Cryptofinance reconciliation involves verifying cryptocurrency transactions against blockchain records to ensure accuracy and prevent fraud, supporting digital asset management within accounting frameworks. Accounts payable reconciliation focuses on matching company liabilities with vendor invoices and payment records to maintain precise financial statements and cash flow control. Explore deeper insights into how these reconciliation processes enhance financial integrity in modern accounting.

Why it is important

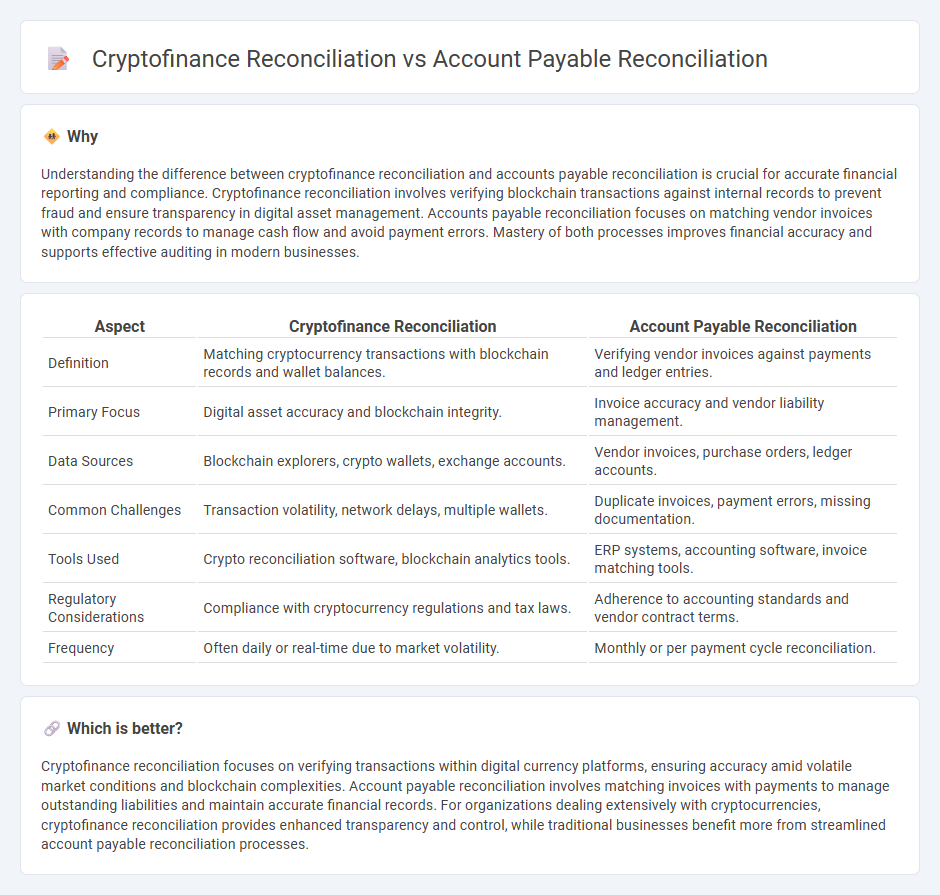

Understanding the difference between cryptofinance reconciliation and accounts payable reconciliation is crucial for accurate financial reporting and compliance. Cryptofinance reconciliation involves verifying blockchain transactions against internal records to prevent fraud and ensure transparency in digital asset management. Accounts payable reconciliation focuses on matching vendor invoices with company records to manage cash flow and avoid payment errors. Mastery of both processes improves financial accuracy and supports effective auditing in modern businesses.

Comparison Table

| Aspect | Cryptofinance Reconciliation | Account Payable Reconciliation |

|---|---|---|

| Definition | Matching cryptocurrency transactions with blockchain records and wallet balances. | Verifying vendor invoices against payments and ledger entries. |

| Primary Focus | Digital asset accuracy and blockchain integrity. | Invoice accuracy and vendor liability management. |

| Data Sources | Blockchain explorers, crypto wallets, exchange accounts. | Vendor invoices, purchase orders, ledger accounts. |

| Common Challenges | Transaction volatility, network delays, multiple wallets. | Duplicate invoices, payment errors, missing documentation. |

| Tools Used | Crypto reconciliation software, blockchain analytics tools. | ERP systems, accounting software, invoice matching tools. |

| Regulatory Considerations | Compliance with cryptocurrency regulations and tax laws. | Adherence to accounting standards and vendor contract terms. |

| Frequency | Often daily or real-time due to market volatility. | Monthly or per payment cycle reconciliation. |

Which is better?

Cryptofinance reconciliation focuses on verifying transactions within digital currency platforms, ensuring accuracy amid volatile market conditions and blockchain complexities. Account payable reconciliation involves matching invoices with payments to manage outstanding liabilities and maintain accurate financial records. For organizations dealing extensively with cryptocurrencies, cryptofinance reconciliation provides enhanced transparency and control, while traditional businesses benefit more from streamlined account payable reconciliation processes.

Connection

Cryptofinance reconciliation and accounts payable reconciliation both involve verifying transactional accuracy to maintain financial integrity. Cryptofinance reconciliation ensures blockchain or cryptocurrency transactions are accurately recorded, while accounts payable reconciliation verifies vendor invoices against payment records. Effective synchronization between these processes reduces errors and supports accurate financial reporting in organizations handling digital assets.

Key Terms

**Account payable reconciliation:**

Account payable reconciliation involves verifying supplier invoices against payment records to ensure accuracy and prevent discrepancies in financial statements. This process is critical for maintaining healthy cash flow management, detecting fraud, and ensuring compliance with accounting standards such as GAAP or IFRS. Explore more about advanced techniques and tools to optimize your account payable reconciliation process.

Vendor statements

Account payable reconciliation focuses on verifying vendor invoices and payment records to ensure accuracy in liabilities, while cryptofinance reconciliation entails tracking digital asset transactions and wallet balances for precise financial reporting. Vendor statements serve as critical evidence for resolving discrepancies and validating outstanding balances in both processes. Explore expert strategies to streamline reconciliation and enhance financial accuracy.

Outstanding invoices

Account payable reconciliation involves matching outstanding invoices against payments to ensure accurate financial records and avoid discrepancies. Cryptofinance reconciliation, however, deals with digital asset transactions where outstanding invoices may reflect blockchain-based payments requiring real-time ledger verification. Explore our detailed analysis to understand the unique challenges and solutions in managing outstanding invoices across these two reconciliation methods.

Source and External Links

How to Reconcile Accounts Payable in 8 Steps - BILL - Accounts payable reconciliation involves checking beginning balances, collecting documents (like vendor invoices, payment receipts, and bank statements), and reviewing vendor invoices to ensure internal records match supplier records and resolve discrepancies.

Accounts Payable Reconciliation: The Complete Guide | Numeric - The process includes verifying that prior periods were reconciled, gathering necessary documents (vendor invoices, purchase orders, AP ledgers, aging reports, bank statements), and comparing company records with supplier statements to confirm accuracy.

AP Reconciliation: How to Reconcile Accounts Payable - Artsyl - AP reconciliation is the matching and verification of a company's accounts payable records with supplier statements to identify and resolve discrepancies, ensure financial statement accuracy, and support compliance.

dowidth.com

dowidth.com