Smart contracts accounting utilizes blockchain technology to automate and verify financial transactions with real-time accuracy and transparency, reducing errors and fraud risks. Accrual accounting, on the other hand, records revenues and expenses when they are incurred, providing a comprehensive view of a company's financial health over a specific period. Explore the key differences and potential benefits of integrating smart contracts into traditional accrual accounting systems.

Why it is important

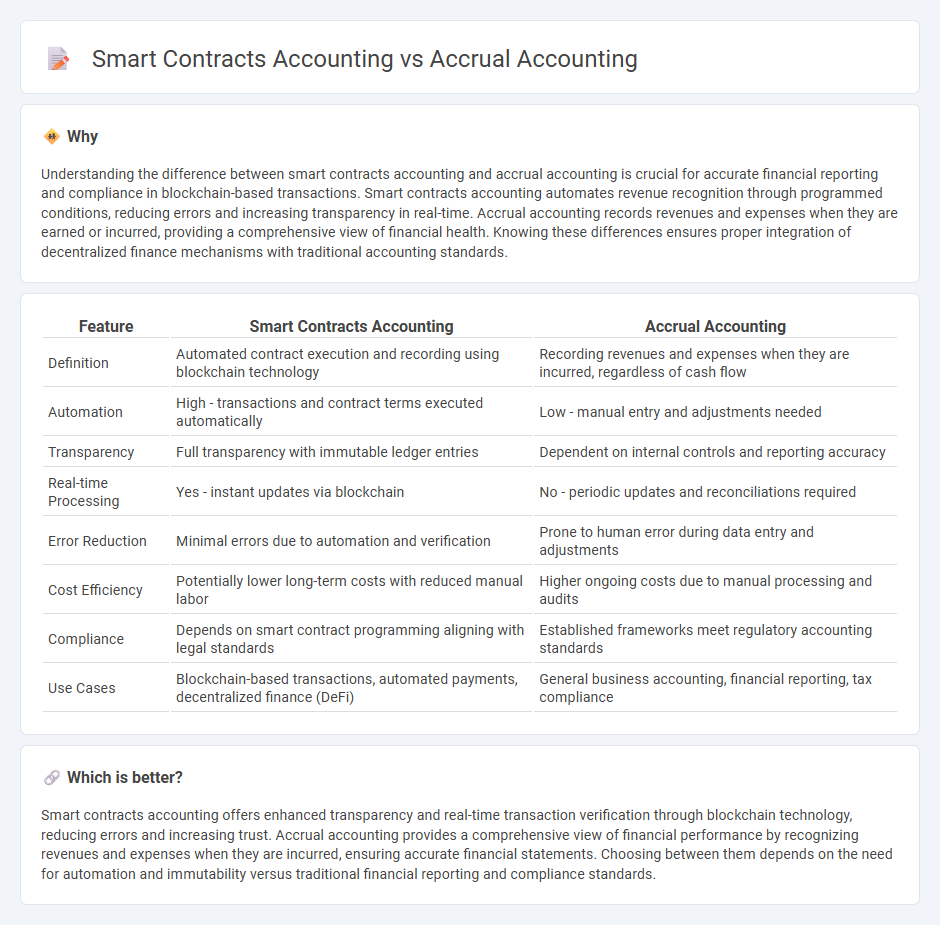

Understanding the difference between smart contracts accounting and accrual accounting is crucial for accurate financial reporting and compliance in blockchain-based transactions. Smart contracts accounting automates revenue recognition through programmed conditions, reducing errors and increasing transparency in real-time. Accrual accounting records revenues and expenses when they are earned or incurred, providing a comprehensive view of financial health. Knowing these differences ensures proper integration of decentralized finance mechanisms with traditional accounting standards.

Comparison Table

| Feature | Smart Contracts Accounting | Accrual Accounting |

|---|---|---|

| Definition | Automated contract execution and recording using blockchain technology | Recording revenues and expenses when they are incurred, regardless of cash flow |

| Automation | High - transactions and contract terms executed automatically | Low - manual entry and adjustments needed |

| Transparency | Full transparency with immutable ledger entries | Dependent on internal controls and reporting accuracy |

| Real-time Processing | Yes - instant updates via blockchain | No - periodic updates and reconciliations required |

| Error Reduction | Minimal errors due to automation and verification | Prone to human error during data entry and adjustments |

| Cost Efficiency | Potentially lower long-term costs with reduced manual labor | Higher ongoing costs due to manual processing and audits |

| Compliance | Depends on smart contract programming aligning with legal standards | Established frameworks meet regulatory accounting standards |

| Use Cases | Blockchain-based transactions, automated payments, decentralized finance (DeFi) | General business accounting, financial reporting, tax compliance |

Which is better?

Smart contracts accounting offers enhanced transparency and real-time transaction verification through blockchain technology, reducing errors and increasing trust. Accrual accounting provides a comprehensive view of financial performance by recognizing revenues and expenses when they are incurred, ensuring accurate financial statements. Choosing between them depends on the need for automation and immutability versus traditional financial reporting and compliance standards.

Connection

Smart contracts accounting automates transaction recording by executing predefined rules on blockchain platforms, ensuring real-time recognition of financial events. Accrual accounting principles require revenue and expenses to be recorded when they are earned or incurred, regardless of cash flow, aligning with smart contracts' ability to trigger entries based on contract terms. Integrating smart contracts with accrual accounting enhances accuracy in financial reporting by reducing manual intervention and ensuring timely recognition of obligations and revenues.

Key Terms

Revenue Recognition

Accrual accounting recognizes revenue when earned, matching revenues with related expenses regardless of cash flow timing, ensuring compliance with GAAP and IFRS standards. Smart contracts accounting automates revenue recognition through self-executing code on blockchain platforms, enabling real-time and transparent transaction verification that reduces errors and enhances auditability. Discover how integrating smart contracts can transform revenue recognition processes and boost financial accuracy.

Automation

Accrual accounting records revenues and expenses when they are earned or incurred, providing a comprehensive financial view but often requiring manual adjustments and reconciliations. Smart contracts accounting leverages blockchain technology to automate transaction recording and enforce contract terms without intermediaries, significantly reducing errors and processing time. Explore how automation transforms financial accuracy and efficiency through smart contracts in accounting.

Immutability

Accrual accounting relies on recording financial transactions when they are incurred, ensuring accurate representation of liabilities and revenues over time through traditional ledgers. Smart contracts accounting leverages blockchain technology to provide immutable records, where transaction data cannot be altered or deleted, enhancing transparency and trust in the audit trail. Discover how immutability in smart contracts is revolutionizing financial record-keeping beyond conventional accrual methods.

Source and External Links

Accrual-Based Accounting Explained: What It Is, Advantages ... - Accrual basis accounting records revenue when earned and expenses when incurred, providing a more accurate financial picture by matching revenues and expenses in the same period, and is required under GAAP for public companies.

Accrual Accounting - Guide, How it Works, Definition - Accrual accounting recognizes revenues earned and expenses incurred regardless of cash receipt or payment timing, aligning with the matching principle to properly allocate financial activity to the relevant periods.

What Is Accrual Accounting? | HBS Online - Accrual accounting is an accounting method recognizing revenue when earned and expenses when related revenue is recognized, based on the matching principle, rather than when cash transactions occur.

dowidth.com

dowidth.com