Revenue recognition automation streamlines the process of identifying and recording income in compliance with accounting standards like ASC 606 and IFRS 15, enhancing accuracy and reducing manual errors. Financial close automation focuses on accelerating the month-end and quarter-end closing processes by integrating data consolidation, reconciliation, and reporting tasks, ultimately improving financial statement reliability. Discover how these automation solutions transform accounting efficiency and compliance by exploring their unique benefits.

Why it is important

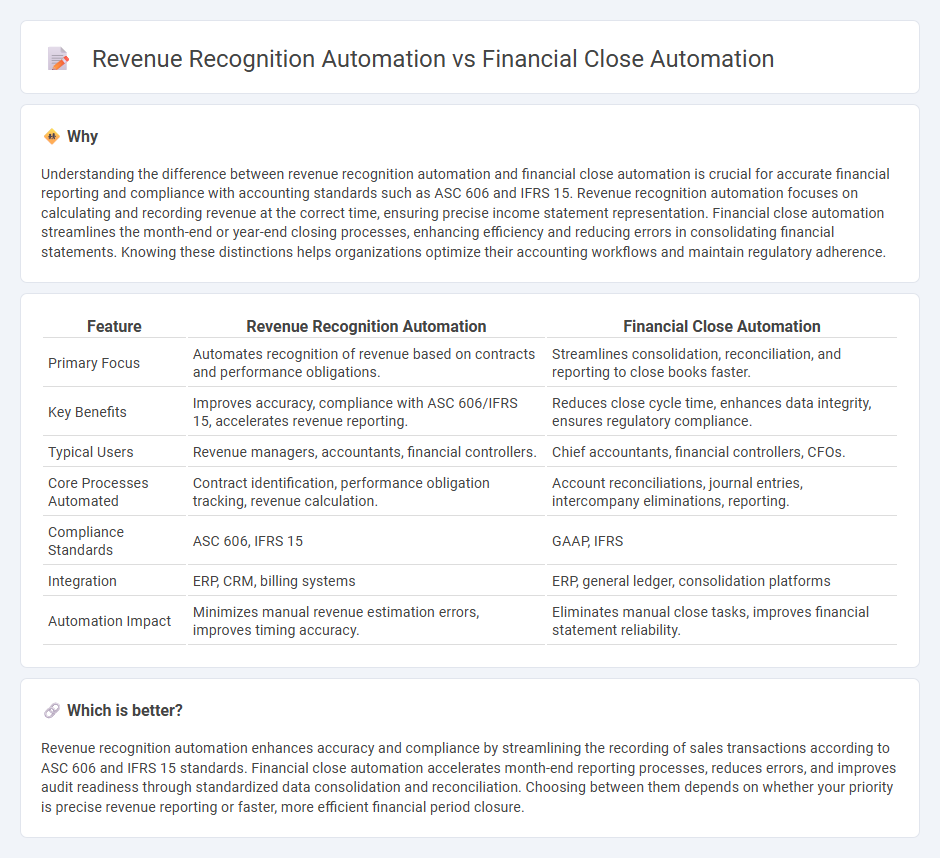

Understanding the difference between revenue recognition automation and financial close automation is crucial for accurate financial reporting and compliance with accounting standards such as ASC 606 and IFRS 15. Revenue recognition automation focuses on calculating and recording revenue at the correct time, ensuring precise income statement representation. Financial close automation streamlines the month-end or year-end closing processes, enhancing efficiency and reducing errors in consolidating financial statements. Knowing these distinctions helps organizations optimize their accounting workflows and maintain regulatory adherence.

Comparison Table

| Feature | Revenue Recognition Automation | Financial Close Automation |

|---|---|---|

| Primary Focus | Automates recognition of revenue based on contracts and performance obligations. | Streamlines consolidation, reconciliation, and reporting to close books faster. |

| Key Benefits | Improves accuracy, compliance with ASC 606/IFRS 15, accelerates revenue reporting. | Reduces close cycle time, enhances data integrity, ensures regulatory compliance. |

| Typical Users | Revenue managers, accountants, financial controllers. | Chief accountants, financial controllers, CFOs. |

| Core Processes Automated | Contract identification, performance obligation tracking, revenue calculation. | Account reconciliations, journal entries, intercompany eliminations, reporting. |

| Compliance Standards | ASC 606, IFRS 15 | GAAP, IFRS |

| Integration | ERP, CRM, billing systems | ERP, general ledger, consolidation platforms |

| Automation Impact | Minimizes manual revenue estimation errors, improves timing accuracy. | Eliminates manual close tasks, improves financial statement reliability. |

Which is better?

Revenue recognition automation enhances accuracy and compliance by streamlining the recording of sales transactions according to ASC 606 and IFRS 15 standards. Financial close automation accelerates month-end reporting processes, reduces errors, and improves audit readiness through standardized data consolidation and reconciliation. Choosing between them depends on whether your priority is precise revenue reporting or faster, more efficient financial period closure.

Connection

Revenue recognition automation streamlines the accurate recording of income by integrating real-time sales data with accounting systems, reducing manual errors. Financial close automation leverages this precise revenue data to expedite closing processes, ensuring timely and compliant financial reporting. Together, they enhance the efficiency and reliability of financial operations by synchronizing revenue insights with closing activities.

Key Terms

**Financial Close Automation:**

Financial Close Automation streamlines the period-end closing process by integrating data from various accounting systems, reducing manual errors, and accelerating financial reporting cycles. It enhances compliance and audit readiness through standardized workflows and real-time visibility into closing tasks and milestones. Discover how Financial Close Automation can optimize your financial operations and improve accuracy.

Reconciliation

Financial close automation streamlines the consolidation and reconciliation of financial data, ensuring accuracy and compliance in reporting by reducing manual intervention and errors. Revenue recognition automation focuses on aligning revenue data with accounting standards, automating the reconciliation between sales, billing, and revenue ledgers to ensure precise revenue reporting. Explore how advanced reconciliation technologies enhance the efficiency and reliability of both financial close and revenue recognition processes.

Journal Entries

Financial close automation streamlines the consolidation of journal entries by ensuring accuracy, reducing manual errors, and accelerating month-end close cycles. Revenue recognition automation focuses on precisely recording revenue-related journal entries according to ASC 606 or IFRS 15 standards, enhancing compliance and improving financial reporting transparency. Explore how integrating these automation solutions can optimize your accounting workflows and regulatory adherence.

Source and External Links

Financial Close Management Software - Trintech - Financial close automation improves efficiency and reduces risk by managing the entire close cycle in one place, enhancing task ownership, visibility, and workflow automation to reduce manual work and financial statement risk.

Financial Month End Close Checklist Software - Redwood - Automates and orchestrates month-end and year-end close tasks with precise workflow controls, detailed audit trails, and centralized dashboards to streamline accounting processes globally and locally.

AI-Powered Financial Close Software - DOKKA - Provides AI-driven financial close automation integrated with accounting platforms, enabling account reconciliation, journal entry management, and report generation to save time and improve accuracy in closing financial books.

dowidth.com

dowidth.com