Continuous auditing employs real-time data analysis and automated tools to provide ongoing assurance of financial accuracy, enhancing risk management and operational efficiency. External auditing involves periodic, independent evaluations of financial statements to ensure compliance with regulatory standards and to offer an unbiased opinion on an organization's financial health. Discover more about how these auditing approaches influence financial transparency and decision-making.

Why it is important

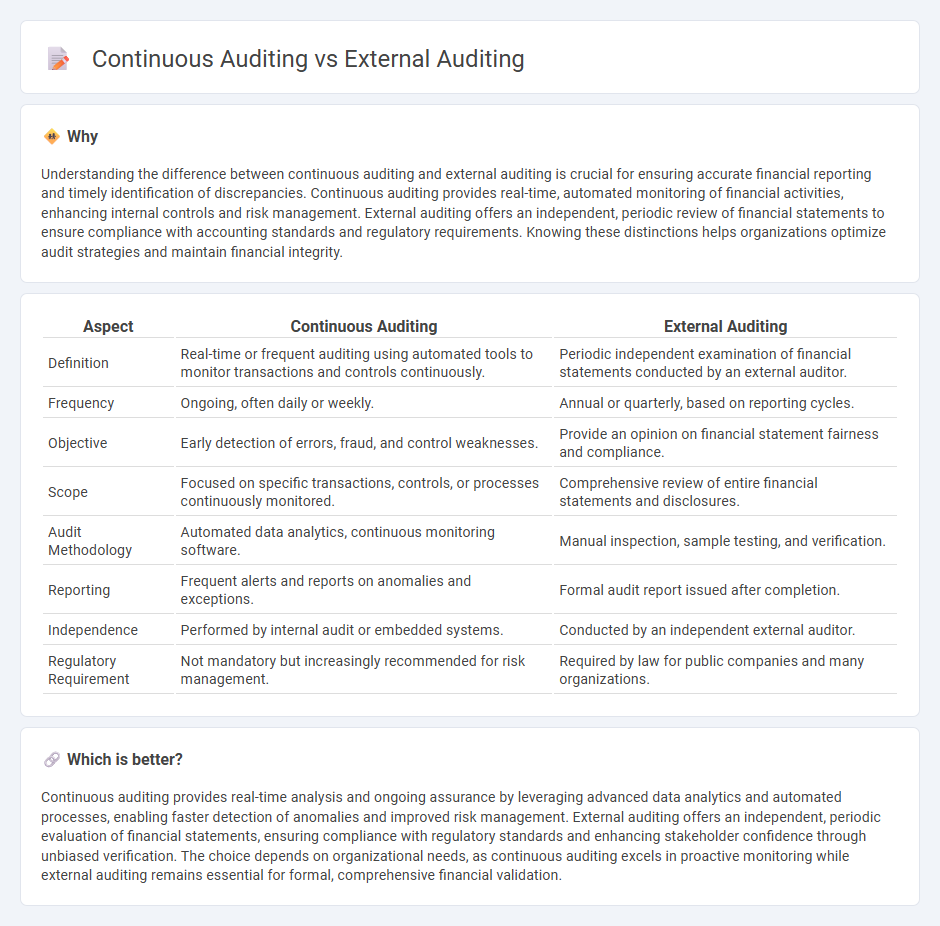

Understanding the difference between continuous auditing and external auditing is crucial for ensuring accurate financial reporting and timely identification of discrepancies. Continuous auditing provides real-time, automated monitoring of financial activities, enhancing internal controls and risk management. External auditing offers an independent, periodic review of financial statements to ensure compliance with accounting standards and regulatory requirements. Knowing these distinctions helps organizations optimize audit strategies and maintain financial integrity.

Comparison Table

| Aspect | Continuous Auditing | External Auditing |

|---|---|---|

| Definition | Real-time or frequent auditing using automated tools to monitor transactions and controls continuously. | Periodic independent examination of financial statements conducted by an external auditor. |

| Frequency | Ongoing, often daily or weekly. | Annual or quarterly, based on reporting cycles. |

| Objective | Early detection of errors, fraud, and control weaknesses. | Provide an opinion on financial statement fairness and compliance. |

| Scope | Focused on specific transactions, controls, or processes continuously monitored. | Comprehensive review of entire financial statements and disclosures. |

| Audit Methodology | Automated data analytics, continuous monitoring software. | Manual inspection, sample testing, and verification. |

| Reporting | Frequent alerts and reports on anomalies and exceptions. | Formal audit report issued after completion. |

| Independence | Performed by internal audit or embedded systems. | Conducted by an independent external auditor. |

| Regulatory Requirement | Not mandatory but increasingly recommended for risk management. | Required by law for public companies and many organizations. |

Which is better?

Continuous auditing provides real-time analysis and ongoing assurance by leveraging advanced data analytics and automated processes, enabling faster detection of anomalies and improved risk management. External auditing offers an independent, periodic evaluation of financial statements, ensuring compliance with regulatory standards and enhancing stakeholder confidence through unbiased verification. The choice depends on organizational needs, as continuous auditing excels in proactive monitoring while external auditing remains essential for formal, comprehensive financial validation.

Connection

Continuous auditing enhances external auditing by providing real-time assurance on financial statements through automated data analysis, improving the accuracy and timeliness of audit findings. This integration enables external auditors to focus on higher-risk areas and compliance issues, leveraging continuous audit insights for a more efficient audit process. Consequently, continuous auditing supports external auditors in identifying anomalies and ensuring regulatory adherence, strengthening overall audit quality.

Key Terms

**External Auditing:**

External auditing involves an independent evaluation of a company's financial statements to ensure accuracy, compliance with regulations, and transparency for stakeholders. It typically occurs annually or quarterly, providing a snapshot of financial health and identifying potential risks or fraud. Explore more to understand how external auditing safeguards investor confidence and regulatory adherence.

Independence

External auditing ensures independence by being performed by third-party auditors who have no stake in the organization, thus providing an unbiased assessment of financial statements. Continuous auditing integrates technology and real-time data analysis within the organization, potentially limiting independence due to internal involvement but enhancing audit timeliness and accuracy. Explore the distinctions between external and continuous auditing methods to better understand their impact on audit independence.

Financial Statements

External auditing provides an independent and systematic evaluation of financial statements to ensure accuracy, compliance with accounting standards, and detection of material misstatements. Continuous auditing employs automated tools and real-time data analysis to monitor financial transactions and control processes throughout the fiscal period, enhancing risk management and timely error identification. Discover more about how these auditing approaches impact financial statement reliability and organizational transparency.

Source and External Links

External Audit vs. Internal Audit: What's the Difference? - External audits focus on verifying the accuracy of a company's financial statements and ensuring compliance with regulations, while internal audits assess operational processes and risks.

Understanding the Purpose and Benefits of External Audits - External audits provide independent assessments of financial statements to ensure accuracy and compliance, enhancing transparency and stakeholder confidence.

External Auditor - An external auditor independently reviews financial statements of companies, ensuring compliance with laws and providing unbiased reports primarily for stakeholders like investors and regulatory bodies.

dowidth.com

dowidth.com