Workflow automation streamlines accounting processes by reducing manual tasks, enhancing accuracy, and accelerating data entry with integrated software solutions such as QuickBooks and SAP. Blockchain accounting introduces decentralized ledger technology to improve transparency, security, and immutability in financial records, enabling real-time audit trails and fraud prevention. Explore how combining workflow automation and blockchain can revolutionize modern accounting practices.

Why it is important

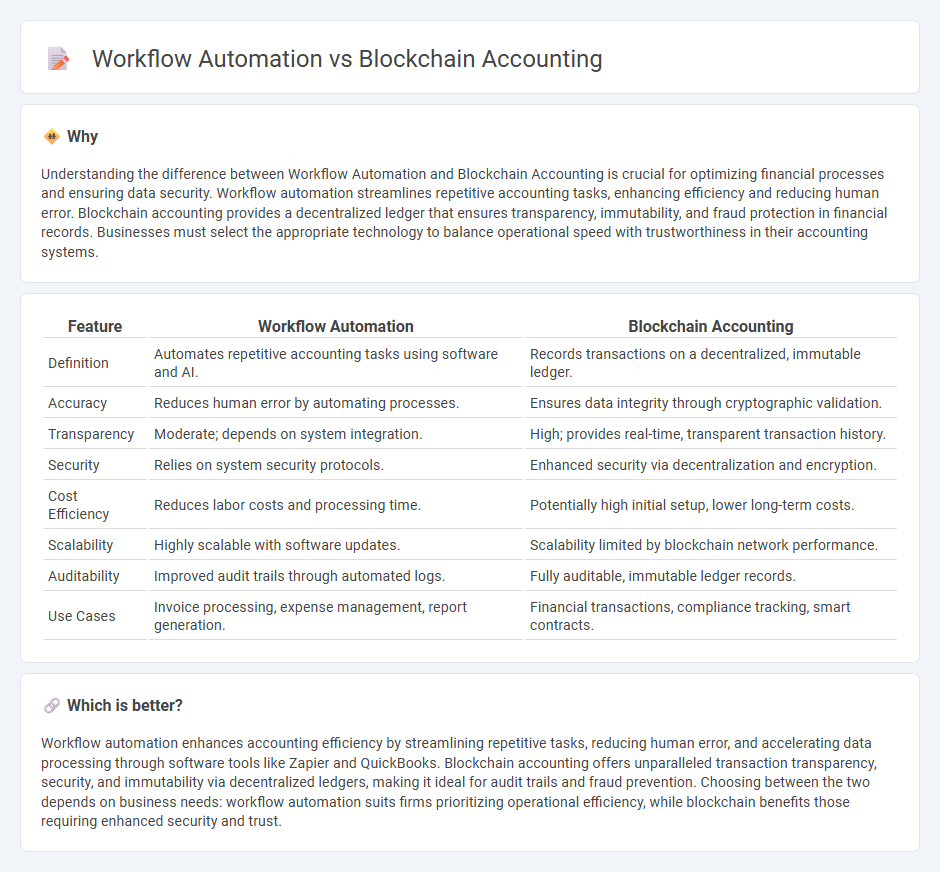

Understanding the difference between Workflow Automation and Blockchain Accounting is crucial for optimizing financial processes and ensuring data security. Workflow automation streamlines repetitive accounting tasks, enhancing efficiency and reducing human error. Blockchain accounting provides a decentralized ledger that ensures transparency, immutability, and fraud protection in financial records. Businesses must select the appropriate technology to balance operational speed with trustworthiness in their accounting systems.

Comparison Table

| Feature | Workflow Automation | Blockchain Accounting |

|---|---|---|

| Definition | Automates repetitive accounting tasks using software and AI. | Records transactions on a decentralized, immutable ledger. |

| Accuracy | Reduces human error by automating processes. | Ensures data integrity through cryptographic validation. |

| Transparency | Moderate; depends on system integration. | High; provides real-time, transparent transaction history. |

| Security | Relies on system security protocols. | Enhanced security via decentralization and encryption. |

| Cost Efficiency | Reduces labor costs and processing time. | Potentially high initial setup, lower long-term costs. |

| Scalability | Highly scalable with software updates. | Scalability limited by blockchain network performance. |

| Auditability | Improved audit trails through automated logs. | Fully auditable, immutable ledger records. |

| Use Cases | Invoice processing, expense management, report generation. | Financial transactions, compliance tracking, smart contracts. |

Which is better?

Workflow automation enhances accounting efficiency by streamlining repetitive tasks, reducing human error, and accelerating data processing through software tools like Zapier and QuickBooks. Blockchain accounting offers unparalleled transaction transparency, security, and immutability via decentralized ledgers, making it ideal for audit trails and fraud prevention. Choosing between the two depends on business needs: workflow automation suits firms prioritizing operational efficiency, while blockchain benefits those requiring enhanced security and trust.

Connection

Workflow automation streamlines accounting processes by reducing manual tasks, increasing accuracy, and accelerating data entry. Blockchain accounting enhances this by providing a decentralized, immutable ledger that ensures transparency and security in financial transactions. Combining workflow automation with blockchain technology results in a highly efficient and reliable accounting system that minimizes errors and fraud.

Key Terms

Distributed Ledger

Blockchain accounting leverages distributed ledger technology (DLT) to provide an immutable, transparent record of financial transactions, enhancing security and reducing fraud risk. Workflow automation streamlines repetitive accounting tasks through software-driven processes but does not inherently offer the decentralized validation provided by blockchain. Explore the unique benefits and integration possibilities of distributed ledger solutions in accounting for a future-ready approach.

Smart Contracts

Smart contracts revolutionize blockchain accounting by automating transaction verification and ensuring immutable records, reducing errors and increasing transparency. Workflow automation enhances these processes by integrating smart contracts with enterprise systems to streamline approvals, notifications, and compliance tasks. Explore how smart contracts drive efficiency and security in both blockchain accounting and workflow automation for your business.

Process Optimization

Blockchain accounting enhances process optimization by providing transparent, immutable transaction records that reduce errors and fraud, streamlining financial audits and compliance. Workflow automation accelerates operations through automated task management and real-time data integration, minimizing manual interventions and improving overall efficiency. Discover how combining blockchain accounting with workflow automation can revolutionize your process optimization strategies.

Source and External Links

Blockchain in Accounting: Transforming Financial Practices - This article explores how blockchain technology transforms accounting by providing a secure, transparent, and immutable ledger for financial transactions.

What is Blockchain Accounting? - It discusses how blockchain impacts the accounting industry, focusing on its ability to streamline workflows and support accountants, particularly in auditing processes.

Blockchain Accounting - Guide & Use Cases - This guide outlines the benefits of blockchain in accounting, including automation, fraud prevention, and enhanced security through smart contracts and immutability.

dowidth.com

dowidth.com