Integrated ESG reporting combines environmental, social, and governance metrics within financial disclosures to offer a comprehensive view of corporate performance, unlike traditional sustainability reporting that focuses primarily on environmental and social factors. This approach enhances transparency by linking non-financial data directly with financial outcomes, aiding stakeholders in making informed decisions. Discover how integrating ESG factors reshapes accounting practices and drives corporate accountability.

Why it is important

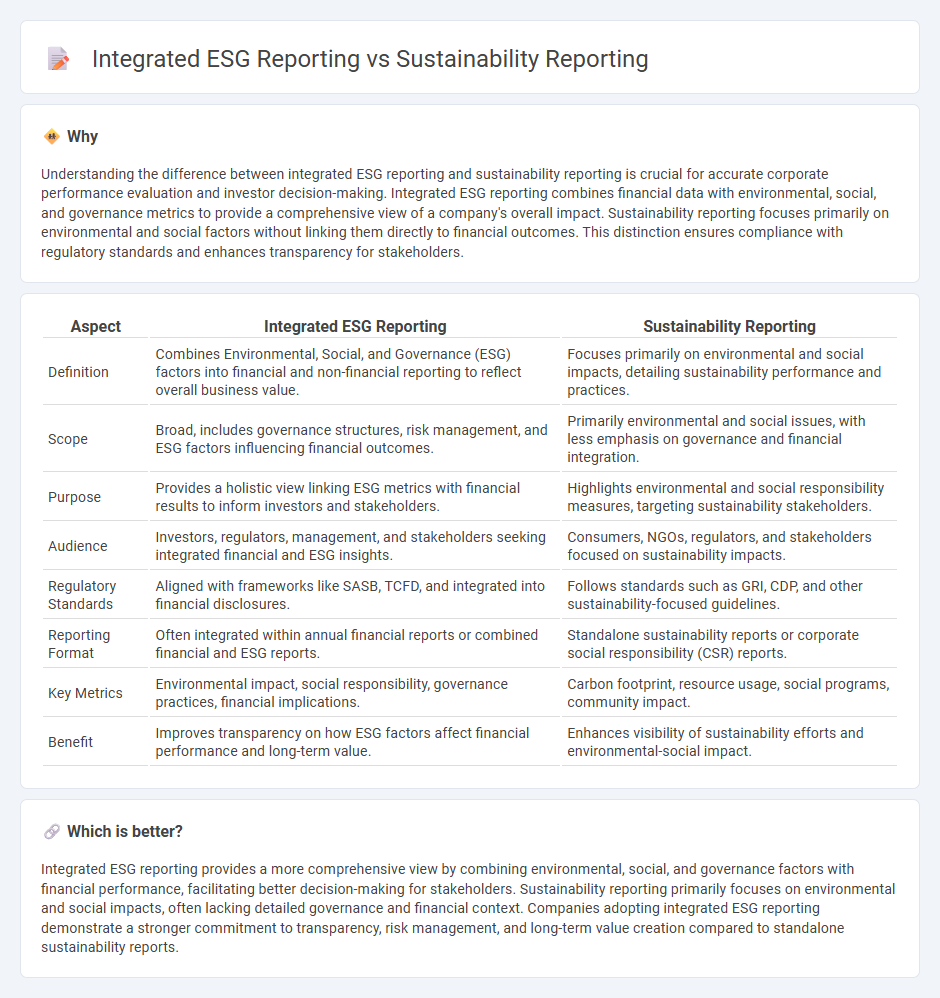

Understanding the difference between integrated ESG reporting and sustainability reporting is crucial for accurate corporate performance evaluation and investor decision-making. Integrated ESG reporting combines financial data with environmental, social, and governance metrics to provide a comprehensive view of a company's overall impact. Sustainability reporting focuses primarily on environmental and social factors without linking them directly to financial outcomes. This distinction ensures compliance with regulatory standards and enhances transparency for stakeholders.

Comparison Table

| Aspect | Integrated ESG Reporting | Sustainability Reporting |

|---|---|---|

| Definition | Combines Environmental, Social, and Governance (ESG) factors into financial and non-financial reporting to reflect overall business value. | Focuses primarily on environmental and social impacts, detailing sustainability performance and practices. |

| Scope | Broad, includes governance structures, risk management, and ESG factors influencing financial outcomes. | Primarily environmental and social issues, with less emphasis on governance and financial integration. |

| Purpose | Provides a holistic view linking ESG metrics with financial results to inform investors and stakeholders. | Highlights environmental and social responsibility measures, targeting sustainability stakeholders. |

| Audience | Investors, regulators, management, and stakeholders seeking integrated financial and ESG insights. | Consumers, NGOs, regulators, and stakeholders focused on sustainability impacts. |

| Regulatory Standards | Aligned with frameworks like SASB, TCFD, and integrated into financial disclosures. | Follows standards such as GRI, CDP, and other sustainability-focused guidelines. |

| Reporting Format | Often integrated within annual financial reports or combined financial and ESG reports. | Standalone sustainability reports or corporate social responsibility (CSR) reports. |

| Key Metrics | Environmental impact, social responsibility, governance practices, financial implications. | Carbon footprint, resource usage, social programs, community impact. |

| Benefit | Improves transparency on how ESG factors affect financial performance and long-term value. | Enhances visibility of sustainability efforts and environmental-social impact. |

Which is better?

Integrated ESG reporting provides a more comprehensive view by combining environmental, social, and governance factors with financial performance, facilitating better decision-making for stakeholders. Sustainability reporting primarily focuses on environmental and social impacts, often lacking detailed governance and financial context. Companies adopting integrated ESG reporting demonstrate a stronger commitment to transparency, risk management, and long-term value creation compared to standalone sustainability reports.

Connection

Integrated ESG reporting and Sustainability reporting converge by encompassing environmental, social, and governance metrics alongside traditional financial data, providing a comprehensive overview of a company's overall impact and performance. ESG reporting focuses specifically on measurable criteria related to environmental stewardship, social responsibility, and corporate governance practices, while Sustainability reporting broader includes long-term strategies and outcomes aligned with sustainable development goals (SDGs). Combining these frameworks enhances transparency, aids risk management, and attracts socially responsible investors by delivering data-driven insights into both financial and non-financial performance.

Key Terms

Triple Bottom Line

Sustainability reporting traditionally emphasizes environmental, social, and governance (ESG) factors linked to the Triple Bottom Line framework, which includes People, Planet, and Profit metrics to measure corporate impact. Integrated ESG reporting combines financial and non-financial data, offering a holistic view of business performance and long-term value creation aligned with sustainable development goals (SDGs). Explore further to understand how integrated ESG reporting drives strategic decision-making and enhances transparency for stakeholders.

Materiality

Sustainability reporting traditionally emphasizes environmental, social, and governance (ESG) metrics without fully integrating financial performance, often leading to fragmented disclosures. Integrated ESG reporting prioritizes materiality by linking sustainability factors directly with economic value creation, providing a holistic view that aligns with frameworks like the International Integrated Reporting Council (IIRC) and SASB standards. Discover how understanding materiality in these reporting approaches can enhance transparency and drive strategic business decisions.

Stakeholder Engagement

Sustainability reporting centers on environmental and social metrics with limited integration of financial data, primarily addressing regulatory compliance and investor requirements. Integrated ESG reporting combines environmental, social, governance metrics with financial performance, offering a comprehensive narrative that enhances transparency and facilitates deeper stakeholder engagement across investors, employees, and communities. Discover how integrating ESG factors transforms stakeholder dialogue and decision-making in corporate reporting.

Source and External Links

What is Sustainability Reporting? - Sustainability reporting is a non-financial disclosure by companies on their environmental, social, and governance (ESG) goals and progress, helping to communicate impacts, assess risks and opportunities, drive green operations, and enhance transparency and brand image.

Sustainability Reporting: Frameworks, Benefits & Challenges - Sustainability reporting publicly discloses a company's ESG performance using recognized frameworks like GRI, enabling stakeholders to assess long-term value and supporting regulatory compliance and corporate reputation.

Sustainability reporting - Sustainability reporting involves voluntary or mandatory disclosure of non-financial ESG information to stakeholders, increasing transparency, consumer confidence, and corporate accountability, with regulations like the EU's CSRD guiding its mandate.

dowidth.com

dowidth.com