Forensic accounting software specializes in detecting and investigating financial fraud, providing tools for auditing, data analysis, and evidence collection to support legal proceedings. Tax preparation software focuses on simplifying tax filing processes, ensuring compliance with tax laws, and maximizing deductions and credits for individuals and businesses. Explore the key features and benefits of forensic accounting versus tax preparation software to determine which best serves your professional needs.

Why it is important

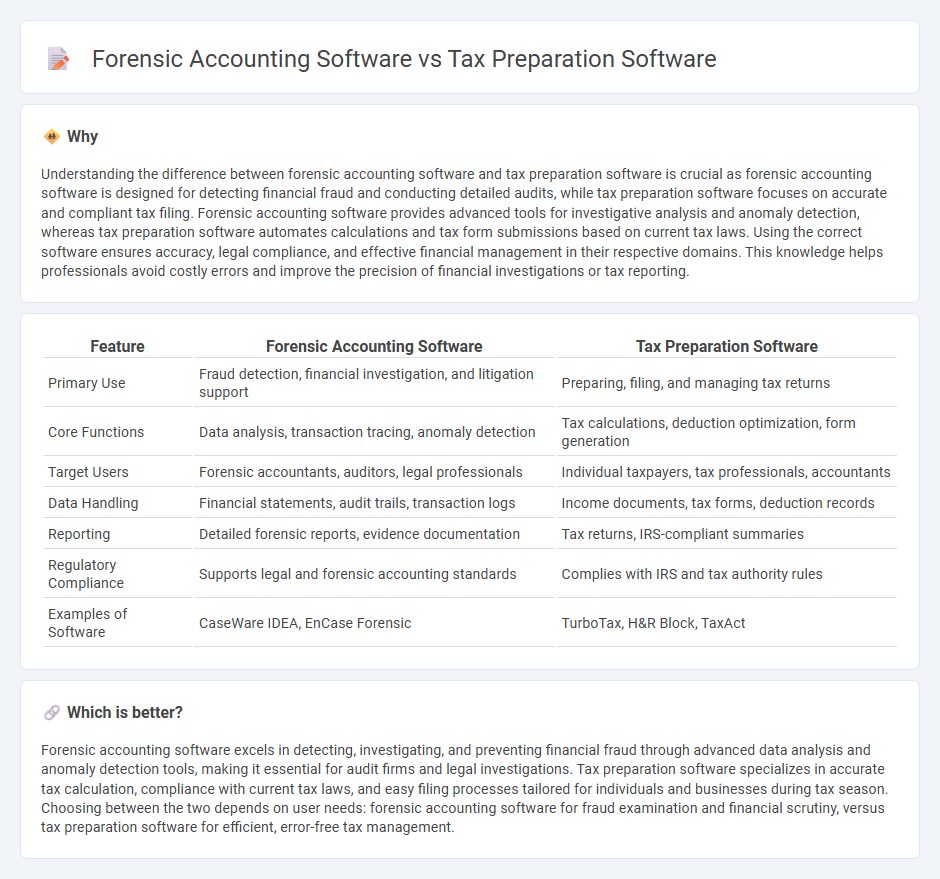

Understanding the difference between forensic accounting software and tax preparation software is crucial as forensic accounting software is designed for detecting financial fraud and conducting detailed audits, while tax preparation software focuses on accurate and compliant tax filing. Forensic accounting software provides advanced tools for investigative analysis and anomaly detection, whereas tax preparation software automates calculations and tax form submissions based on current tax laws. Using the correct software ensures accuracy, legal compliance, and effective financial management in their respective domains. This knowledge helps professionals avoid costly errors and improve the precision of financial investigations or tax reporting.

Comparison Table

| Feature | Forensic Accounting Software | Tax Preparation Software |

|---|---|---|

| Primary Use | Fraud detection, financial investigation, and litigation support | Preparing, filing, and managing tax returns |

| Core Functions | Data analysis, transaction tracing, anomaly detection | Tax calculations, deduction optimization, form generation |

| Target Users | Forensic accountants, auditors, legal professionals | Individual taxpayers, tax professionals, accountants |

| Data Handling | Financial statements, audit trails, transaction logs | Income documents, tax forms, deduction records |

| Reporting | Detailed forensic reports, evidence documentation | Tax returns, IRS-compliant summaries |

| Regulatory Compliance | Supports legal and forensic accounting standards | Complies with IRS and tax authority rules |

| Examples of Software | CaseWare IDEA, EnCase Forensic | TurboTax, H&R Block, TaxAct |

Which is better?

Forensic accounting software excels in detecting, investigating, and preventing financial fraud through advanced data analysis and anomaly detection tools, making it essential for audit firms and legal investigations. Tax preparation software specializes in accurate tax calculation, compliance with current tax laws, and easy filing processes tailored for individuals and businesses during tax season. Choosing between the two depends on user needs: forensic accounting software for fraud examination and financial scrutiny, versus tax preparation software for efficient, error-free tax management.

Connection

Forensic accounting software and tax preparation software are connected through their shared focus on financial data accuracy and compliance. Forensic accounting software analyzes financial records to detect fraud and discrepancies, while tax preparation software ensures the accurate calculation and filing of tax returns based on verified financial information. Integrating these tools enhances overall financial transparency and reduces the risk of errors or fraudulent tax reporting.

Key Terms

Automation

Tax preparation software automates routine tasks such as data entry, deduction identification, and tax form generation, streamlining compliance for individual and small business taxpayers. Forensic accounting software emphasizes automation in data analysis, fraud detection, and complex financial investigations, leveraging AI and machine learning to identify irregular patterns and anomalies. Explore how automation enhances efficiency and accuracy across these specialized financial software solutions.

Fraud detection

Tax preparation software primarily automates the filing of tax returns and ensures compliance with tax laws but offers limited capabilities in detecting fraudulent activities. Forensic accounting software specializes in fraud detection by analyzing financial data patterns, identifying discrepancies, and supporting investigations of financial crimes with advanced analytics. Discover how these software types differ in enhancing fraud prevention and support financial integrity.

Compliance

Tax preparation software is designed to ensure accurate calculation and filing of tax returns by complying with current tax laws and regulations, making it essential for meeting IRS deadlines and avoiding penalties. Forensic accounting software, on the other hand, specializes in detecting financial discrepancies, fraud, and compliance violations through advanced data analysis and audit trail capabilities. Explore the distinct compliance benefits of these tools to optimize your financial management strategy.

Source and External Links

IRS Free File - Offers free federal income tax preparation and filing for those with an Adjusted Gross Income (AGI) of $84,000 or less.

TurboTax - Provides user-friendly tax preparation software with guaranteed accuracy, offering various packages for different tax needs.

TaxSlayer Pro - Offers professional tax preparation software for tax preparers, supporting federal, state, and local returns.

dowidth.com

dowidth.com