting, budgeting, forecasting, cash flow management | Investment analysis, market insights, merger & acquisition advice |

| Engagement Duration | Long-term part-time or project-based involvement | Short-term or specific project consulting |

| Target Clients | Startups, SMEs needing strategic financial leadership | Businesses seeking specialized financial expertise |

| Decision-Making | Active role in executive decisions and financial operations | Advisory role with recommendations and analysis |

| Cost Structure | Monthly retainer or hourly rate, cost-effective CFO access | Project-based fees or hourly consulting charges |

| Value Delivered | Improved financial management, strategy, and cash optimization | Expert financial insights driving informed investment choices |

Which is better?

Fractional CFO services provide businesses with experienced financial leadership on a part-time basis, offering strategic planning, cash flow management, and financial reporting without the cost of a full-time executive. Financial advisory focuses on investment strategies, risk management, and long-term wealth growth, catering primarily to individual investors and companies seeking expert guidance on capital allocation. For startups and small-to-medium enterprises requiring hands-on financial management, fractional CFO services often deliver more practical value than financial advisory alone.

Connection

Fractional CFO services provide businesses with part-time, expert financial leadership that enhances strategic planning and financial decision-making, directly complementing financial advisory by delivering actionable insights grounded in real-time data analysis. These services bridge gaps in financial management, enabling companies to optimize cash flow, forecast accurately, and implement robust budgeting processes, which are core aspects of financial advisory. By integrating Fractional CFO expertise with comprehensive financial advisory, businesses gain tailored solutions that drive growth and improve overall financial health.

Key Terms

Strategic Financial Planning

Financial advisory focuses on guiding businesses through short-term financial decisions, investment options, and risk management strategies, while fractional CFO services provide ongoing strategic financial planning, budgeting, and leadership at a fraction of the cost of a full-time CFO. Fractional CFOs deliver deep insights into cash flow optimization, financial forecasting, and long-term growth strategies tailored to specific business goals. Explore how fractional CFO services can transform your financial strategy and elevate your business performance.

Cash Flow Management

Financial advisory services provide strategic guidance on budgeting, forecasting, and optimizing cash flow to improve liquidity and operational efficiency. Fractional CFOs offer hands-on management of cash flow, implementing real-time monitoring, managing receivables and payables, and aligning cash strategies with overall business goals. Explore how each approach can enhance your company's cash flow management for sustained financial health.

Financial Reporting

Financial advisory services emphasize comprehensive financial reporting to support strategic decision-making, ensuring accuracy and regulatory compliance across financial statements. Fractional CFO services provide ongoing leadership with a hands-on approach to financial reporting, including budgeting, forecasting, and performance analysis to drive business growth. Explore the distinct advantages of each service to optimize your organization's financial management.

Source and External Links

Best Financial Advisors - Offers guidance on selecting top financial advisory firms based on personal needs and budget.

NAPFA: The National Association of Personal Financial Advisors - Provides a platform to find fee-only fiduciary financial planners who prioritize client interests.

Lazard Financial Advisory - Specializes in advising businesses and governments on strategic financial matters worldwide.

dowidth.com

dowidth.com