Embedded finance reporting integrates financial data directly within operational platforms, enabling real-time insights and seamless transaction tracking. Management reporting consolidates financial and non-financial information, providing strategic analysis for informed decision-making and performance evaluation. Explore the key differences and benefits to optimize your accounting processes.

Why it is important

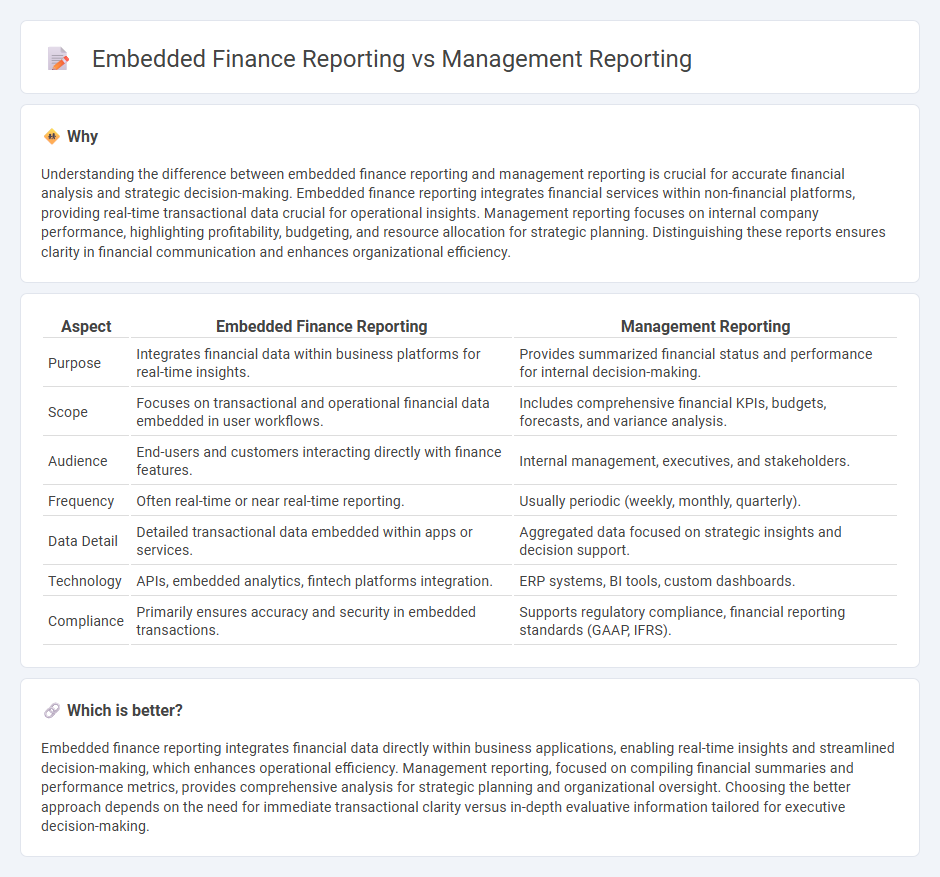

Understanding the difference between embedded finance reporting and management reporting is crucial for accurate financial analysis and strategic decision-making. Embedded finance reporting integrates financial services within non-financial platforms, providing real-time transactional data crucial for operational insights. Management reporting focuses on internal company performance, highlighting profitability, budgeting, and resource allocation for strategic planning. Distinguishing these reports ensures clarity in financial communication and enhances organizational efficiency.

Comparison Table

| Aspect | Embedded Finance Reporting | Management Reporting |

|---|---|---|

| Purpose | Integrates financial data within business platforms for real-time insights. | Provides summarized financial status and performance for internal decision-making. |

| Scope | Focuses on transactional and operational financial data embedded in user workflows. | Includes comprehensive financial KPIs, budgets, forecasts, and variance analysis. |

| Audience | End-users and customers interacting directly with finance features. | Internal management, executives, and stakeholders. |

| Frequency | Often real-time or near real-time reporting. | Usually periodic (weekly, monthly, quarterly). |

| Data Detail | Detailed transactional data embedded within apps or services. | Aggregated data focused on strategic insights and decision support. |

| Technology | APIs, embedded analytics, fintech platforms integration. | ERP systems, BI tools, custom dashboards. |

| Compliance | Primarily ensures accuracy and security in embedded transactions. | Supports regulatory compliance, financial reporting standards (GAAP, IFRS). |

Which is better?

Embedded finance reporting integrates financial data directly within business applications, enabling real-time insights and streamlined decision-making, which enhances operational efficiency. Management reporting, focused on compiling financial summaries and performance metrics, provides comprehensive analysis for strategic planning and organizational oversight. Choosing the better approach depends on the need for immediate transactional clarity versus in-depth evaluative information tailored for executive decision-making.

Connection

Embedded finance reporting integrates financial data directly within operational platforms, enabling real-time insights that enhance management reporting accuracy. This seamless data flow supports comprehensive analysis of financial performance, operational efficiency, and strategic decision-making. Consequently, management reporting becomes more dynamic and reflective of actual business conditions through embedded finance reporting.

Key Terms

**Management Reporting:**

Management reporting involves the systematic collection, analysis, and presentation of financial and operational data to support decision-making and strategic planning within an organization. It focuses on key performance indicators (KPIs), financial forecasting, budget variance analysis, and operational efficiency metrics to provide stakeholders with actionable insights. Explore the latest techniques and tools in management reporting to enhance business intelligence and drive informed decisions.

Financial Performance

Management reporting provides comprehensive insights into overall financial performance, including profitability, cost analysis, and budget variance, enabling strategic decision-making. Embedded finance reporting centers on transactional and operational data within financial products, emphasizing real-time metrics such as payment volumes, loan performance, and customer credit risk. Explore detailed comparisons and best practices for optimizing financial performance through both reporting methods.

Variance Analysis

Management reporting centers on variance analysis by comparing budgeted versus actual financial performance to identify deviations impacting business objectives. Embedded finance reporting integrates financial services within non-financial platforms, using variance analysis to monitor transaction discrepancies, user activity, and operational efficiencies in real-time. Explore further to understand how these reporting approaches enhance decision-making and financial control.

Source and External Links

Management reporting - CCH Tagetik - Management reporting involves creating internal reports containing financial and operational data for managers and executives to monitor performance, make decisions, and guide business activities without external regulation, focusing on internal goals and frequent performance monitoring.

What Should Go In Your Monthly Management Report? - A monthly management report consolidates data from various departments to provide timely insights that help track progress, identify trends, hold teams accountable, and align all departments with strategic objectives for informed decision-making.

Managerial Reporting: Definition, Purpose and Best Practices - Managerial reporting collects data tailored to different managerial roles to track KPIs and guide managers in making accurate, data-driven decisions that improve department efficiency and overall business performance.

dowidth.com

dowidth.com