Digital twin accounting leverages virtual models of financial processes to simulate and predict outcomes, enhancing forecasting accuracy and decision-making. Real-time accounting captures and processes financial transactions instantaneously, ensuring up-to-date financial information and rapid response capabilities. Explore how integrating these approaches transforms financial management and operational efficiency.

Why it is important

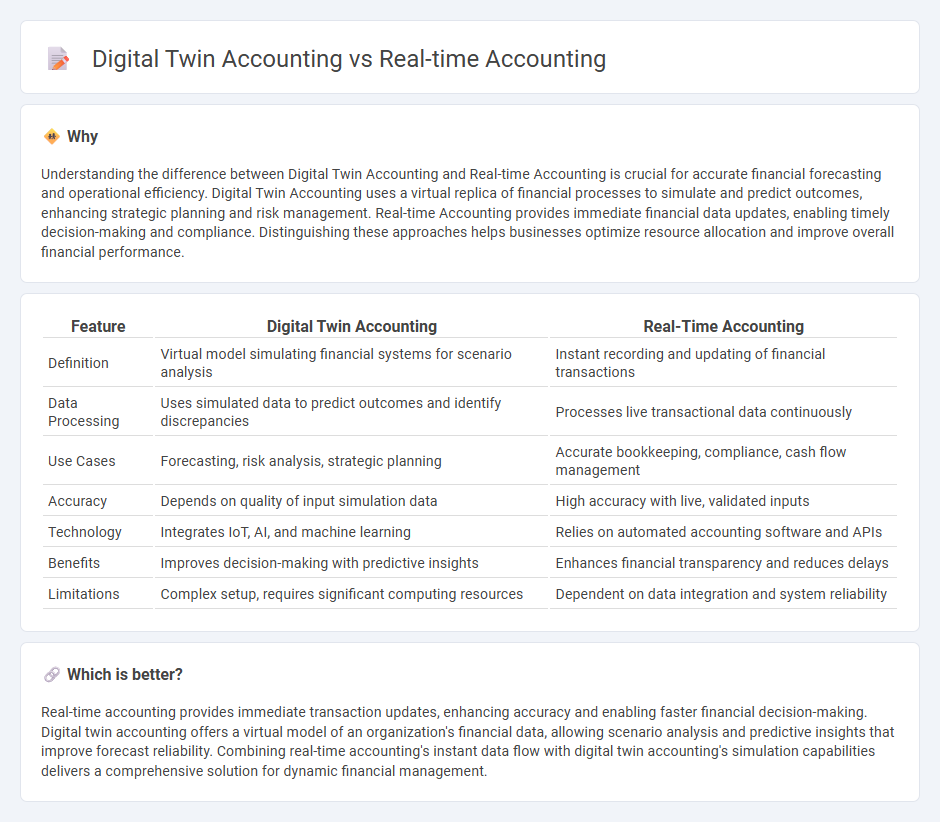

Understanding the difference between Digital Twin Accounting and Real-time Accounting is crucial for accurate financial forecasting and operational efficiency. Digital Twin Accounting uses a virtual replica of financial processes to simulate and predict outcomes, enhancing strategic planning and risk management. Real-time Accounting provides immediate financial data updates, enabling timely decision-making and compliance. Distinguishing these approaches helps businesses optimize resource allocation and improve overall financial performance.

Comparison Table

| Feature | Digital Twin Accounting | Real-Time Accounting |

|---|---|---|

| Definition | Virtual model simulating financial systems for scenario analysis | Instant recording and updating of financial transactions |

| Data Processing | Uses simulated data to predict outcomes and identify discrepancies | Processes live transactional data continuously |

| Use Cases | Forecasting, risk analysis, strategic planning | Accurate bookkeeping, compliance, cash flow management |

| Accuracy | Depends on quality of input simulation data | High accuracy with live, validated inputs |

| Technology | Integrates IoT, AI, and machine learning | Relies on automated accounting software and APIs |

| Benefits | Improves decision-making with predictive insights | Enhances financial transparency and reduces delays |

| Limitations | Complex setup, requires significant computing resources | Dependent on data integration and system reliability |

Which is better?

Real-time accounting provides immediate transaction updates, enhancing accuracy and enabling faster financial decision-making. Digital twin accounting offers a virtual model of an organization's financial data, allowing scenario analysis and predictive insights that improve forecast reliability. Combining real-time accounting's instant data flow with digital twin accounting's simulation capabilities delivers a comprehensive solution for dynamic financial management.

Connection

Digital twin accounting creates virtual replicas of financial processes, enabling continuous data synchronization with real-time accounting systems. This integration allows instantaneous transaction monitoring and error detection, enhancing accuracy and transparency. Leveraging IoT and AI technologies, both approaches streamline financial reporting and decision-making through up-to-the-minute data analysis.

Key Terms

Data Synchronization

Real-time accounting ensures continuous, up-to-date financial data by integrating transactions instantly, while digital twin accounting creates a dynamic virtual replica of an organization's financial ecosystem for predictive analysis and scenario testing. Data synchronization in real-time accounting involves immediate ledger updates, whereas digital twin accounting requires comprehensive alignment between physical operations and their digital counterparts to maintain accuracy. Explore how these approaches transform financial management by enhancing data accuracy and strategic decision-making.

Simulation Modeling

Real-time accounting continuously updates financial data to reflect current transactions and cash flows, enabling immediate decision-making. Digital twin accounting extends this by integrating simulation modeling to create dynamic virtual replicas of financial processes, allowing businesses to predict outcomes and test scenarios without real-world risks. Explore how simulation modeling in digital twin accounting can transform financial strategy and forecasting.

Transaction Automation

Real-time accounting leverages automated transaction processing to update financial data instantaneously, ensuring accuracy and timely decision-making. Digital twin accounting extends this by creating a virtual replica of an organization's financial processes, enabling predictive analytics and scenario testing through transaction automation. Explore how integrating these technologies can revolutionize your financial operations and transaction management.

Source and External Links

Real-Time Financial Control: A Complete Guide - HubiFi - Real-time accounting is a financial management method where data is continuously updated and accessible instantly, enabling faster and more strategic business decisions based on current financial information rather than outdated reports.

Real-Time Accounting: Why It's Worth the Switch - Talley LLP - Real-time accounting automates continuous capture and reporting of financial data to give businesses immediate insights that improve decision-making, cash flow management, and the ability to respond proactively to financial trends.

What Is Real Time Accounting? | Ballards LLP - Real-time accounting allows instant access to updated financial data anytime and anywhere, streamlining processes through automation and cloud-based systems while improving reporting accuracy and collaboration between accountants and business owners.

dowidth.com

dowidth.com