Fair value measurement reflects an asset's or liability's current market price, emphasizing exit price in an orderly transaction, while present value calculates the current worth of future cash flows discounted at a specific rate. Accounting standards like IFRS 13 and ASC 820 provide frameworks for fair value, whereas present value is crucial in impairment testing and lease accounting under IFRS 16 and ASC 842. Explore detailed applications and distinctions between these valuation methods to enhance financial analysis.

Why it is important

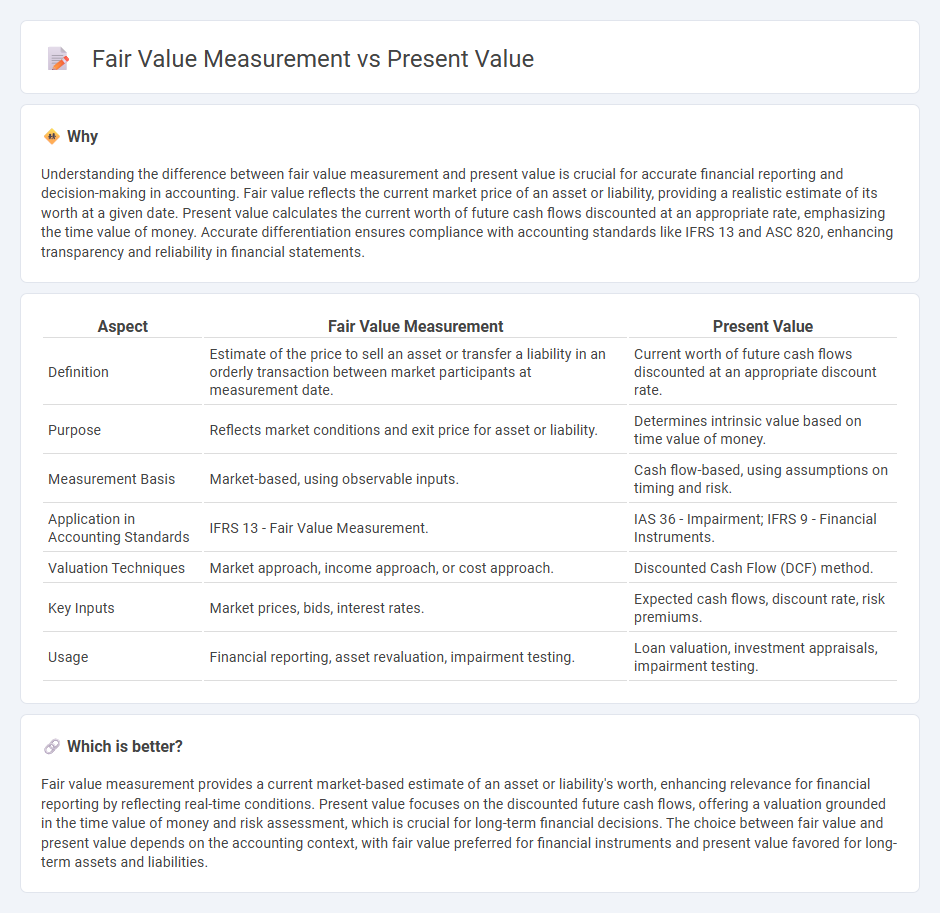

Understanding the difference between fair value measurement and present value is crucial for accurate financial reporting and decision-making in accounting. Fair value reflects the current market price of an asset or liability, providing a realistic estimate of its worth at a given date. Present value calculates the current worth of future cash flows discounted at an appropriate rate, emphasizing the time value of money. Accurate differentiation ensures compliance with accounting standards like IFRS 13 and ASC 820, enhancing transparency and reliability in financial statements.

Comparison Table

| Aspect | Fair Value Measurement | Present Value |

|---|---|---|

| Definition | Estimate of the price to sell an asset or transfer a liability in an orderly transaction between market participants at measurement date. | Current worth of future cash flows discounted at an appropriate discount rate. |

| Purpose | Reflects market conditions and exit price for asset or liability. | Determines intrinsic value based on time value of money. |

| Measurement Basis | Market-based, using observable inputs. | Cash flow-based, using assumptions on timing and risk. |

| Application in Accounting Standards | IFRS 13 - Fair Value Measurement. | IAS 36 - Impairment; IFRS 9 - Financial Instruments. |

| Valuation Techniques | Market approach, income approach, or cost approach. | Discounted Cash Flow (DCF) method. |

| Key Inputs | Market prices, bids, interest rates. | Expected cash flows, discount rate, risk premiums. |

| Usage | Financial reporting, asset revaluation, impairment testing. | Loan valuation, investment appraisals, impairment testing. |

Which is better?

Fair value measurement provides a current market-based estimate of an asset or liability's worth, enhancing relevance for financial reporting by reflecting real-time conditions. Present value focuses on the discounted future cash flows, offering a valuation grounded in the time value of money and risk assessment, which is crucial for long-term financial decisions. The choice between fair value and present value depends on the accounting context, with fair value preferred for financial instruments and present value favored for long-term assets and liabilities.

Connection

Fair value measurement relies on estimating the current market price of an asset or liability, reflecting its exit value under market conditions. Present value plays a crucial role by discounting expected future cash flows to their present amount, ensuring accurate valuation for accounting purposes. This connection enables precise financial reporting and decision-making aligned with accounting standards such as IFRS 13 and ASC 820.

Key Terms

Discount Rate

Present value measurement discounts future cash flows using a rate that reflects the time value of money and risk specific to the asset, often the entity's incremental borrowing rate or market rate for similar instruments. Fair value measurement prioritizes an exit price in an orderly transaction, incorporating market participant assumptions and frequently using a discount rate derived from observable market data or a weighted-average cost of capital. Explore more to understand how discount rate selection impacts financial reporting accuracy.

Market-Based Inputs

Market-based inputs play a crucial role in distinguishing present value from fair value measurement, as fair value relies primarily on observable market prices and quotes from active markets to reflect an asset's exit price. Present value measurement emphasizes the discounted cash flows expected from the asset, incorporating market participant assumptions but often utilizing unobservable inputs when active markets are absent. Explore more to understand how both valuation techniques impact financial reporting and decision-making.

Future Cash Flows

Present value measurement calculates the worth of future cash flows by discounting them to their current value using a specific discount rate, reflecting the time value of money. Fair value measurement estimates the price at which an asset or liability could be exchanged in an orderly transaction between market participants at the measurement date, often incorporating market-based inputs. Explore more to understand how these valuation techniques impact financial reporting and decision-making.

Source and External Links

Present Value Calculator - Present value (PV) is the current worth of a future sum of money or stream of cash flows given a specified rate of return, calculated as PV = FV / (1 + r)^n, where FV is future value, r is the interest rate, and n is the number of periods.

Present value - Wikipedia - Present value quantifies the value today of an expected future income stream by discounting it with compound interest: \(PV = \frac{C}{(1+i)^n}\), capturing the time value of money and reflecting concepts like inflation and risk.

Present Value (PV) | Formula + Calculator - Wall Street Prep - Present value measures how much future cash flows are worth today by discounting for the opportunity cost of capital and inflation, based on the time value of money principle.

dowidth.com

dowidth.com