Microtransaction accounting focuses on tracking and recording small-value transactions, often seen in digital platforms and gaming industries, ensuring precise revenue recognition and cost management. Transaction fee accounting deals with fees imposed on larger transactions, requiring detailed analysis for accurate expense allocation and financial reporting. Explore these distinct approaches to understand their impact on financial accuracy and business performance.

Why it is important

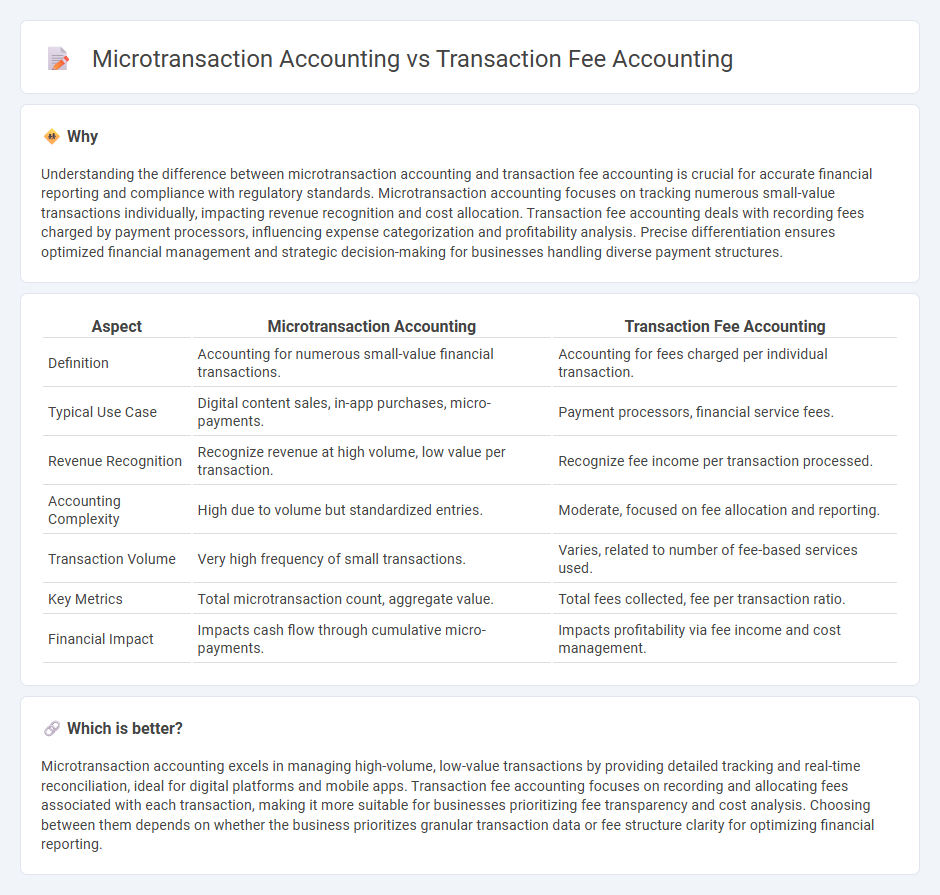

Understanding the difference between microtransaction accounting and transaction fee accounting is crucial for accurate financial reporting and compliance with regulatory standards. Microtransaction accounting focuses on tracking numerous small-value transactions individually, impacting revenue recognition and cost allocation. Transaction fee accounting deals with recording fees charged by payment processors, influencing expense categorization and profitability analysis. Precise differentiation ensures optimized financial management and strategic decision-making for businesses handling diverse payment structures.

Comparison Table

| Aspect | Microtransaction Accounting | Transaction Fee Accounting |

|---|---|---|

| Definition | Accounting for numerous small-value financial transactions. | Accounting for fees charged per individual transaction. |

| Typical Use Case | Digital content sales, in-app purchases, micro-payments. | Payment processors, financial service fees. |

| Revenue Recognition | Recognize revenue at high volume, low value per transaction. | Recognize fee income per transaction processed. |

| Accounting Complexity | High due to volume but standardized entries. | Moderate, focused on fee allocation and reporting. |

| Transaction Volume | Very high frequency of small transactions. | Varies, related to number of fee-based services used. |

| Key Metrics | Total microtransaction count, aggregate value. | Total fees collected, fee per transaction ratio. |

| Financial Impact | Impacts cash flow through cumulative micro-payments. | Impacts profitability via fee income and cost management. |

Which is better?

Microtransaction accounting excels in managing high-volume, low-value transactions by providing detailed tracking and real-time reconciliation, ideal for digital platforms and mobile apps. Transaction fee accounting focuses on recording and allocating fees associated with each transaction, making it more suitable for businesses prioritizing fee transparency and cost analysis. Choosing between them depends on whether the business prioritizes granular transaction data or fee structure clarity for optimizing financial reporting.

Connection

Microtransaction accounting focuses on recording and managing numerous small-valued transactions essential in digital platforms, while transaction fee accounting deals with the costs associated with processing these transactions. Both accounting practices intersect as the accurate calculation and allocation of transaction fees directly impact the net revenue reported from microtransactions. This connection ensures precise financial reporting, compliance, and profitability analysis within businesses handling high-volume, low-value sales.

Key Terms

Revenue recognition

Transaction fee accounting recognizes revenue when the transaction is completed, often using accrual methods to match income with expenses during the accounting period. Microtransaction accounting focuses on recognizing revenue at a granular level, typically involving numerous small payments, requiring real-time tracking and allocation to accurately reflect earnings. Explore detailed methodologies and compliance guidelines to optimize your revenue recognition process.

Cost allocation

Transaction fee accounting allocates costs based on the processing fees incurred per individual transaction, reflecting expenses such as interchange fees and gateway charges. Microtransaction accounting focuses on cost allocation at a granular level, often managing thousands of small-value transactions to accurately distribute overhead and taxation costs. Explore further how these accounting methods impact financial reporting and operational efficiency.

Transaction aggregation

Transaction fee accounting consolidates multiple fees into a single aggregate amount to simplify financial reporting, whereas microtransaction accounting records each small transaction separately, increasing granularity but also complexity. Aggregating transactions reduces processing costs and streamlines reconciliation processes, critical for businesses with high transaction volumes. Explore detailed strategies to optimize transaction aggregation for accurate fee accounting and improved financial efficiency.

Source and External Links

Transaction Fees: Definition and Examples - Bill.com - Transaction fees are expenses charged by payment processors or intermediaries, often calculated as fixed amounts, percentages, or hybrids, and are recorded as costs above the sales price in accounting.

Accounting for Transaction Processing Fees - YouTube - Businesses record the full sales revenue from transactions but account for transaction fees as an operating expense, not reducing the sales revenue figure.

Transaction Fees - Financial Edge Training - In mergers and acquisitions, transaction fees include advisory fees expensed immediately and debt issuance fees that are capitalized and amortized over loan duration, reflecting how transaction fees are accounted for differently by type.

dowidth.com

dowidth.com