Greenwashing detection focuses on identifying deceptive practices where companies exaggerate or falsify their environmental impact claims. Non-financial disclosure analysis involves evaluating the accuracy and completeness of environmental, social, and governance (ESG) information presented by firms. Explore in-depth insights on how these approaches enhance corporate transparency and investor confidence.

Why it is important

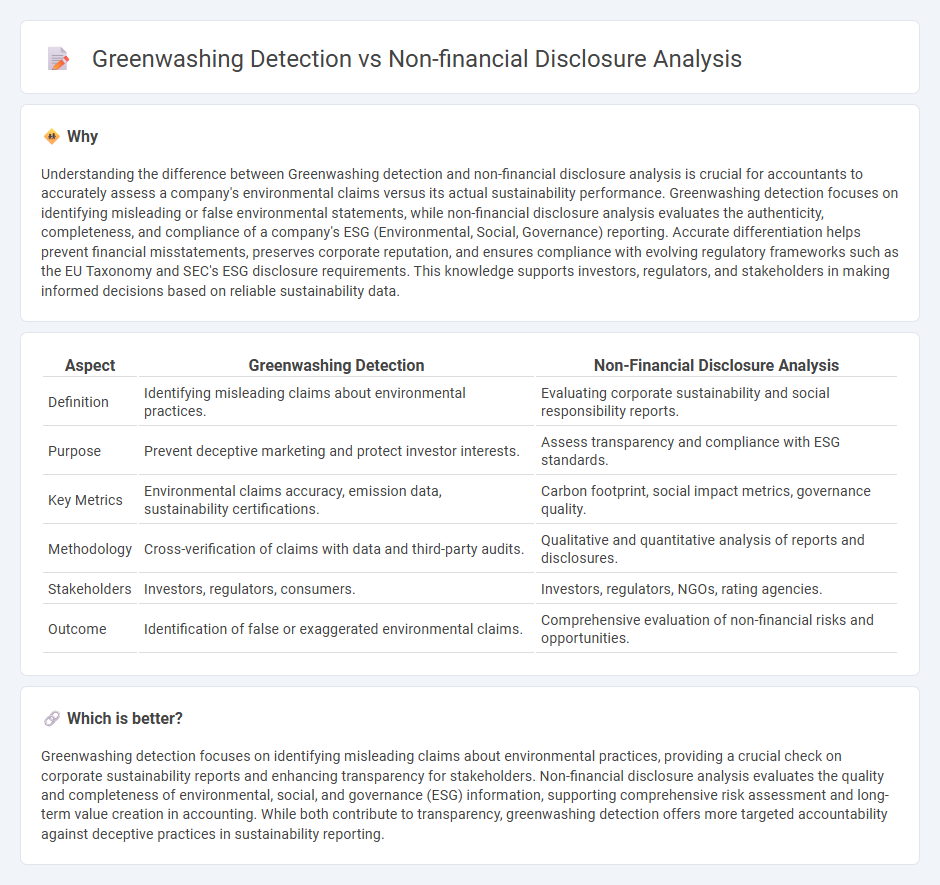

Understanding the difference between Greenwashing detection and non-financial disclosure analysis is crucial for accountants to accurately assess a company's environmental claims versus its actual sustainability performance. Greenwashing detection focuses on identifying misleading or false environmental statements, while non-financial disclosure analysis evaluates the authenticity, completeness, and compliance of a company's ESG (Environmental, Social, Governance) reporting. Accurate differentiation helps prevent financial misstatements, preserves corporate reputation, and ensures compliance with evolving regulatory frameworks such as the EU Taxonomy and SEC's ESG disclosure requirements. This knowledge supports investors, regulators, and stakeholders in making informed decisions based on reliable sustainability data.

Comparison Table

| Aspect | Greenwashing Detection | Non-Financial Disclosure Analysis |

|---|---|---|

| Definition | Identifying misleading claims about environmental practices. | Evaluating corporate sustainability and social responsibility reports. |

| Purpose | Prevent deceptive marketing and protect investor interests. | Assess transparency and compliance with ESG standards. |

| Key Metrics | Environmental claims accuracy, emission data, sustainability certifications. | Carbon footprint, social impact metrics, governance quality. |

| Methodology | Cross-verification of claims with data and third-party audits. | Qualitative and quantitative analysis of reports and disclosures. |

| Stakeholders | Investors, regulators, consumers. | Investors, regulators, NGOs, rating agencies. |

| Outcome | Identification of false or exaggerated environmental claims. | Comprehensive evaluation of non-financial risks and opportunities. |

Which is better?

Greenwashing detection focuses on identifying misleading claims about environmental practices, providing a crucial check on corporate sustainability reports and enhancing transparency for stakeholders. Non-financial disclosure analysis evaluates the quality and completeness of environmental, social, and governance (ESG) information, supporting comprehensive risk assessment and long-term value creation in accounting. While both contribute to transparency, greenwashing detection offers more targeted accountability against deceptive practices in sustainability reporting.

Connection

Greenwashing detection leverages non-financial disclosure analysis to evaluate the authenticity of a company's environmental claims by scrutinizing sustainability reports, carbon emission data, and social responsibility initiatives. Accounting frameworks increasingly integrate environmental, social, and governance (ESG) metrics, making transparent non-financial disclosures essential for identifying discrepancies or exaggerations in reported green practices. This connection enhances auditors' ability to ensure compliance, improve corporate accountability, and inform stakeholders about the true environmental impact of business operations.

Key Terms

ESG Reporting

Non-financial disclosure analysis systematically evaluates ESG reporting to ensure transparency and accountability in corporate sustainability practices. Greenwashing detection identifies misleading claims within these reports that exaggerate environmental and social commitments, protecting stakeholders from deceptive information. Explore comprehensive strategies to enhance ESG reporting accuracy and credibility.

Materiality Assessment

Materiality assessment in non-financial disclosure analysis identifies relevant environmental, social, and governance (ESG) issues critical to stakeholders and business impact, ensuring transparency and accountability. Greenwashing detection evaluates the authenticity and accuracy of companies' sustainability claims to prevent misleading stakeholders and protect market integrity. Explore how materiality assessment strengthens non-financial reporting and combats greenwashing for responsible corporate communication.

Sustainability Assurance

Non-financial disclosure analysis evaluates the accuracy and completeness of sustainability reports issued by corporations, ensuring alignment with environmental, social, and governance (ESG) criteria. Greenwashing detection focuses on identifying deceptive claims that exaggerate a company's environmental responsibility, often misleading stakeholders about its true sustainability impact. Explore in-depth methods and tools for enhancing sustainability assurance by understanding the nuances between these critical assessment approaches.

Source and External Links

Non-Financial Disclosure Analysis - Analyzing non-financial data to understand a company's environmental, social, and governance performance and impact.

Non-financial disclosure and stock prices: a literature review - A study examining the relationship between non-financial disclosures (environmental, social, governance) and their impact on stock prices.

Non-financial reporting - WBCSD Publications - Discussing the importance of non-financial reporting in communicating with stakeholders and its increasing global adoption.

dowidth.com

dowidth.com