Revenue recognition automation enhances accuracy and compliance by systematically capturing earned income according to accounting standards, streamlining the financial close process. Cost allocation automation optimizes expense distribution by using predefined algorithms to assign indirect costs accurately across departments or projects, improving budget control and financial transparency. Explore the distinct advantages and implementation strategies of both automation methods to elevate your accounting practices.

Why it is important

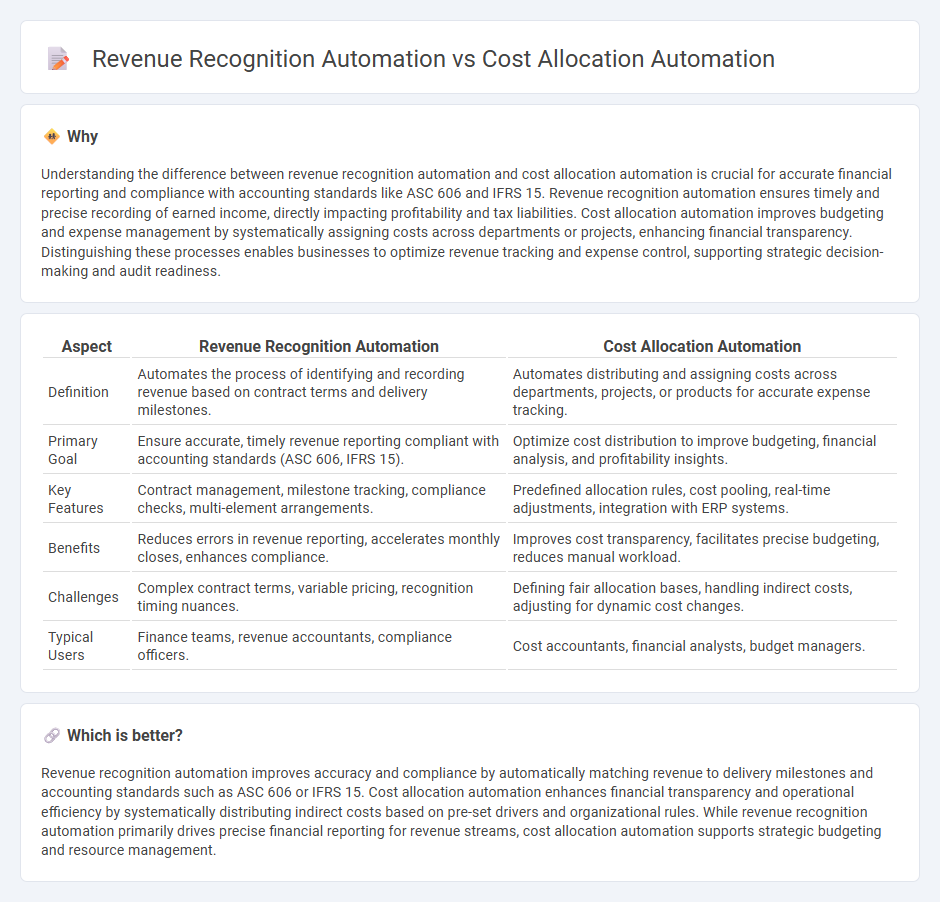

Understanding the difference between revenue recognition automation and cost allocation automation is crucial for accurate financial reporting and compliance with accounting standards like ASC 606 and IFRS 15. Revenue recognition automation ensures timely and precise recording of earned income, directly impacting profitability and tax liabilities. Cost allocation automation improves budgeting and expense management by systematically assigning costs across departments or projects, enhancing financial transparency. Distinguishing these processes enables businesses to optimize revenue tracking and expense control, supporting strategic decision-making and audit readiness.

Comparison Table

| Aspect | Revenue Recognition Automation | Cost Allocation Automation |

|---|---|---|

| Definition | Automates the process of identifying and recording revenue based on contract terms and delivery milestones. | Automates distributing and assigning costs across departments, projects, or products for accurate expense tracking. |

| Primary Goal | Ensure accurate, timely revenue reporting compliant with accounting standards (ASC 606, IFRS 15). | Optimize cost distribution to improve budgeting, financial analysis, and profitability insights. |

| Key Features | Contract management, milestone tracking, compliance checks, multi-element arrangements. | Predefined allocation rules, cost pooling, real-time adjustments, integration with ERP systems. |

| Benefits | Reduces errors in revenue reporting, accelerates monthly closes, enhances compliance. | Improves cost transparency, facilitates precise budgeting, reduces manual workload. |

| Challenges | Complex contract terms, variable pricing, recognition timing nuances. | Defining fair allocation bases, handling indirect costs, adjusting for dynamic cost changes. |

| Typical Users | Finance teams, revenue accountants, compliance officers. | Cost accountants, financial analysts, budget managers. |

Which is better?

Revenue recognition automation improves accuracy and compliance by automatically matching revenue to delivery milestones and accounting standards such as ASC 606 or IFRS 15. Cost allocation automation enhances financial transparency and operational efficiency by systematically distributing indirect costs based on pre-set drivers and organizational rules. While revenue recognition automation primarily drives precise financial reporting for revenue streams, cost allocation automation supports strategic budgeting and resource management.

Connection

Revenue recognition automation and cost allocation automation are connected through their shared goal of enhancing financial accuracy and compliance by streamlining complex accounting processes. Both systems leverage advanced algorithms and real-time data integration to ensure precise matching of revenues and expenses, which supports better financial reporting and decision-making. This connection reduces manual errors, accelerates closing cycles, and improves adherence to accounting standards such as ASC 606 and IFRS 15.

Key Terms

**Cost Allocation Automation:**

Cost allocation automation streamlines the process of distributing expenses across departments or projects using predefined rules and real-time data integration, enhancing accuracy and reducing manual errors. By leveraging AI and machine learning algorithms, this automation improves financial transparency and accelerates month-end closing cycles. Discover how cost allocation automation can transform your financial operations and drive efficiency.

Expense Distribution

Cost allocation automation streamlines the process of Expense Distribution by accurately assigning costs to departments or projects using predefined rules and algorithms, reducing manual errors and improving financial transparency. Revenue recognition automation focuses on accurately recording revenue based on contract terms and compliance standards, but it does not address the detailed distribution of expenses across cost centers. Explore the distinctions between these automation processes to optimize your financial operations effectively.

Overhead Allocation

Cost allocation automation streamlines the process of distributing overhead expenses across departments or projects, enhancing accuracy and reducing manual errors. Revenue recognition automation ensures compliance with accounting standards by systematically matching revenue with related expenses, but overhead allocation remains a critical factor in both processes for precise financial reporting. Explore how integrating automation in overhead allocation can optimize both cost distribution and revenue recognition workflows.

Source and External Links

Automating Cost Allocations * AETI - Automating cost allocation eliminates guesswork and manual efforts by using exposure-based allocation methods with software like Quadra, simplifying invoice distribution and asset exposure tracking for transparent risk management.

Cascade Suite: Automate expense allocations - Deloitte - Deloitte's automated expense allocation solution, Cascade Suite, drives efficiency and transparency through analytics, centralized workflow automation, audit trails, and customizable allocation rules based on assets, locations, or employee time.

Cost Allocation and Settlement - Microsoft AppSource - The ANEGIS module for Dynamics 365 automates cost allocation and settlement processes using real-time data and flexible logic, integrating directly with general ledger or projects to streamline indirect cost management.

dowidth.com

dowidth.com