Integrated reporting combines financial, environmental, social, and governance data into a single cohesive document, offering a comprehensive view of organizational performance. Annual reporting primarily focuses on financial results and compliance, providing detailed financial statements and management discussion for the fiscal year. Explore the benefits and differences of these reporting methods to enhance your understanding of corporate transparency and accountability.

Why it is important

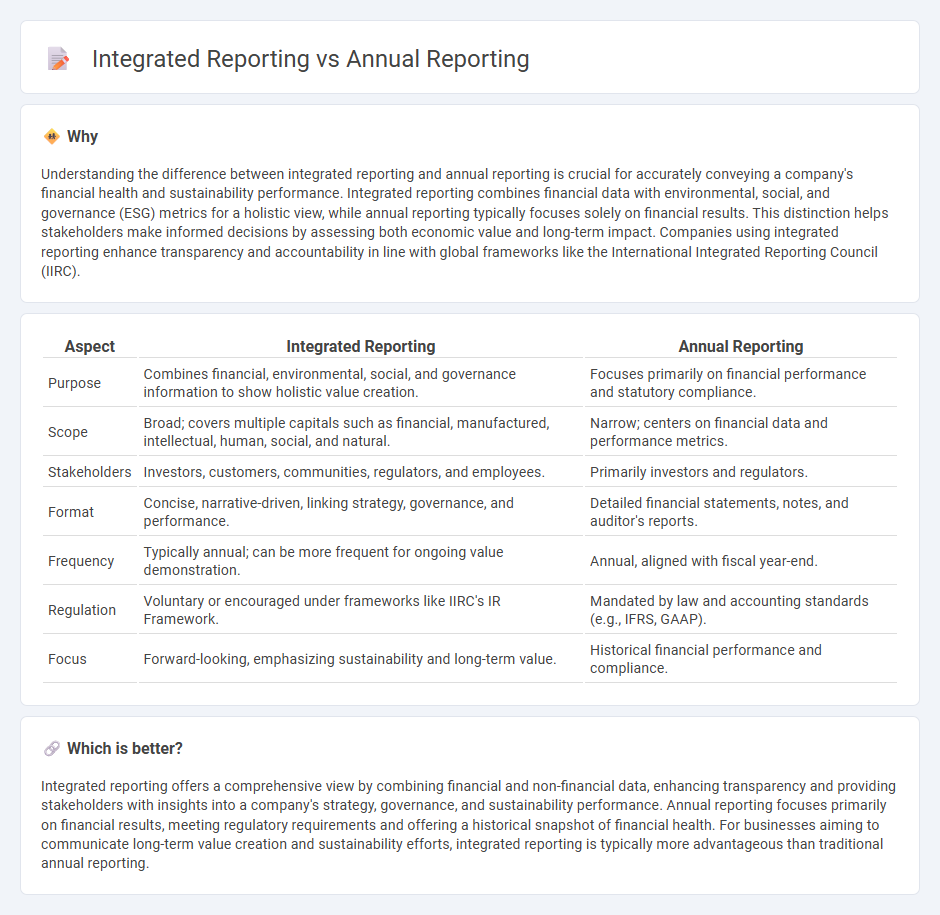

Understanding the difference between integrated reporting and annual reporting is crucial for accurately conveying a company's financial health and sustainability performance. Integrated reporting combines financial data with environmental, social, and governance (ESG) metrics for a holistic view, while annual reporting typically focuses solely on financial results. This distinction helps stakeholders make informed decisions by assessing both economic value and long-term impact. Companies using integrated reporting enhance transparency and accountability in line with global frameworks like the International Integrated Reporting Council (IIRC).

Comparison Table

| Aspect | Integrated Reporting | Annual Reporting |

|---|---|---|

| Purpose | Combines financial, environmental, social, and governance information to show holistic value creation. | Focuses primarily on financial performance and statutory compliance. |

| Scope | Broad; covers multiple capitals such as financial, manufactured, intellectual, human, social, and natural. | Narrow; centers on financial data and performance metrics. |

| Stakeholders | Investors, customers, communities, regulators, and employees. | Primarily investors and regulators. |

| Format | Concise, narrative-driven, linking strategy, governance, and performance. | Detailed financial statements, notes, and auditor's reports. |

| Frequency | Typically annual; can be more frequent for ongoing value demonstration. | Annual, aligned with fiscal year-end. |

| Regulation | Voluntary or encouraged under frameworks like IIRC's IR Framework. | Mandated by law and accounting standards (e.g., IFRS, GAAP). |

| Focus | Forward-looking, emphasizing sustainability and long-term value. | Historical financial performance and compliance. |

Which is better?

Integrated reporting offers a comprehensive view by combining financial and non-financial data, enhancing transparency and providing stakeholders with insights into a company's strategy, governance, and sustainability performance. Annual reporting focuses primarily on financial results, meeting regulatory requirements and offering a historical snapshot of financial health. For businesses aiming to communicate long-term value creation and sustainability efforts, integrated reporting is typically more advantageous than traditional annual reporting.

Connection

Integrated reporting and annual reporting are connected through their shared goal of providing a comprehensive view of a company's financial performance and sustainability. Integrated reporting combines financial data, environmental, social, and governance (ESG) factors to deliver a holistic account, whereas annual reporting primarily focuses on financial statements and regulatory disclosures. Both reports aid investors and stakeholders in making informed decisions by enhancing transparency and accountability in corporate reporting.

Key Terms

Financial Statements

Annual reporting primarily emphasizes Financial Statements such as the balance sheet, income statement, and cash flow statement to provide a clear snapshot of a company's financial performance over the fiscal year. Integrated reporting goes beyond traditional financial metrics by incorporating non-financial information like environmental, social, and governance (ESG) factors, offering a holistic view of an organization's value creation. Discover more about how integrated reporting reshapes corporate transparency and stakeholder engagement.

Sustainability Metrics

Annual reporting primarily emphasizes financial performance and compliance, often providing limited disclosure on sustainability metrics. Integrated reporting combines financial data with comprehensive sustainability metrics, offering stakeholders a holistic view of environmental, social, and governance (ESG) impacts. Discover how integrating sustainability metrics into reporting can enhance transparency and drive long-term value creation.

Stakeholder Communication

Annual reporting primarily targets shareholders by providing financial performance summaries, compliance data, and strategic overviews to fulfill regulatory requirements. Integrated reporting extends beyond financial metrics to include environmental, social, and governance (ESG) factors, offering a holistic view of value creation that engages a broader range of stakeholders such as employees, customers, and communities. Explore how integrated reporting transforms stakeholder communication by delivering comprehensive, transparent insights.

Source and External Links

Annual Report Preparation and Filing is Made Easy - Most states require corporations, LLCs, and nonprofits to annually file an "Annual Report" (sometimes called a Statement of Information) with updated company details, directors, officers, and registered agent information, or risk penalties and possible suspension.

What is an annual report? Definitions & filing requirements - Nearly all states mandate statutory business entities to file regular information reports (usually annually, but some require biennial or periodic reports) to maintain public records and compliance, with non-compliance risking penalties.

LLC/Corporation Annual Reports (50-State) - Due dates, fees, and forms for annual reports vary by state and entity type, with some states requiring biennial or even decennial filings, and initial reports may also be required after entity formation.

dowidth.com

dowidth.com