Cryptotax involves managing and reporting cryptocurrency transactions for tax compliance, focusing on capital gains, income, and tax liability calculations. Bookkeeping encompasses the systematic recording and organizing of all financial transactions, including sales, expenses, and payroll, to maintain accurate financial records. Discover how integrating cryptotax with traditional bookkeeping enhances financial accuracy and regulatory compliance.

Why it is important

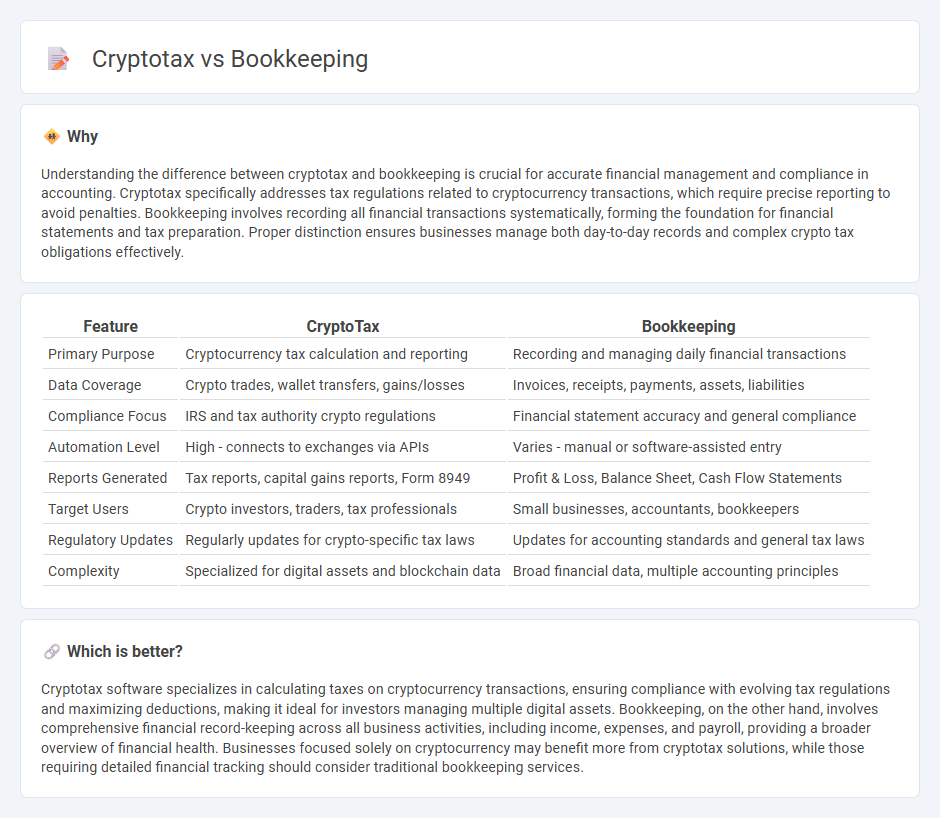

Understanding the difference between cryptotax and bookkeeping is crucial for accurate financial management and compliance in accounting. Cryptotax specifically addresses tax regulations related to cryptocurrency transactions, which require precise reporting to avoid penalties. Bookkeeping involves recording all financial transactions systematically, forming the foundation for financial statements and tax preparation. Proper distinction ensures businesses manage both day-to-day records and complex crypto tax obligations effectively.

Comparison Table

| Feature | CryptoTax | Bookkeeping |

|---|---|---|

| Primary Purpose | Cryptocurrency tax calculation and reporting | Recording and managing daily financial transactions |

| Data Coverage | Crypto trades, wallet transfers, gains/losses | Invoices, receipts, payments, assets, liabilities |

| Compliance Focus | IRS and tax authority crypto regulations | Financial statement accuracy and general compliance |

| Automation Level | High - connects to exchanges via APIs | Varies - manual or software-assisted entry |

| Reports Generated | Tax reports, capital gains reports, Form 8949 | Profit & Loss, Balance Sheet, Cash Flow Statements |

| Target Users | Crypto investors, traders, tax professionals | Small businesses, accountants, bookkeepers |

| Regulatory Updates | Regularly updates for crypto-specific tax laws | Updates for accounting standards and general tax laws |

| Complexity | Specialized for digital assets and blockchain data | Broad financial data, multiple accounting principles |

Which is better?

Cryptotax software specializes in calculating taxes on cryptocurrency transactions, ensuring compliance with evolving tax regulations and maximizing deductions, making it ideal for investors managing multiple digital assets. Bookkeeping, on the other hand, involves comprehensive financial record-keeping across all business activities, including income, expenses, and payroll, providing a broader overview of financial health. Businesses focused solely on cryptocurrency may benefit more from cryptotax solutions, while those requiring detailed financial tracking should consider traditional bookkeeping services.

Connection

Cryptotax and bookkeeping are interconnected through the systematic recording and reporting of cryptocurrency transactions for tax compliance. Accurate bookkeeping ensures detailed tracking of buys, sells, transfers, and income related to digital assets, enabling precise calculation of taxable gains or losses. Integrating cryptotax software with bookkeeping practices streamlines tax filing, reduces errors, and ensures adherence to evolving cryptocurrency tax regulations.

Key Terms

**Bookkeeping:**

Bookkeeping involves the systematic recording and organization of financial transactions, ensuring accurate tracking of income, expenses, assets, and liabilities essential for business operations. It provides a clear financial snapshot through detailed ledgers and reconciliations, which is crucial for preparing tax filings and financial reports. Explore how effective bookkeeping sets the foundation for managing crypto tax obligations and overall financial health.

Ledger

Ledger serves as a critical tool in both bookkeeping and crypto tax management by accurately recording financial transactions and tracking assets. In bookkeeping, Ledger organizes traditional financial data to ensure compliance and financial clarity, while in crypto tax, it helps capture complex blockchain transactions for precise tax reporting. Explore how Ledger integrates with your financial systems to streamline bookkeeping and crypto tax processes seamlessly.

Double-entry

Double-entry bookkeeping records each financial transaction with equal debits and credits, ensuring balance in ledgers for accurate financial statements. Cryptotax leveraging double-entry principles tracks crypto asset inflows and outflows, addressing unique challenges like transaction timestamps and valuation differences. Explore how integrating double-entry methods streamlines cryptotax compliance and reporting.

Source and External Links

What is Bookkeeping? 2025 Business Owner's Guide - Bookkeeping is the process of tracking and recording a business's financial transactions, using documents like journals, cash sales journals, and bank statements, with two main methods: single-entry and double-entry bookkeeping.

What Is Bookkeeping? Tasks, Skills, and How to Become a ... - Bookkeeping involves systematically recording and organizing business financial transactions daily to maintain up-to-date records, supporting operations and tax reporting, with single-entry suitable for small businesses and double-entry offering greater accuracy for larger businesses.

Bookkeeping - Bookkeeping is the recording of financial transactions including purchases, sales, receipts, and payments, and is part of accounting; it includes maintaining daybooks and ledgers, with bookkeepers preparing data for accountants to create financial reports.

dowidth.com

dowidth.com