Tokenized assets accounting involves recording blockchain-based digital representations of physical or financial assets, emphasizing transparency, immutability, and real-time transaction tracking. Intangible asset accounting focuses on valuing non-physical assets such as patents, trademarks, and goodwill, often requiring amortization and impairment assessments. Explore the distinctions between these accounting approaches to optimize your financial reporting strategies.

Why it is important

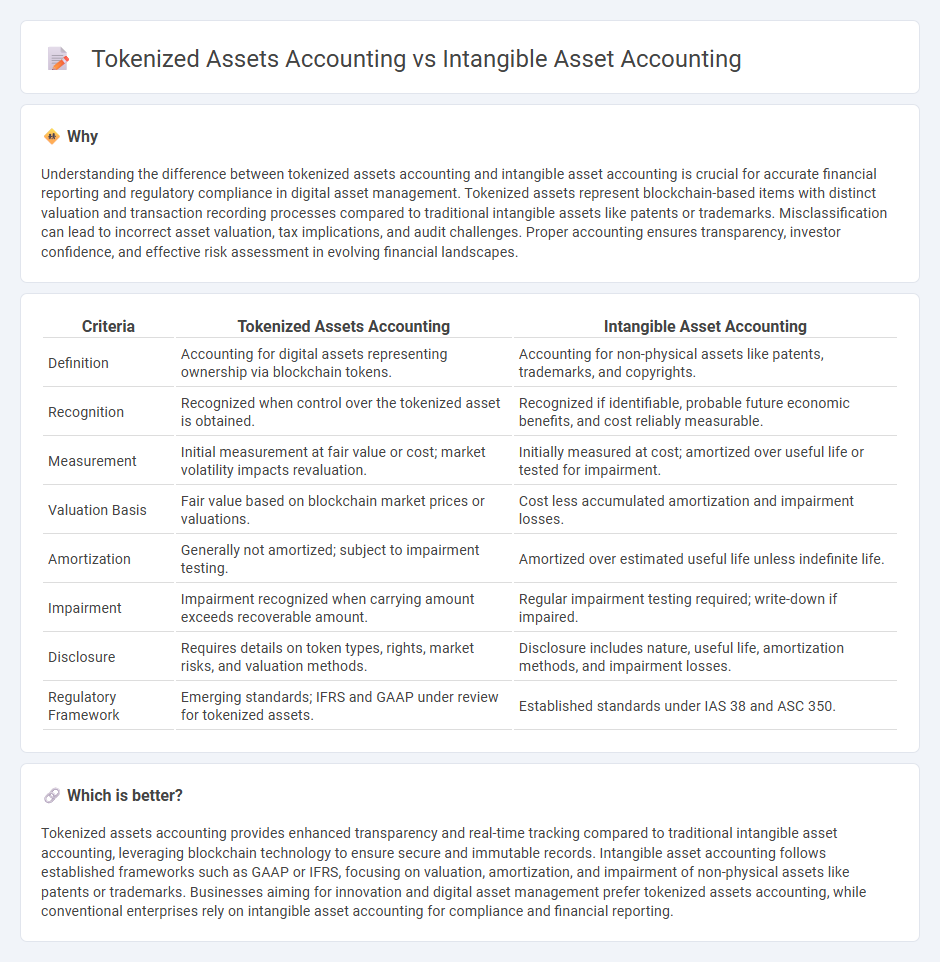

Understanding the difference between tokenized assets accounting and intangible asset accounting is crucial for accurate financial reporting and regulatory compliance in digital asset management. Tokenized assets represent blockchain-based items with distinct valuation and transaction recording processes compared to traditional intangible assets like patents or trademarks. Misclassification can lead to incorrect asset valuation, tax implications, and audit challenges. Proper accounting ensures transparency, investor confidence, and effective risk assessment in evolving financial landscapes.

Comparison Table

| Criteria | Tokenized Assets Accounting | Intangible Asset Accounting |

|---|---|---|

| Definition | Accounting for digital assets representing ownership via blockchain tokens. | Accounting for non-physical assets like patents, trademarks, and copyrights. |

| Recognition | Recognized when control over the tokenized asset is obtained. | Recognized if identifiable, probable future economic benefits, and cost reliably measurable. |

| Measurement | Initial measurement at fair value or cost; market volatility impacts revaluation. | Initially measured at cost; amortized over useful life or tested for impairment. |

| Valuation Basis | Fair value based on blockchain market prices or valuations. | Cost less accumulated amortization and impairment losses. |

| Amortization | Generally not amortized; subject to impairment testing. | Amortized over estimated useful life unless indefinite life. |

| Impairment | Impairment recognized when carrying amount exceeds recoverable amount. | Regular impairment testing required; write-down if impaired. |

| Disclosure | Requires details on token types, rights, market risks, and valuation methods. | Disclosure includes nature, useful life, amortization methods, and impairment losses. |

| Regulatory Framework | Emerging standards; IFRS and GAAP under review for tokenized assets. | Established standards under IAS 38 and ASC 350. |

Which is better?

Tokenized assets accounting provides enhanced transparency and real-time tracking compared to traditional intangible asset accounting, leveraging blockchain technology to ensure secure and immutable records. Intangible asset accounting follows established frameworks such as GAAP or IFRS, focusing on valuation, amortization, and impairment of non-physical assets like patents or trademarks. Businesses aiming for innovation and digital asset management prefer tokenized assets accounting, while conventional enterprises rely on intangible asset accounting for compliance and financial reporting.

Connection

Tokenized assets accounting and intangible asset accounting intersect through the treatment of digital representations of value, where tokenized assets are often recognized as intangible assets on the balance sheet due to their non-physical nature and associated rights. Both accounting approaches require accurate valuation and impairment testing under standards like IFRS IAS 38 and ensure that blockchain-based tokens comply with financial reporting frameworks for recognition, measurement, and disclosure. The convergence highlights the need for robust controls around digital asset classification, transaction recording, and regulatory compliance within evolving accounting environments.

Key Terms

Amortization vs. Fractional Ownership

Intangible asset accounting typically involves amortization, systematically expensing the asset's cost over its useful life according to accounting standards like IAS 38, while tokenized assets accounting emphasizes fractional ownership, enabling divisible rights and real-time tracking on blockchain platforms. Tokenized assets represent a shift from traditional amortization models to dynamic, transparent ownership records, impacting valuation and regulatory compliance. Explore how evolving accounting frameworks are integrating digital asset tokenization for enhanced financial reporting and asset management.

Impairment Testing vs. Smart Contract Valuation

Impairment testing in intangible asset accounting involves evaluating the recoverable amount of assets against their carrying value to ensure accurate financial reporting, often requiring complex estimates of future cash flows and market conditions. In contrast, tokenized assets accounting leverages smart contract valuation, using blockchain-based automated algorithms that provide transparent, real-time asset valuations and reduce subjectivity in impairment assessments. Explore deeper insights into how evolving technologies are reshaping asset valuation frameworks and compliance.

Recognition Criteria vs. Blockchain Ledger Validation

Intangible asset accounting relies on recognition criteria defined by accounting standards such as IFRS or GAAP, emphasizing identifiability, control, and future economic benefits. Tokenized assets accounting integrates blockchain ledger validation, ensuring transparent, immutable records of ownership and transaction history, which enhances asset traceability and reduces fraud risk. Explore the evolving frameworks bridging traditional accounting principles with blockchain technology for precise asset management.

Source and External Links

Intangible asset - Intangible asset accounting involves recognizing purchased intangibles but generally not internally developed legal intangibles, amortizing those with identifiable useful lives over their economic or legal life, and testing indefinite-life intangibles like goodwill for impairment annually under standards such as IAS 38 and US GAAP.

IFRS - IAS 38 Intangible Assets - IAS 38 defines criteria for recognizing and measuring intangible assets, requiring expenditures to be expensed unless the asset is identifiable and meets recognition criteria, with internally generated goodwill not recognized; research costs are expensed while qualifying development costs can be capitalized.

Accounting for Intangible Assets: Amortization & Useful Life - Amortization spreads an intangible asset's cost over its useful life (typically no residual value), applicable only to finite-life intangibles such as patents, which are expensed systematically to reflect consumption of economic benefits.

dowidth.com

dowidth.com