Embedded lease accounting focuses on identifying and reporting lease components within complex contracts, ensuring accurate financial recognition of both lease liabilities and right-of-use assets as per ASC 842 or IFRS 16 standards. Capital lease accounting, now replaced by finance lease classification, requires lessees to recognize leased assets and liabilities on the balance sheet, reflecting ownership risks and benefits despite not holding legal title. Explore detailed differences and compliance requirements to optimize your lease accounting processes effectively.

Why it is important

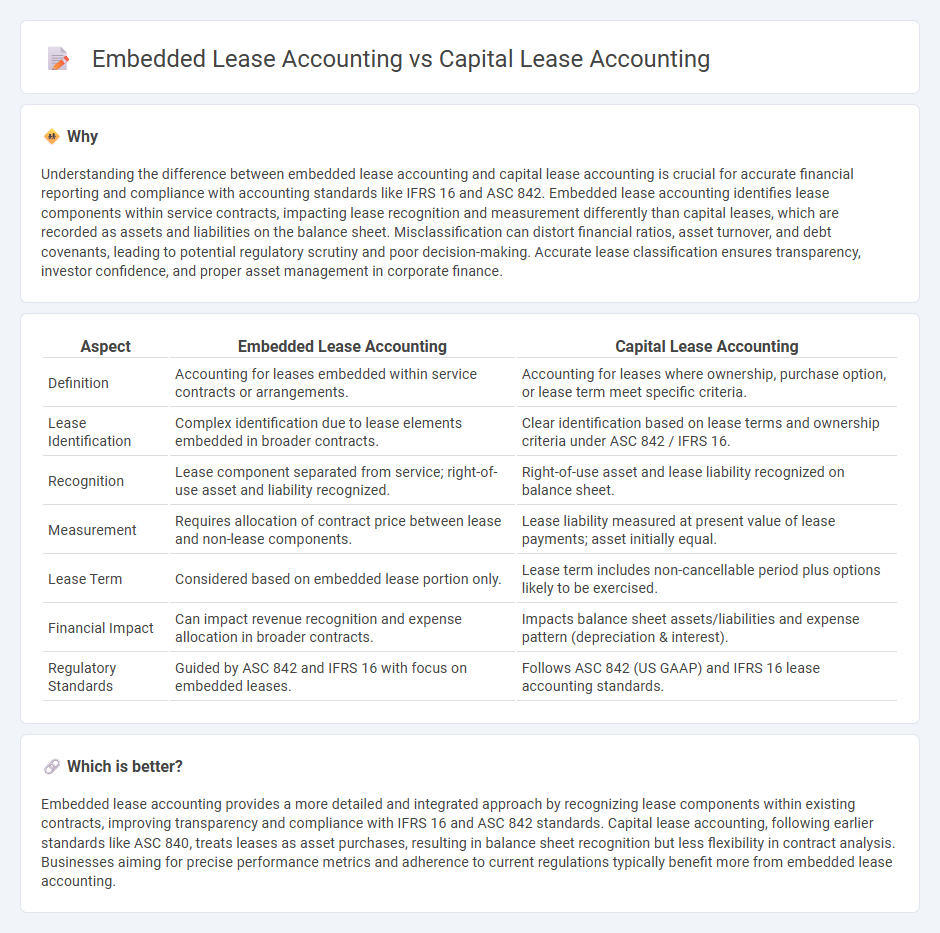

Understanding the difference between embedded lease accounting and capital lease accounting is crucial for accurate financial reporting and compliance with accounting standards like IFRS 16 and ASC 842. Embedded lease accounting identifies lease components within service contracts, impacting lease recognition and measurement differently than capital leases, which are recorded as assets and liabilities on the balance sheet. Misclassification can distort financial ratios, asset turnover, and debt covenants, leading to potential regulatory scrutiny and poor decision-making. Accurate lease classification ensures transparency, investor confidence, and proper asset management in corporate finance.

Comparison Table

| Aspect | Embedded Lease Accounting | Capital Lease Accounting |

|---|---|---|

| Definition | Accounting for leases embedded within service contracts or arrangements. | Accounting for leases where ownership, purchase option, or lease term meet specific criteria. |

| Lease Identification | Complex identification due to lease elements embedded in broader contracts. | Clear identification based on lease terms and ownership criteria under ASC 842 / IFRS 16. |

| Recognition | Lease component separated from service; right-of-use asset and liability recognized. | Right-of-use asset and lease liability recognized on balance sheet. |

| Measurement | Requires allocation of contract price between lease and non-lease components. | Lease liability measured at present value of lease payments; asset initially equal. |

| Lease Term | Considered based on embedded lease portion only. | Lease term includes non-cancellable period plus options likely to be exercised. |

| Financial Impact | Can impact revenue recognition and expense allocation in broader contracts. | Impacts balance sheet assets/liabilities and expense pattern (depreciation & interest). |

| Regulatory Standards | Guided by ASC 842 and IFRS 16 with focus on embedded leases. | Follows ASC 842 (US GAAP) and IFRS 16 lease accounting standards. |

Which is better?

Embedded lease accounting provides a more detailed and integrated approach by recognizing lease components within existing contracts, improving transparency and compliance with IFRS 16 and ASC 842 standards. Capital lease accounting, following earlier standards like ASC 840, treats leases as asset purchases, resulting in balance sheet recognition but less flexibility in contract analysis. Businesses aiming for precise performance metrics and adherence to current regulations typically benefit more from embedded lease accounting.

Connection

Embedded lease accounting and capital lease accounting are connected through the recognition of lease obligations on the balance sheet, reflecting a company's financial commitments. Both accounting approaches require identifying lease terms, lease assets, and liabilities, ensuring compliance with accounting standards such as IFRS 16 and ASC 842. The integration of embedded lease accounting automates the detection of lease components in contracts, streamlining the capital lease accounting process and improving accuracy in financial reporting.

Key Terms

Lease Classification

Capital lease accounting classifies leases based on ownership transfer, bargain purchase options, lease term and present value of payments, leading to capitalization on the balance sheet. Embedded lease accounting identifies lease components within service contracts, requiring detailed analysis to separate lease and non-lease elements for proper classification under ASC 842 or IFRS 16. Explore the distinctions and criteria in lease classification to optimize financial reporting compliance.

Right-of-Use Asset

Capital lease accounting records a Right-of-Use (ROU) asset and corresponding lease liability on the balance sheet, reflecting control of the leased asset for the lease term. Embedded lease accounting involves identifying lease components within broader contracts and recognizing a ROU asset when the contract conveys control of an identified asset. Learn more about how these accounting methods impact financial statements and compliance.

Lease Liability

Capital lease accounting records lease liabilities on the balance sheet by recognizing the present value of lease payments, reflecting both asset ownership and financial obligation. Embedded lease accounting identifies lease components within broader contracts, requiring separate measurement of lease liabilities based on cash flows related strictly to the leased asset. Explore the detailed differences in lease liability recognition and measurement in both accounting methods to ensure compliance and accurate financial reporting.

Source and External Links

Accounting for a capital lease - AccountingTools - A capital lease is treated like a purchase, with the lessee recording both an asset and a liability on the balance sheet, reflecting the risks and rewards of ownership.

Capital Lease Accounting Formula: Accounting Explained - Vintti - When a lease is classified as a capital lease, the lessee records the leased asset as a fixed asset and a corresponding liability for the present value of future lease payments, with depreciation expense also recorded over the asset's useful life.

Capital Lease vs. Operating Lease | Difference + Examples - Wall Street Prep - Under U.S. GAAP, a capital lease must meet one of four criteria (such as ownership transfer or lease term over 75% of asset life), and the lessee accounts for the asset and liability as if they own it.

dowidth.com

dowidth.com