Crypto asset valuation requires specialized approaches due to market volatility and regulatory uncertainty, differing significantly from the traditional Lower of Cost or Market (LCM) method used for tangible assets. Unlike LCM, which bases valuation on the lower historical cost or market value, crypto asset valuation often incorporates fair value measurement, considering active market prices and potential impairments. Explore detailed strategies and accounting standards governing crypto asset valuation to enhance financial reporting accuracy.

Why it is important

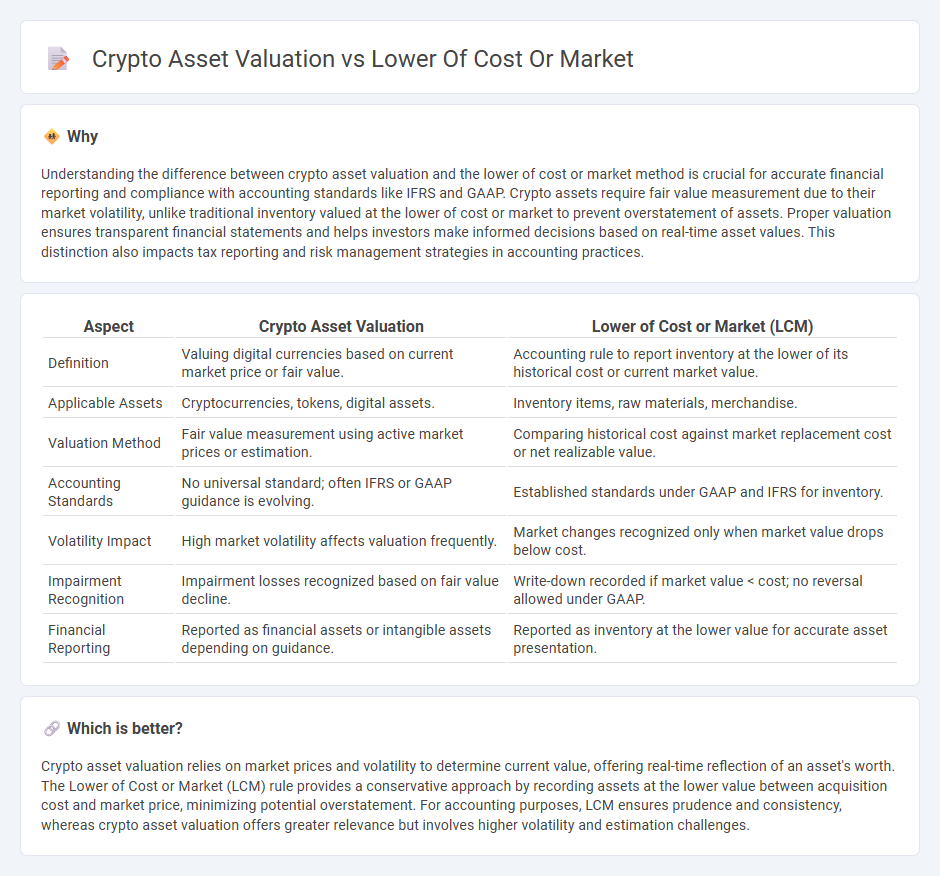

Understanding the difference between crypto asset valuation and the lower of cost or market method is crucial for accurate financial reporting and compliance with accounting standards like IFRS and GAAP. Crypto assets require fair value measurement due to their market volatility, unlike traditional inventory valued at the lower of cost or market to prevent overstatement of assets. Proper valuation ensures transparent financial statements and helps investors make informed decisions based on real-time asset values. This distinction also impacts tax reporting and risk management strategies in accounting practices.

Comparison Table

| Aspect | Crypto Asset Valuation | Lower of Cost or Market (LCM) |

|---|---|---|

| Definition | Valuing digital currencies based on current market price or fair value. | Accounting rule to report inventory at the lower of its historical cost or current market value. |

| Applicable Assets | Cryptocurrencies, tokens, digital assets. | Inventory items, raw materials, merchandise. |

| Valuation Method | Fair value measurement using active market prices or estimation. | Comparing historical cost against market replacement cost or net realizable value. |

| Accounting Standards | No universal standard; often IFRS or GAAP guidance is evolving. | Established standards under GAAP and IFRS for inventory. |

| Volatility Impact | High market volatility affects valuation frequently. | Market changes recognized only when market value drops below cost. |

| Impairment Recognition | Impairment losses recognized based on fair value decline. | Write-down recorded if market value < cost; no reversal allowed under GAAP. |

| Financial Reporting | Reported as financial assets or intangible assets depending on guidance. | Reported as inventory at the lower value for accurate asset presentation. |

Which is better?

Crypto asset valuation relies on market prices and volatility to determine current value, offering real-time reflection of an asset's worth. The Lower of Cost or Market (LCM) rule provides a conservative approach by recording assets at the lower value between acquisition cost and market price, minimizing potential overstatement. For accounting purposes, LCM ensures prudence and consistency, whereas crypto asset valuation offers greater relevance but involves higher volatility and estimation challenges.

Connection

Crypto asset valuation relies heavily on the lower of cost or market (LCM) rule to ensure accurate financial reporting. This accounting principle requires companies to report crypto assets at the lower value between their original purchase cost and current market price. Applying LCM helps mitigate risks from market volatility and prevents overstatement of asset values on balance sheets.

Key Terms

Historical Cost

Historical cost for crypto asset valuation records the original purchase price, ensuring objective financial reporting and minimizing volatility compared to market fluctuations. The lower of cost or market (LCM) method adjusts asset value to prevent overstatement, recognizing impairments when market prices fall below historical costs. Explore further how applying LCM impacts crypto asset accounting standards and investor decision-making.

Fair Value

The lower of cost or market (LCM) rule requires valuing inventory or assets at the lesser of their historical cost or current market value, ensuring prudent asset reporting, while crypto asset valuation primarily relies on fair value measurement reflecting active market prices and volatility. Fair value offers a more dynamic and transparent approach for crypto assets, capturing real-time market sentiment and liquidity, contrasting with the conservative approach of LCM that might undervalue rapidly appreciating digital assets. Explore detailed methodologies and regulatory perspectives to better understand the nuances between these valuation techniques in digital finance.

Impairment

The lower of cost or market (LCM) method requires assets to be reported at the lesser of historical cost or current market value, often triggering impairment losses when market values decline below cost, which aligns with the valuation principles applied to crypto assets under accounting standards like IAS 38 and IFRS 9. Crypto assets frequently experience significant volatility, making impairment assessments crucial as declines in fair value below amortized cost necessitate timely recognition to reflect true financial performance. Explore the detailed impact of impairment considerations on crypto asset valuation methodologies and financial reporting standards.

Source and External Links

Lower of cost or market (LCM) definition - AccountingTools - The lower of cost or market rule requires a business to report inventory at the lower of its original cost or its current replacement cost, constrained by net realizable value, ensuring inventory values reflect declines due to obsolescence or price drops under GAAP.

Lower of cost or market - Wikipedia - LCM is a conservative inventory valuation method where inventory is reported at historical cost or current market value, whichever is lower, with losses recorded in cost of goods sold or as inventory write-downs, reflecting declines in net realizable value.

Lower of Cost or Market (LCM): Definition, Overview & Example - The LCM accounting principle mandates writing down inventory to the lower of cost or market value to provide a more accurate and transparent financial picture, preventing inventory overvaluation on the balance sheet.

dowidth.com

dowidth.com