Integrated reporting combines financial, environmental, social, and governance data to provide a comprehensive view of an organization's overall performance and value creation beyond traditional financial metrics. Statutory reporting focuses on compliance-driven financial statements required by law, emphasizing accuracy and adherence to accounting standards. Explore the differences and benefits of integrated versus statutory reporting to enhance your financial transparency and strategic insight.

Why it is important

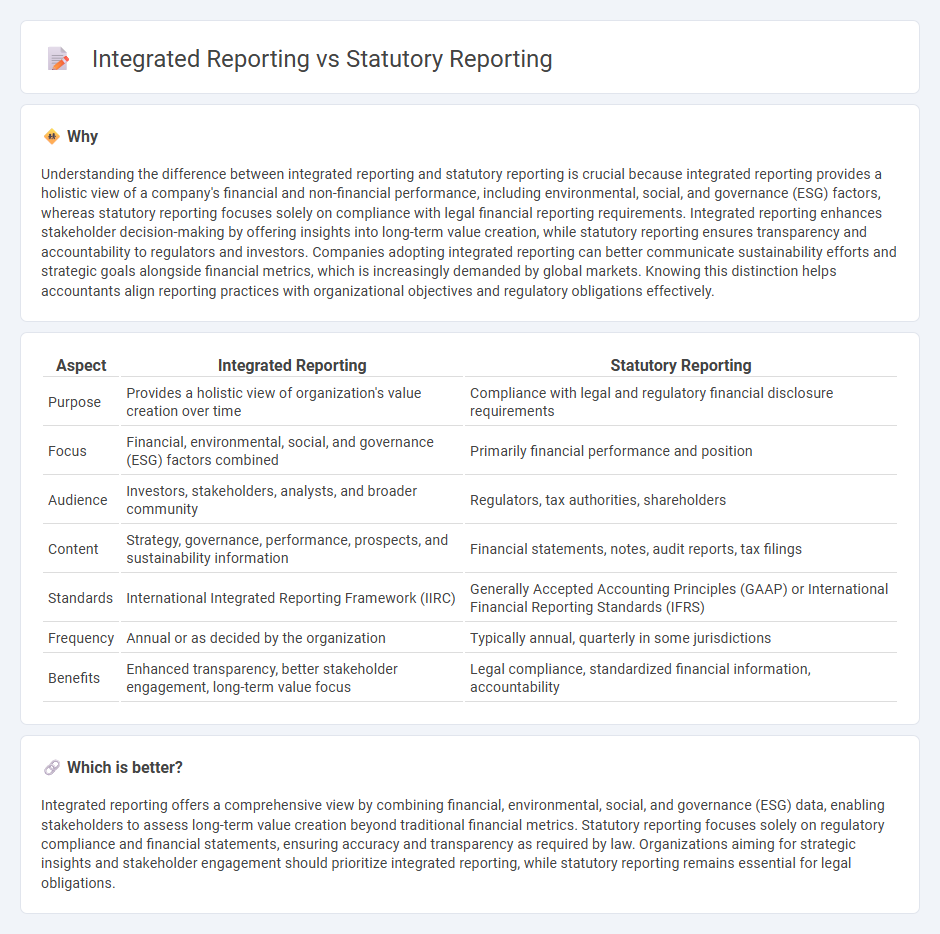

Understanding the difference between integrated reporting and statutory reporting is crucial because integrated reporting provides a holistic view of a company's financial and non-financial performance, including environmental, social, and governance (ESG) factors, whereas statutory reporting focuses solely on compliance with legal financial reporting requirements. Integrated reporting enhances stakeholder decision-making by offering insights into long-term value creation, while statutory reporting ensures transparency and accountability to regulators and investors. Companies adopting integrated reporting can better communicate sustainability efforts and strategic goals alongside financial metrics, which is increasingly demanded by global markets. Knowing this distinction helps accountants align reporting practices with organizational objectives and regulatory obligations effectively.

Comparison Table

| Aspect | Integrated Reporting | Statutory Reporting |

|---|---|---|

| Purpose | Provides a holistic view of organization's value creation over time | Compliance with legal and regulatory financial disclosure requirements |

| Focus | Financial, environmental, social, and governance (ESG) factors combined | Primarily financial performance and position |

| Audience | Investors, stakeholders, analysts, and broader community | Regulators, tax authorities, shareholders |

| Content | Strategy, governance, performance, prospects, and sustainability information | Financial statements, notes, audit reports, tax filings |

| Standards | International Integrated Reporting Framework (IIRC) | Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) |

| Frequency | Annual or as decided by the organization | Typically annual, quarterly in some jurisdictions |

| Benefits | Enhanced transparency, better stakeholder engagement, long-term value focus | Legal compliance, standardized financial information, accountability |

Which is better?

Integrated reporting offers a comprehensive view by combining financial, environmental, social, and governance (ESG) data, enabling stakeholders to assess long-term value creation beyond traditional financial metrics. Statutory reporting focuses solely on regulatory compliance and financial statements, ensuring accuracy and transparency as required by law. Organizations aiming for strategic insights and stakeholder engagement should prioritize integrated reporting, while statutory reporting remains essential for legal obligations.

Connection

Integrated reporting and statutory reporting are connected through their shared goal of providing comprehensive financial information to stakeholders, with statutory reporting focusing on compliance and legal requirements, while integrated reporting expands the scope by incorporating environmental, social, and governance (ESG) factors. This connection enables organizations to present a holistic view of performance, reflecting financial results alongside sustainability and strategic value creation. By aligning statutory disclosures with integrated reports, companies enhance transparency and foster informed decision-making among investors, regulators, and the public.

Key Terms

Compliance

Statutory reporting focuses on mandatory financial disclosures required by law to ensure regulatory compliance and transparency to stakeholders. Integrated reporting combines financial and non-financial information, emphasizing value creation over time and aligning with broader corporate strategy and sustainability goals. Explore the differences in compliance mandates and strategic benefits to understand which reporting approach suits your organization best.

Materiality

Statutory reporting emphasizes compliance with regulatory requirements and financial disclosures, focusing on quantifiable data mandated by law. Integrated reporting prioritizes materiality by combining financial and non-financial information to provide a holistic view of an organization's impact on social, environmental, and economic factors. Explore how materiality shapes reporting strategies to enhance transparency and stakeholder engagement.

Stakeholders

Statutory reporting primarily caters to regulatory authorities, ensuring compliance with legal and financial standards to provide transparent financial information. Integrated reporting emphasizes a broader range of stakeholders, including investors, employees, customers, and communities, by combining financial data with environmental, social, and governance (ESG) performance to reflect the organization's overall value creation. Explore how integrated reporting offers a comprehensive view of stakeholder engagement and long-term sustainability.

Source and External Links

What is Statutory Reporting? Understand Its types & Importance - This article explains statutory reporting as a legal requirement for companies to submit financial and non-financial information to regulatory bodies, ensuring transparency and compliance with laws.

Prepare for Regulatory and Statutory Reporting - This piece provides guidance on handling statutory reporting effectively by outlining key steps such as statutory account preparation, audit, and filing.

Global Statutory Reporting Services - Deloitte offers services to manage and transform statutory reporting processes, enhancing efficiency and reducing risks through technology and industry expertise.

dowidth.com

dowidth.com