Blockchain reconciliation leverages distributed ledger technology to ensure immutable and transparent transaction records, reducing errors and fraud during the verification process. Real-time reconciliation continuously updates financial data, allowing immediate detection and resolution of discrepancies for enhanced accuracy and efficiency. Explore the key differences and benefits of each method to optimize your accounting practices.

Why it is important

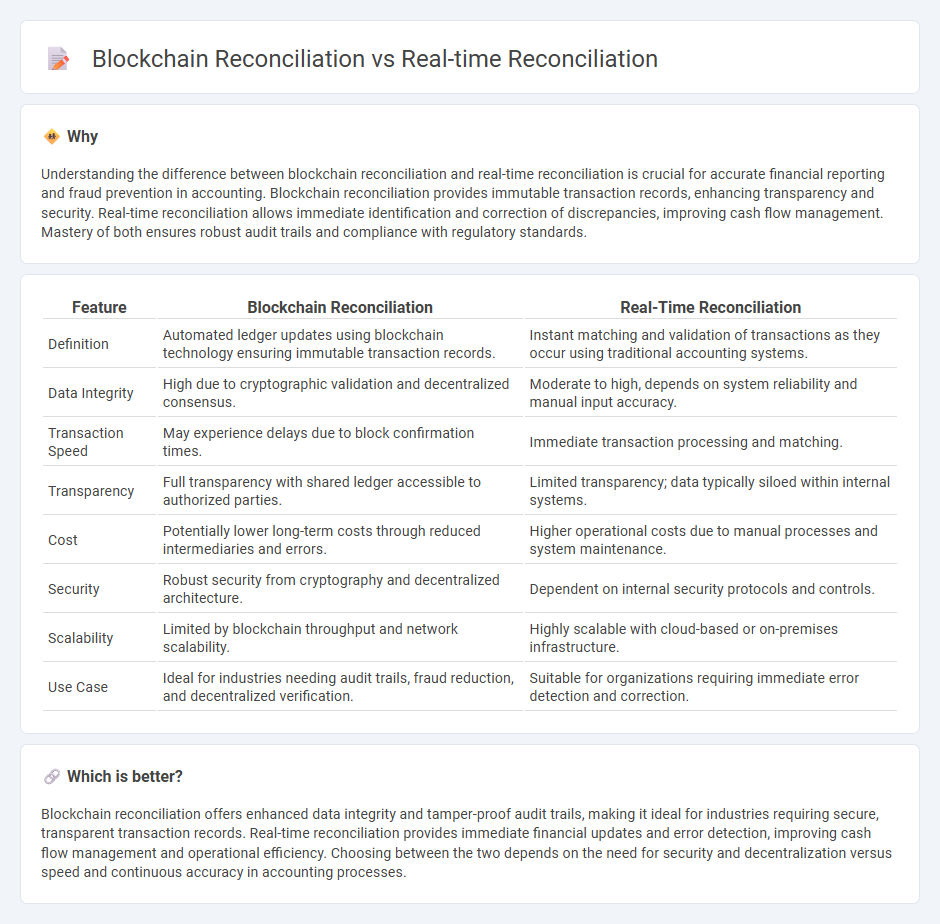

Understanding the difference between blockchain reconciliation and real-time reconciliation is crucial for accurate financial reporting and fraud prevention in accounting. Blockchain reconciliation provides immutable transaction records, enhancing transparency and security. Real-time reconciliation allows immediate identification and correction of discrepancies, improving cash flow management. Mastery of both ensures robust audit trails and compliance with regulatory standards.

Comparison Table

| Feature | Blockchain Reconciliation | Real-Time Reconciliation |

|---|---|---|

| Definition | Automated ledger updates using blockchain technology ensuring immutable transaction records. | Instant matching and validation of transactions as they occur using traditional accounting systems. |

| Data Integrity | High due to cryptographic validation and decentralized consensus. | Moderate to high, depends on system reliability and manual input accuracy. |

| Transaction Speed | May experience delays due to block confirmation times. | Immediate transaction processing and matching. |

| Transparency | Full transparency with shared ledger accessible to authorized parties. | Limited transparency; data typically siloed within internal systems. |

| Cost | Potentially lower long-term costs through reduced intermediaries and errors. | Higher operational costs due to manual processes and system maintenance. |

| Security | Robust security from cryptography and decentralized architecture. | Dependent on internal security protocols and controls. |

| Scalability | Limited by blockchain throughput and network scalability. | Highly scalable with cloud-based or on-premises infrastructure. |

| Use Case | Ideal for industries needing audit trails, fraud reduction, and decentralized verification. | Suitable for organizations requiring immediate error detection and correction. |

Which is better?

Blockchain reconciliation offers enhanced data integrity and tamper-proof audit trails, making it ideal for industries requiring secure, transparent transaction records. Real-time reconciliation provides immediate financial updates and error detection, improving cash flow management and operational efficiency. Choosing between the two depends on the need for security and decentralization versus speed and continuous accuracy in accounting processes.

Connection

Blockchain reconciliation enhances accounting accuracy by providing an immutable ledger that automatically verifies and records transactions in real time, reducing the risk of errors and fraud. Real-time reconciliation leverages blockchain technology to instantly match and confirm financial data across multiple parties, streamlining the accounting process and ensuring up-to-date financial statements. This integration improves transparency, accelerates audit processes, and supports compliance with regulatory standards.

Key Terms

Ledger

Real-time reconciliation leverages traditional ledger systems to instantly match transactions across accounts, enhancing accuracy and reducing errors in financial processes. Blockchain reconciliation utilizes decentralized ledger technology, providing transparency, immutability, and secure verification of transactions without intermediaries. Explore how these ledger-focused methods transform financial operations and improve trust in transaction records.

Immutability

Real-time reconciliation leverages traditional databases and automated workflows to ensure transaction accuracy instantly, but it may still be vulnerable to data alterations or unauthorized changes. Blockchain reconciliation utilizes decentralized ledger technology, providing inherent immutability through cryptographic hashing and consensus mechanisms, making transaction records tamper-proof and transparent. Explore how blockchain's immutability enhances financial integrity and operational efficiency in reconciliation processes.

Automation

Real-time reconciliation leverages automated data processing to instantly verify and match transactions across systems, significantly reducing errors and operational delays. Blockchain reconciliation employs distributed ledger technology, enabling automated, tamper-proof records that enhance transparency and trust while streamlining verification processes. Explore our comprehensive guide to understand how automation shapes the future of reconciliation in finance.

Source and External Links

Real-Time Reconciliation | Optimus FinTech Knowledge Base - Real-time reconciliation instantly verifies transactions and financial records as they occur, using advanced technology and automation to ensure accuracy and consistency across all financial records.

Real-Time Reconciliation and Receivables Aging with RTP(r) and ... - This platform offers real-time reconciliation tools backed by RTP and FedNow networks, providing instant visibility into payments and financial activities across multiple accounts.

The future of reconciliation is real time - CFO.com - Real-time reconciliation combines automation, continuous bank integrations, and AI to increase speed and efficiency in financial processes, reducing errors and improving financial decision-making.

dowidth.com

dowidth.com