Continuous assurance leverages real-time data analysis and automated controls to provide ongoing validation of financial information, enhancing accuracy and reducing risk. Retrospective review evaluates financial records and transactions after the reporting period to identify discrepancies and ensure compliance with accounting standards. Discover how continuous assurance transforms financial auditing for greater efficiency and reliability.

Why it is important

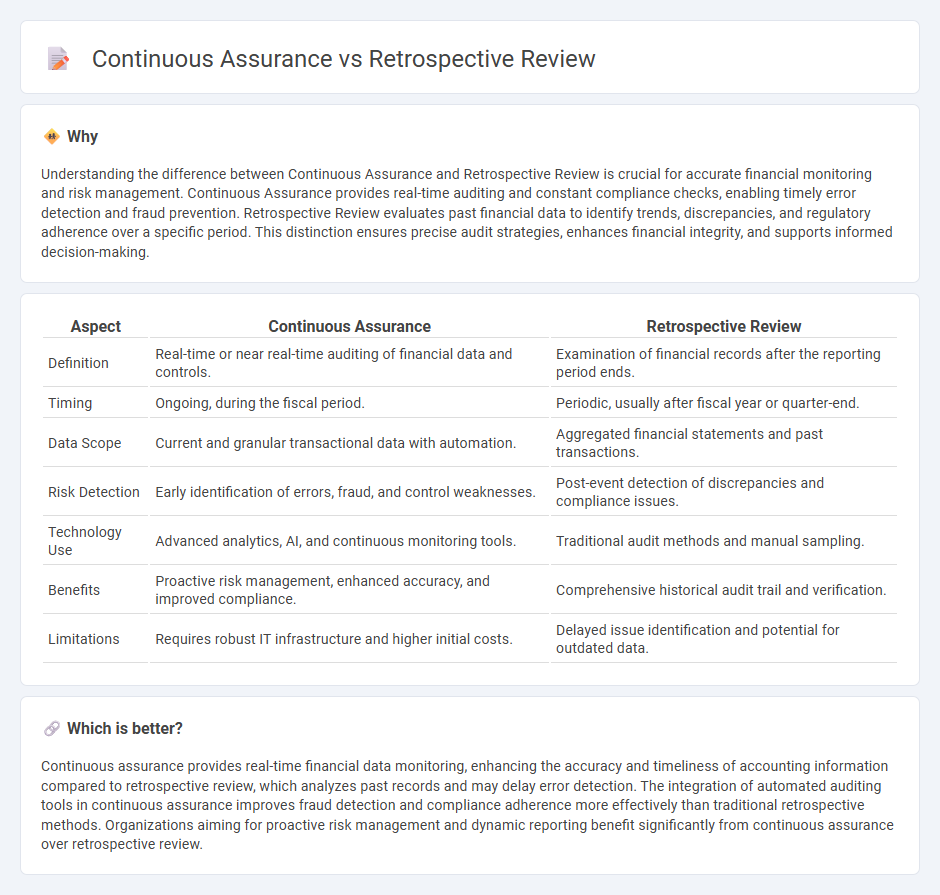

Understanding the difference between Continuous Assurance and Retrospective Review is crucial for accurate financial monitoring and risk management. Continuous Assurance provides real-time auditing and constant compliance checks, enabling timely error detection and fraud prevention. Retrospective Review evaluates past financial data to identify trends, discrepancies, and regulatory adherence over a specific period. This distinction ensures precise audit strategies, enhances financial integrity, and supports informed decision-making.

Comparison Table

| Aspect | Continuous Assurance | Retrospective Review |

|---|---|---|

| Definition | Real-time or near real-time auditing of financial data and controls. | Examination of financial records after the reporting period ends. |

| Timing | Ongoing, during the fiscal period. | Periodic, usually after fiscal year or quarter-end. |

| Data Scope | Current and granular transactional data with automation. | Aggregated financial statements and past transactions. |

| Risk Detection | Early identification of errors, fraud, and control weaknesses. | Post-event detection of discrepancies and compliance issues. |

| Technology Use | Advanced analytics, AI, and continuous monitoring tools. | Traditional audit methods and manual sampling. |

| Benefits | Proactive risk management, enhanced accuracy, and improved compliance. | Comprehensive historical audit trail and verification. |

| Limitations | Requires robust IT infrastructure and higher initial costs. | Delayed issue identification and potential for outdated data. |

Which is better?

Continuous assurance provides real-time financial data monitoring, enhancing the accuracy and timeliness of accounting information compared to retrospective review, which analyzes past records and may delay error detection. The integration of automated auditing tools in continuous assurance improves fraud detection and compliance adherence more effectively than traditional retrospective methods. Organizations aiming for proactive risk management and dynamic reporting benefit significantly from continuous assurance over retrospective review.

Connection

Continuous assurance relies on real-time data monitoring and automated controls to provide ongoing verification of financial information, while retrospective review involves analyzing past transactions and reports to identify discrepancies or errors. Both methods enhance the reliability and accuracy of accounting records by combining proactive oversight with detailed historical analysis. Integrating continuous assurance with retrospective review strengthens internal controls and supports timely detection of financial irregularities.

Key Terms

Audit

Retrospective review in audit involves analyzing historical financial data to identify errors or irregularities after the reporting period, ensuring compliance with regulations and accuracy in financial statements. Continuous assurance employs real-time monitoring techniques, leveraging advanced analytics and automated controls to provide ongoing validation of transactions and internal controls, enhancing audit efficiency and risk management. Explore how integrating these approaches can strengthen audit quality and drive timely decision-making.

Internal controls

Retrospective review examines past financial transactions and internal controls to identify compliance gaps and weaknesses after the fact, often relying on sampling and periodic audits. Continuous assurance implements real-time monitoring of internal controls through automated systems, providing ongoing validation and immediate detection of anomalies or control failures. Explore advanced methodologies to enhance your internal control assessments for improved risk management and operational efficiency.

Financial statements

Retrospective review evaluates financial statements after the reporting period, identifying inaccuracies and compliance issues based on historical data and transactions. Continuous assurance involves real-time monitoring and verification of financial data, ensuring ongoing accuracy and reducing risk by integrating automated controls throughout the accounting process. Explore more to understand how these approaches enhance financial reporting accuracy and compliance.

Source and External Links

Retrospective Review - Wikipedia - The Retrospective Review was an English periodical from 1820 to 1828 focused on Early Modern English literature, originally founded and edited by Henry Southern.

Retrospective Studies | EBMT - A retrospective study uses past data to compare patient outcomes, is faster and less expensive than prospective studies, and is valuable for epidemiological surveillance, treatment evaluation, and studies where clinical trials are not feasible.

The retrospective chart review: important methodological considerations - This article discusses common methodological errors in retrospective chart reviews in healthcare research and provides best practice guidelines to enhance study quality and validity.

dowidth.com

dowidth.com