Lease accounting software streamlines the tracking and reporting of lease agreements in compliance with accounting standards such as ASC 842 and IFRS 16, ensuring accurate financial statements and lease liability management. Fixed asset management software focuses on the lifecycle of physical assets, including acquisition, depreciation, maintenance, and disposal, helping companies optimize asset utilization and accounting accuracy. Explore the distinct advantages and functionalities of each solution to determine which best fits your organization's financial management needs.

Why it is important

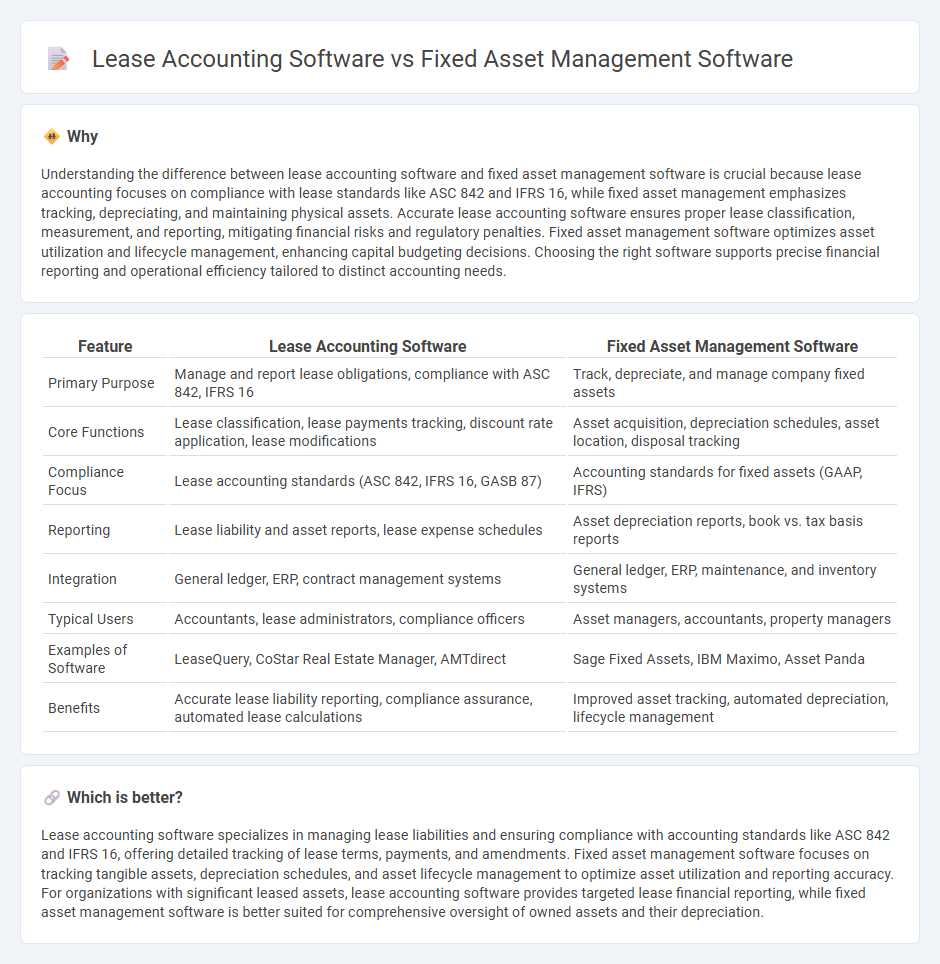

Understanding the difference between lease accounting software and fixed asset management software is crucial because lease accounting focuses on compliance with lease standards like ASC 842 and IFRS 16, while fixed asset management emphasizes tracking, depreciating, and maintaining physical assets. Accurate lease accounting software ensures proper lease classification, measurement, and reporting, mitigating financial risks and regulatory penalties. Fixed asset management software optimizes asset utilization and lifecycle management, enhancing capital budgeting decisions. Choosing the right software supports precise financial reporting and operational efficiency tailored to distinct accounting needs.

Comparison Table

| Feature | Lease Accounting Software | Fixed Asset Management Software |

|---|---|---|

| Primary Purpose | Manage and report lease obligations, compliance with ASC 842, IFRS 16 | Track, depreciate, and manage company fixed assets |

| Core Functions | Lease classification, lease payments tracking, discount rate application, lease modifications | Asset acquisition, depreciation schedules, asset location, disposal tracking |

| Compliance Focus | Lease accounting standards (ASC 842, IFRS 16, GASB 87) | Accounting standards for fixed assets (GAAP, IFRS) |

| Reporting | Lease liability and asset reports, lease expense schedules | Asset depreciation reports, book vs. tax basis reports |

| Integration | General ledger, ERP, contract management systems | General ledger, ERP, maintenance, and inventory systems |

| Typical Users | Accountants, lease administrators, compliance officers | Asset managers, accountants, property managers |

| Examples of Software | LeaseQuery, CoStar Real Estate Manager, AMTdirect | Sage Fixed Assets, IBM Maximo, Asset Panda |

| Benefits | Accurate lease liability reporting, compliance assurance, automated lease calculations | Improved asset tracking, automated depreciation, lifecycle management |

Which is better?

Lease accounting software specializes in managing lease liabilities and ensuring compliance with accounting standards like ASC 842 and IFRS 16, offering detailed tracking of lease terms, payments, and amendments. Fixed asset management software focuses on tracking tangible assets, depreciation schedules, and asset lifecycle management to optimize asset utilization and reporting accuracy. For organizations with significant leased assets, lease accounting software provides targeted lease financial reporting, while fixed asset management software is better suited for comprehensive oversight of owned assets and their depreciation.

Connection

Lease accounting software integrates seamlessly with fixed asset management software by automating the tracking and reporting of leased assets throughout their lifecycle. This connection ensures compliance with accounting standards like ASC 842 and IFRS 16 by accurately capturing lease liabilities and right-of-use assets. Synchronizing lease data with fixed asset registers enhances financial transparency, streamlines depreciation calculations, and improves audit readiness.

Key Terms

Depreciation

Fixed asset management software tracks the depreciation of owned assets using methods like straight-line or declining balance to allocate costs over their useful life. Lease accounting software handles the depreciation of leased assets while complying with standards such as ASC 842 or IFRS 16, ensuring accurate right-of-use asset valuation. Explore the distinct impacts of each software type on financial reporting and compliance.

Lease liability

Fixed asset management software primarily tracks and manages physical assets such as machinery, vehicles, and property, ensuring accurate depreciation and asset lifecycle management. Lease accounting software specializes in recognizing, measuring, and reporting lease liabilities and right-of-use assets in compliance with IFRS 16 and ASC 842 standards. Explore how lease accounting software enhances lease liability management and financial reporting accuracy.

Asset capitalization

Fixed asset management software streamlines asset capitalization by tracking acquisition costs, depreciation schedules, and asset lifecycles to ensure accurate financial reporting and compliance with accounting standards. Lease accounting software primarily focuses on capitalizing leased assets according to lease terms under ASC 842 or IFRS 16, automating lease classification and obligation calculations. Explore comprehensive solutions that integrate both to optimize asset capitalization and lease accounting efficiency.

Source and External Links

Best Fixed Asset Management Software In India In 2025 - Nitso Asset-Specialist offers comprehensive fixed asset tracking, maintenance scheduling, insurance management, and accurate depreciation calculations tailored for Indian corporates and manufacturers.

Fixed Assets Management Software - Newgen - Newgen provides end-to-end asset lifecycle management, centralized document storage, rule-based alerts, and seamless integration with ERPs for compliance and operational efficiency.

Fixed asset & depreciation accounting software - Thomson Reuters tax - Fixed Assets CS simplifies asset management with robust depreciation tracking, customizable reporting, and support for federal and state tax requirements.

dowidth.com

dowidth.com