Intercompany automation streamlines financial transactions and reconciliations between subsidiaries, reducing errors and enhancing process efficiency within multinational corporations. Tax compliance automation focuses on ensuring accurate tax calculations, timely filings, and adherence to complex regulatory requirements, minimizing risks of penalties and audits. Explore the benefits and differences between intercompany automation and tax compliance automation to optimize your accounting operations.

Why it is important

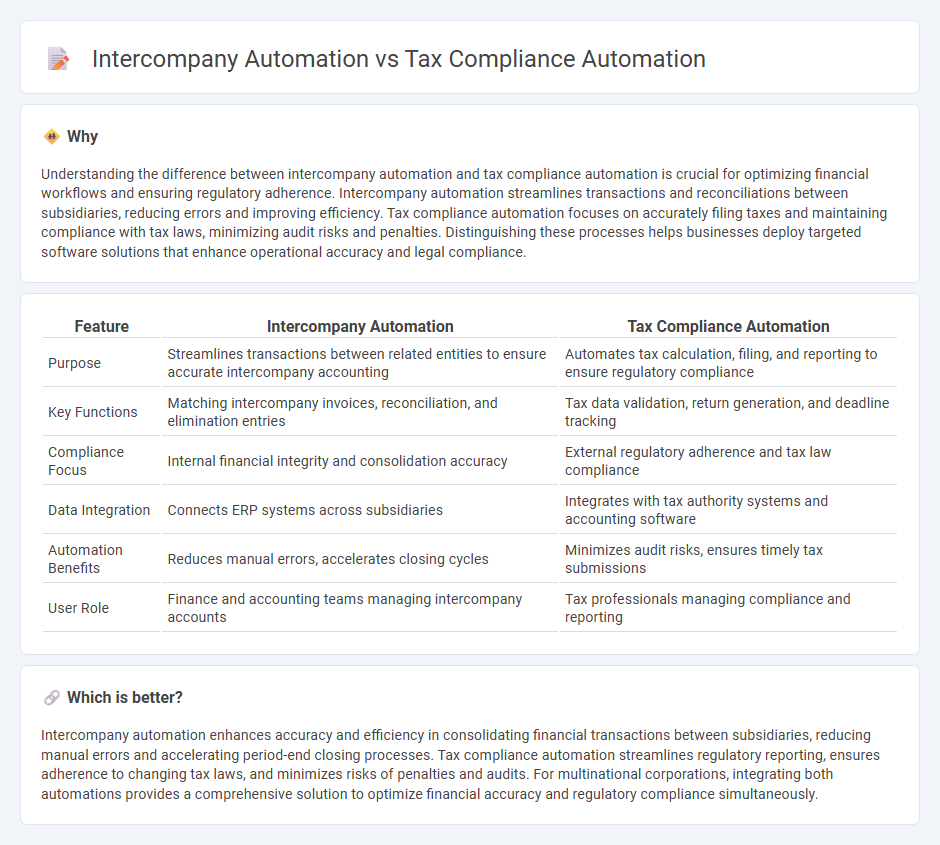

Understanding the difference between intercompany automation and tax compliance automation is crucial for optimizing financial workflows and ensuring regulatory adherence. Intercompany automation streamlines transactions and reconciliations between subsidiaries, reducing errors and improving efficiency. Tax compliance automation focuses on accurately filing taxes and maintaining compliance with tax laws, minimizing audit risks and penalties. Distinguishing these processes helps businesses deploy targeted software solutions that enhance operational accuracy and legal compliance.

Comparison Table

| Feature | Intercompany Automation | Tax Compliance Automation |

|---|---|---|

| Purpose | Streamlines transactions between related entities to ensure accurate intercompany accounting | Automates tax calculation, filing, and reporting to ensure regulatory compliance |

| Key Functions | Matching intercompany invoices, reconciliation, and elimination entries | Tax data validation, return generation, and deadline tracking |

| Compliance Focus | Internal financial integrity and consolidation accuracy | External regulatory adherence and tax law compliance |

| Data Integration | Connects ERP systems across subsidiaries | Integrates with tax authority systems and accounting software |

| Automation Benefits | Reduces manual errors, accelerates closing cycles | Minimizes audit risks, ensures timely tax submissions |

| User Role | Finance and accounting teams managing intercompany accounts | Tax professionals managing compliance and reporting |

Which is better?

Intercompany automation enhances accuracy and efficiency in consolidating financial transactions between subsidiaries, reducing manual errors and accelerating period-end closing processes. Tax compliance automation streamlines regulatory reporting, ensures adherence to changing tax laws, and minimizes risks of penalties and audits. For multinational corporations, integrating both automations provides a comprehensive solution to optimize financial accuracy and regulatory compliance simultaneously.

Connection

Intercompany automation streamlines financial transactions between subsidiaries by standardizing data and enhancing accuracy, which directly supports tax compliance automation by ensuring consistent and timely reporting of intercompany activities for regulatory authorities. Automated reconciliation and transaction matching reduce manual errors and facilitate the generation of accurate tax filings across jurisdictions. This integrated approach minimizes risks related to tax audits and penalties, improving overall corporate governance and financial transparency.

Key Terms

**Tax Compliance Automation:**

Tax compliance automation streamlines the process of managing tax filings, calculations, and reporting, significantly reducing errors and ensuring adherence to complex regulatory requirements. It leverages advanced software to automatically update tax rules, enhance data accuracy, and provide real-time compliance monitoring across jurisdictions. Explore how tax compliance automation can optimize your financial operations and minimize risk exposure.

E-filing

Tax compliance automation streamlines E-filing by automatically generating and submitting tax documents, reducing errors and ensuring adherence to regulatory deadlines. Intercompany automation enhances E-filing accuracy by reconciling transactions and standardizing reporting across multiple subsidiaries within a corporate group. Explore how integrating these automation solutions can optimize your E-filing processes and improve overall financial compliance.

Tax calculation engines

Tax compliance automation streamlines the process of adhering to tax regulations by integrating tax calculation engines that ensure accurate and real-time tax computations across multiple jurisdictions. Intercompany automation leverages these engines to manage intra-group transactions, eliminating discrepancies and enhancing financial reporting accuracy. Explore how advanced tax calculation engines can optimize both tax compliance and intercompany processes for your business.

Source and External Links

ComplyIQ by IGEN - Offers an automated tax compliance platform that simplifies tax operations by automating data transformation, license management, and reconciliation processes.

TaxJar - Provides a cloud-based platform for automating the sales tax compliance lifecycle, including calculations, nexus tracking, reporting, and filing.

Avalara - Automates sales tax compliance with solutions that streamline reporting and filing, supporting businesses across multiple countries and various tax types.

dowidth.com

dowidth.com