Deferred revenue recognition records income when earned, aligning with accrual accounting principles, while cash basis accounting recognizes revenue only when cash is received, impacting financial statements differently. Understanding deferred revenue ensures accurate matching of income with related expenses, enhancing financial clarity for businesses. Explore further to grasp how these methods affect financial reporting and decision-making.

Why it is important

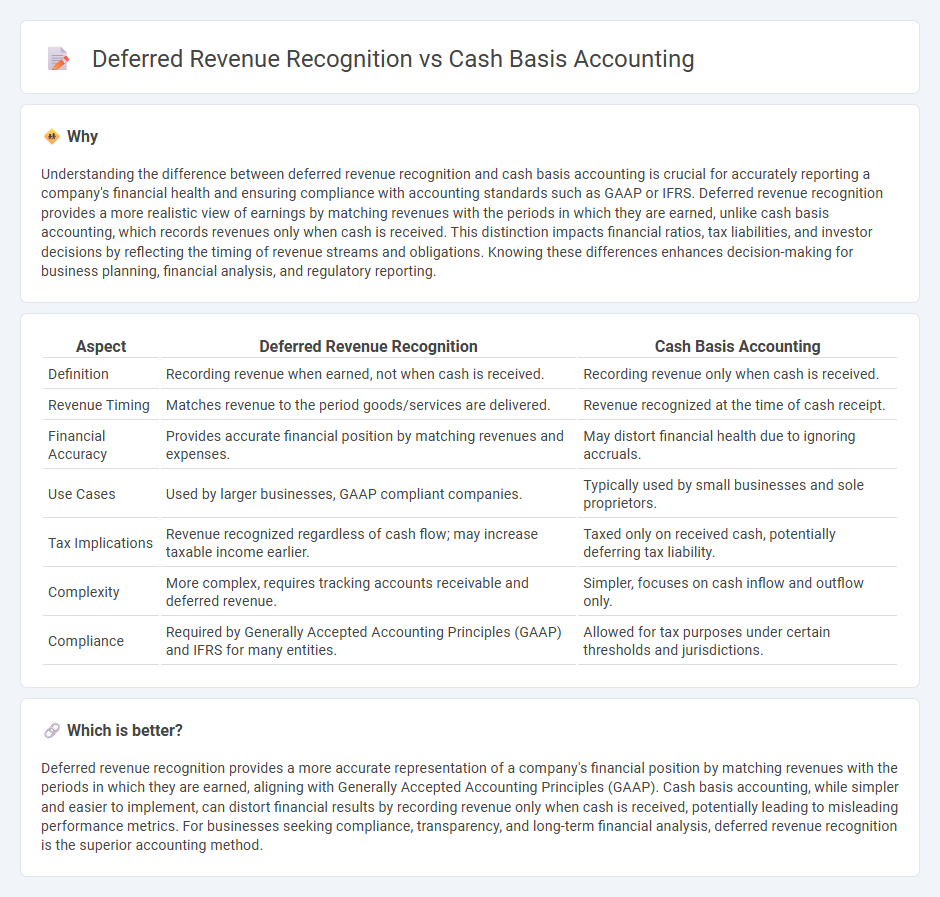

Understanding the difference between deferred revenue recognition and cash basis accounting is crucial for accurately reporting a company's financial health and ensuring compliance with accounting standards such as GAAP or IFRS. Deferred revenue recognition provides a more realistic view of earnings by matching revenues with the periods in which they are earned, unlike cash basis accounting, which records revenues only when cash is received. This distinction impacts financial ratios, tax liabilities, and investor decisions by reflecting the timing of revenue streams and obligations. Knowing these differences enhances decision-making for business planning, financial analysis, and regulatory reporting.

Comparison Table

| Aspect | Deferred Revenue Recognition | Cash Basis Accounting |

|---|---|---|

| Definition | Recording revenue when earned, not when cash is received. | Recording revenue only when cash is received. |

| Revenue Timing | Matches revenue to the period goods/services are delivered. | Revenue recognized at the time of cash receipt. |

| Financial Accuracy | Provides accurate financial position by matching revenues and expenses. | May distort financial health due to ignoring accruals. |

| Use Cases | Used by larger businesses, GAAP compliant companies. | Typically used by small businesses and sole proprietors. |

| Tax Implications | Revenue recognized regardless of cash flow; may increase taxable income earlier. | Taxed only on received cash, potentially deferring tax liability. |

| Complexity | More complex, requires tracking accounts receivable and deferred revenue. | Simpler, focuses on cash inflow and outflow only. |

| Compliance | Required by Generally Accepted Accounting Principles (GAAP) and IFRS for many entities. | Allowed for tax purposes under certain thresholds and jurisdictions. |

Which is better?

Deferred revenue recognition provides a more accurate representation of a company's financial position by matching revenues with the periods in which they are earned, aligning with Generally Accepted Accounting Principles (GAAP). Cash basis accounting, while simpler and easier to implement, can distort financial results by recording revenue only when cash is received, potentially leading to misleading performance metrics. For businesses seeking compliance, transparency, and long-term financial analysis, deferred revenue recognition is the superior accounting method.

Connection

Deferred revenue recognition impacts cash basis accounting by recording revenue only when cash is received, regardless of when the service is performed or goods are delivered. In cash basis accounting, deferred revenue represents cash collected in advance and is not recognized as revenue until earned, aligning cash flow with income reporting. This connection ensures that revenue recognition matches actual cash inflows, providing a clear picture of financial health under cash accounting principles.

Key Terms

Revenue Recognition

Cash basis accounting recognizes revenue only when cash is received, making it simpler but less reflective of actual business activity. Deferred revenue recognition records revenue when earned, not necessarily when cash is received, ensuring compliance with GAAP and providing a more accurate financial picture. Explore these revenue recognition methods in-depth to optimize your accounting practices.

Accrual Accounting

Accrual accounting records revenues when earned and expenses when incurred, contrasting with cash basis accounting that recognizes transactions upon cash movement. Deferred revenue recognition under accrual accounting ensures revenue is matched with the period in which goods or services are delivered, enhancing financial accuracy and compliance with GAAP. Explore more about how these accounting methods impact financial reporting and business decision-making.

Unearned Revenue

Cash basis accounting recognizes revenue only when cash is received, whereas deferred revenue recognition records unearned revenue as a liability until the service or product is delivered. Unearned revenue, also known as deferred revenue, represents payments received in advance for goods or services yet to be provided. Explore how managing unearned revenue impacts financial reporting accuracy and compliance.

Source and External Links

What Is Cash Basis Accounting? Definition and Guide - Cash basis accounting is a method where revenue and expenses are recorded only when cash is received or paid, typically used by small businesses or individuals with high cash flow.

Cash-based accounting: A guide to the cash basis - This guide explains how cash-based accounting works, its pros and cons, and how it affects tax reporting and business financial tracking.

Cash basis: Overview - Cash basis accounting is the standard method for sole traders and partnerships to record income and expenses only when money is received or paid, simplifying tax reporting.

dowidth.com

dowidth.com