Digital ledger technology enhances data security and transparency by creating immutable records of transactions, while automated reconciliation streamlines the matching of financial records to reduce errors and save time. Both technologies significantly improve accounting accuracy and efficiency through advanced algorithms and real-time processing. Explore how integrating these innovations can transform your financial operations and compliance.

Why it is important

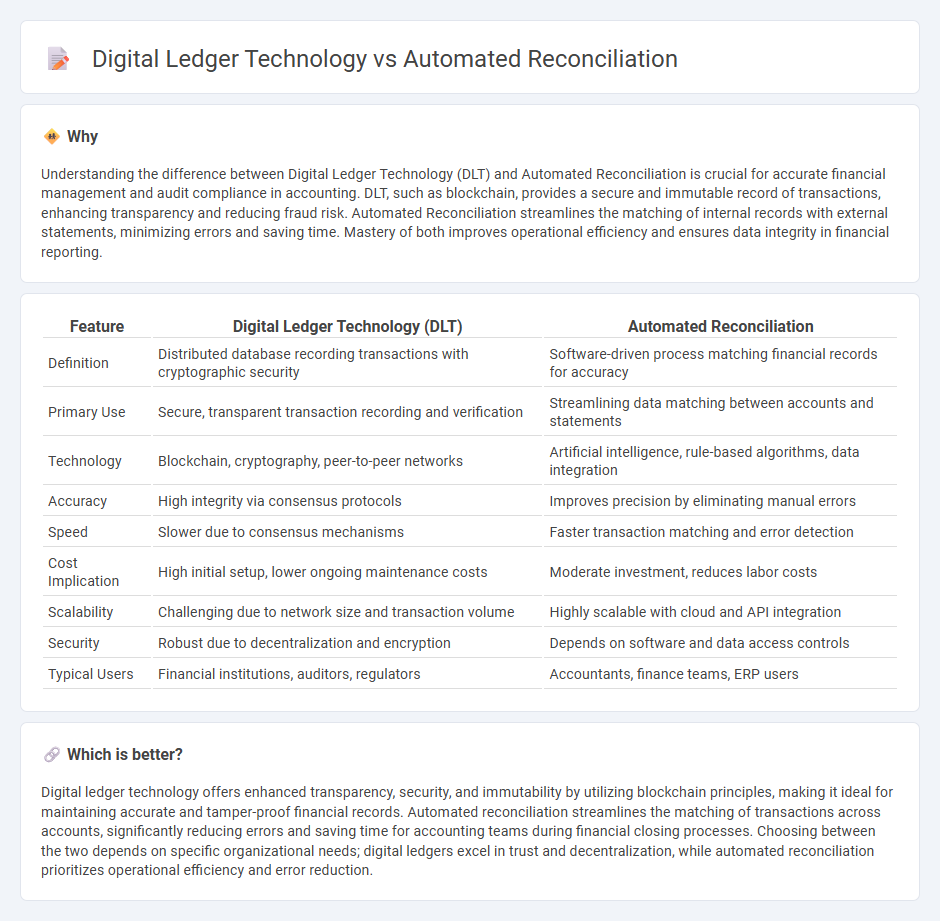

Understanding the difference between Digital Ledger Technology (DLT) and Automated Reconciliation is crucial for accurate financial management and audit compliance in accounting. DLT, such as blockchain, provides a secure and immutable record of transactions, enhancing transparency and reducing fraud risk. Automated Reconciliation streamlines the matching of internal records with external statements, minimizing errors and saving time. Mastery of both improves operational efficiency and ensures data integrity in financial reporting.

Comparison Table

| Feature | Digital Ledger Technology (DLT) | Automated Reconciliation |

|---|---|---|

| Definition | Distributed database recording transactions with cryptographic security | Software-driven process matching financial records for accuracy |

| Primary Use | Secure, transparent transaction recording and verification | Streamlining data matching between accounts and statements |

| Technology | Blockchain, cryptography, peer-to-peer networks | Artificial intelligence, rule-based algorithms, data integration |

| Accuracy | High integrity via consensus protocols | Improves precision by eliminating manual errors |

| Speed | Slower due to consensus mechanisms | Faster transaction matching and error detection |

| Cost Implication | High initial setup, lower ongoing maintenance costs | Moderate investment, reduces labor costs |

| Scalability | Challenging due to network size and transaction volume | Highly scalable with cloud and API integration |

| Security | Robust due to decentralization and encryption | Depends on software and data access controls |

| Typical Users | Financial institutions, auditors, regulators | Accountants, finance teams, ERP users |

Which is better?

Digital ledger technology offers enhanced transparency, security, and immutability by utilizing blockchain principles, making it ideal for maintaining accurate and tamper-proof financial records. Automated reconciliation streamlines the matching of transactions across accounts, significantly reducing errors and saving time for accounting teams during financial closing processes. Choosing between the two depends on specific organizational needs; digital ledgers excel in trust and decentralization, while automated reconciliation prioritizes operational efficiency and error reduction.

Connection

Digital ledger technology (DLT) enhances accounting accuracy by providing a secure, immutable record of financial transactions, which simplifies automated reconciliation processes. Automated reconciliation leverages DLT's real-time data validation and transparency to detect discrepancies quickly and reduce manual errors. This integration streamlines financial closing cycles and improves audit traceability within accounting systems.

Key Terms

Data Matching Algorithms

Data matching algorithms play a critical role in automated reconciliation by swiftly comparing transaction records to identify discrepancies and ensure accuracy, leveraging pattern recognition and fuzzy logic techniques. Digital ledger technology utilizes consensus-driven data matching mechanisms embedded within a decentralized network, enhancing transparency and immutability in financial record-keeping. Explore these innovative approaches to understand how cutting-edge algorithms optimize financial data integrity.

Distributed Ledger

Automated reconciliation enhances the accuracy and efficiency of financial record matching by utilizing algorithms to compare transactions and identify discrepancies, significantly reducing manual errors. Digital ledger technology, particularly Distributed Ledger Technology (DLT), offers a decentralized and immutable system for secure transaction recording, enabling real-time synchronization across multiple parties without a central authority. Explore how integrating automated reconciliation with distributed ledger solutions can revolutionize financial transparency and operational workflows.

Transaction Validation

Automated reconciliation systems enhance transaction validation by using algorithms to match records and detect discrepancies quickly, reducing manual errors and accelerating financial closing processes. Digital ledger technology (DLT), such as blockchain, ensures transaction validation through decentralized, tamper-proof ledgers that provide enhanced transparency and security across multiple stakeholders. Discover how integrating these technologies can transform transaction validation in modern financial ecosystems.

Source and External Links

Ultimate Guide to Automated Reconciliation - Automated reconciliation uses software to streamline and speed up the process of matching internal records with external financial statements, drastically reducing manual effort and human error while providing near-perfect accuracy and freeing finance teams for strategic work.

What is Automated Reconciliation? - Automated reconciliation software automatically matches transactions across financial records and bank statements using algorithms and machine learning, minimizing manual intervention and improving accuracy and audit trails.

Manual vs. Automated Reconciliation: Why Automation Wins - Modern automated reconciliation platforms powered by AI and rules-based systems perform real-time data matching and flag only exceptions, enhancing speed, control, and visibility while reducing financial errors.

dowidth.com

dowidth.com