Dark data auditing uncovers hidden, unused, or unstructured data within an organization, focusing on identifying risks and optimizing data management for better decision-making. Compliance audits verify adherence to regulatory standards, ensuring financial reports and accounting practices meet legal and industry requirements. Explore in-depth comparisons and methodologies to enhance your organization's audit strategies.

Why it is important

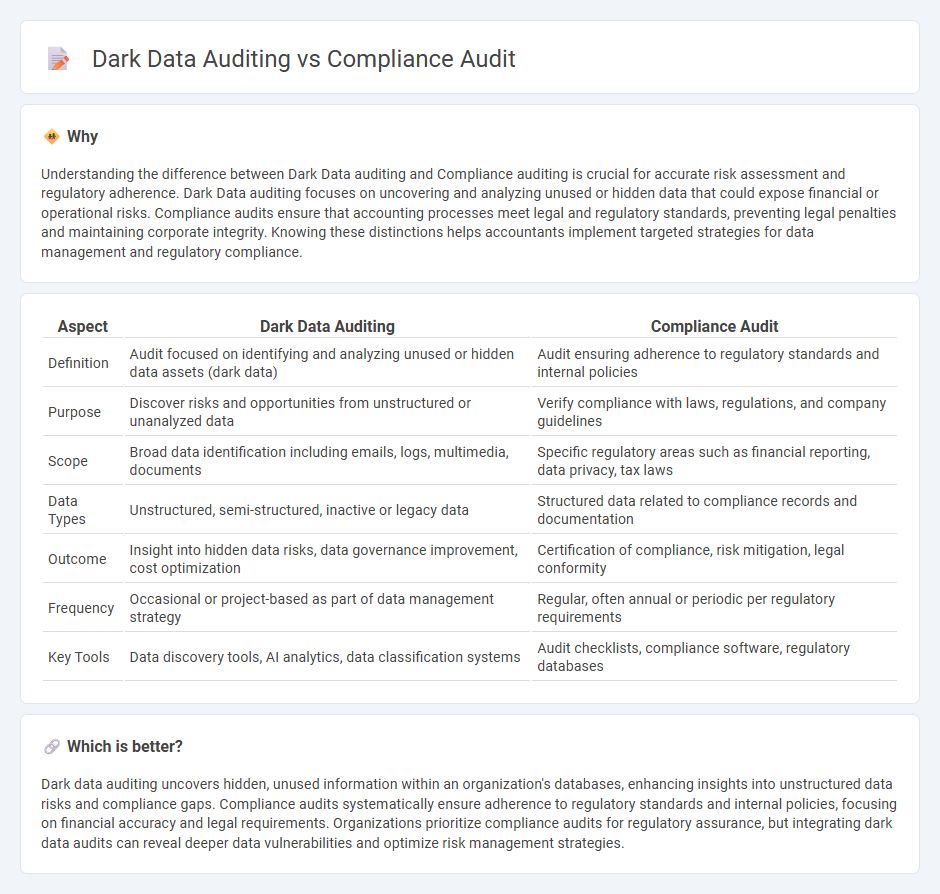

Understanding the difference between Dark Data auditing and Compliance auditing is crucial for accurate risk assessment and regulatory adherence. Dark Data auditing focuses on uncovering and analyzing unused or hidden data that could expose financial or operational risks. Compliance audits ensure that accounting processes meet legal and regulatory standards, preventing legal penalties and maintaining corporate integrity. Knowing these distinctions helps accountants implement targeted strategies for data management and regulatory compliance.

Comparison Table

| Aspect | Dark Data Auditing | Compliance Audit |

|---|---|---|

| Definition | Audit focused on identifying and analyzing unused or hidden data assets (dark data) | Audit ensuring adherence to regulatory standards and internal policies |

| Purpose | Discover risks and opportunities from unstructured or unanalyzed data | Verify compliance with laws, regulations, and company guidelines |

| Scope | Broad data identification including emails, logs, multimedia, documents | Specific regulatory areas such as financial reporting, data privacy, tax laws |

| Data Types | Unstructured, semi-structured, inactive or legacy data | Structured data related to compliance records and documentation |

| Outcome | Insight into hidden data risks, data governance improvement, cost optimization | Certification of compliance, risk mitigation, legal conformity |

| Frequency | Occasional or project-based as part of data management strategy | Regular, often annual or periodic per regulatory requirements |

| Key Tools | Data discovery tools, AI analytics, data classification systems | Audit checklists, compliance software, regulatory databases |

Which is better?

Dark data auditing uncovers hidden, unused information within an organization's databases, enhancing insights into unstructured data risks and compliance gaps. Compliance audits systematically ensure adherence to regulatory standards and internal policies, focusing on financial accuracy and legal requirements. Organizations prioritize compliance audits for regulatory assurance, but integrating dark data audits can reveal deeper data vulnerabilities and optimize risk management strategies.

Connection

Dark data auditing uncovers hidden or unused information within financial records that may pose compliance risks or reporting errors. Compliance audits evaluate adherence to regulatory standards, relying on thorough data analysis, including insights from dark data, to ensure accuracy and prevent fraud. Integrating dark data auditing enhances the completeness and reliability of compliance audits in accounting practices.

Key Terms

**Compliance audit:**

Compliance audit evaluates an organization's adherence to regulatory standards, internal policies, and industry-specific requirements, ensuring legal and operational conformity. It involves systematic examination of records, processes, and controls to identify non-compliance risks that could result in penalties, reputational damage, or operational disruptions. Discover how compliance audits safeguard organizational integrity and support strategic risk management.

Regulatory standards

Compliance audits evaluate organizational adherence to regulatory standards such as GDPR, HIPAA, or SOX, ensuring all data handling practices meet legal requirements. Dark data auditing identifies and assesses unstructured or hidden data assets that may pose compliance risks due to lack of visibility or governance. Explore effective strategies to bridge compliance gaps and manage dark data risks.

Internal controls

Compliance audits emphasize verifying adherence to internal controls and regulatory requirements to mitigate risks and ensure organizational accountability. Dark data auditing involves identifying and managing hidden or unused data within internal control systems to prevent security breaches and improve operational efficiency. Explore further to understand how these auditing approaches strengthen internal controls and data governance.

Source and External Links

What is Compliance Audit: A Comprehensive Guide | MetricStream - A compliance audit is a formal review process that assesses whether an organization adheres to relevant regulations and standards by planning, execution, reporting, and follow-up steps to identify and address compliance gaps.

Compliance Audit: Definition, Types, and What to Expect - AuditBoard - Compliance audits are formal evaluations conducted by independent auditors that examine an organization's adherence to regulatory frameworks, requiring document reviews, interviews, and evidence gathering to ensure compliance.

What is compliance audit? | Definition from TechTarget - Compliance audits comprehensively assess how well an organization follows regulatory guidelines, varying by industry and data sensitivity, and include internal audits by employees and external audits by independent third parties.

dowidth.com

dowidth.com