Fair value measurement reflects the current market price of an asset or liability, ensuring financial statements present accurate, up-to-date valuations based on active market conditions. The revaluation model allows companies to carry assets at their fair value but requires regular reassessments to adjust the carrying amount, enhancing the relevance of financial information. Explore the differences and implications of these approaches to better understand their impact on financial reporting.

Why it is important

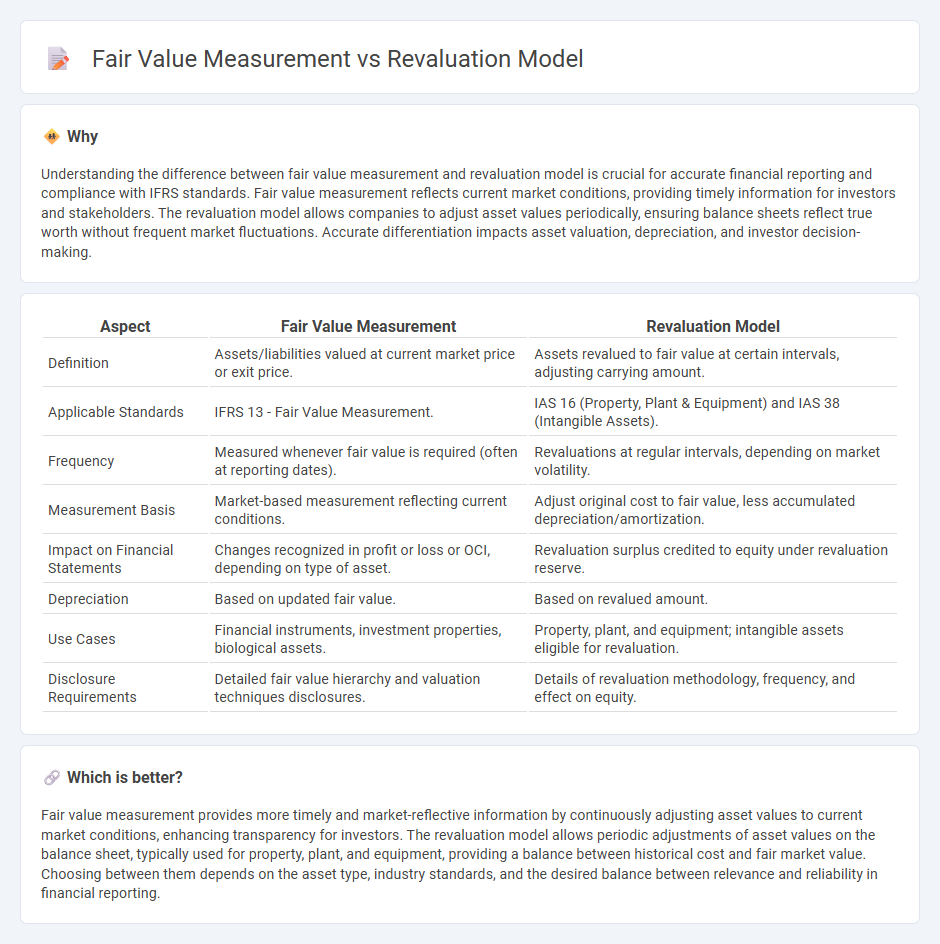

Understanding the difference between fair value measurement and revaluation model is crucial for accurate financial reporting and compliance with IFRS standards. Fair value measurement reflects current market conditions, providing timely information for investors and stakeholders. The revaluation model allows companies to adjust asset values periodically, ensuring balance sheets reflect true worth without frequent market fluctuations. Accurate differentiation impacts asset valuation, depreciation, and investor decision-making.

Comparison Table

| Aspect | Fair Value Measurement | Revaluation Model |

|---|---|---|

| Definition | Assets/liabilities valued at current market price or exit price. | Assets revalued to fair value at certain intervals, adjusting carrying amount. |

| Applicable Standards | IFRS 13 - Fair Value Measurement. | IAS 16 (Property, Plant & Equipment) and IAS 38 (Intangible Assets). |

| Frequency | Measured whenever fair value is required (often at reporting dates). | Revaluations at regular intervals, depending on market volatility. |

| Measurement Basis | Market-based measurement reflecting current conditions. | Adjust original cost to fair value, less accumulated depreciation/amortization. |

| Impact on Financial Statements | Changes recognized in profit or loss or OCI, depending on type of asset. | Revaluation surplus credited to equity under revaluation reserve. |

| Depreciation | Based on updated fair value. | Based on revalued amount. |

| Use Cases | Financial instruments, investment properties, biological assets. | Property, plant, and equipment; intangible assets eligible for revaluation. |

| Disclosure Requirements | Detailed fair value hierarchy and valuation techniques disclosures. | Details of revaluation methodology, frequency, and effect on equity. |

Which is better?

Fair value measurement provides more timely and market-reflective information by continuously adjusting asset values to current market conditions, enhancing transparency for investors. The revaluation model allows periodic adjustments of asset values on the balance sheet, typically used for property, plant, and equipment, providing a balance between historical cost and fair market value. Choosing between them depends on the asset type, industry standards, and the desired balance between relevance and reliability in financial reporting.

Connection

Fair value measurement serves as the foundational basis for the revaluation model in accounting, ensuring asset values reflect current market conditions. The revaluation model uses fair value to adjust asset carrying amounts, providing accurate and timely financial reporting in accordance with IFRS standards. This connection enhances transparency and reliability in financial statements by capturing asset value fluctuations over time.

Key Terms

Carrying Amount

The revaluation model adjusts the carrying amount of an asset to its fair value at the revaluation date, with changes recognized in equity under revaluation surplus, except impairment losses which affect profit or loss. In contrast, fair value measurement reflects the current market value of an asset or liability at the measurement date, which directly impacts profit or loss unless specified otherwise by accounting standards. Explore detailed differences and implications in IFRS and GAAP frameworks to deepen your understanding.

Revaluation Surplus

The Revaluation Surplus arises under the Revaluation Model when an asset's carrying amount is increased to its fair value, reflecting unrealized gains that are credited directly to equity rather than profit or loss. Fair Value Measurement, a broader concept under IFRS 13, determines the price at which an asset could be exchanged between knowledgeable, willing parties, but it is used for various accounting purposes beyond revaluation. Explore the nuances of how Revaluation Surplus enhances equity transparency and impacts financial statements for a comprehensive understanding.

Market-Based Value

The revaluation model adjusts an asset's carrying amount to its fair value based on market-based evidence, refining balance sheet accuracy without frequent fluctuations. Fair value measurement consistently reflects the asset's exit price in an orderly transaction between market participants, emphasizing current market conditions and liquidity. Explore detailed comparisons to understand practical applications and accounting impacts further.

Source and External Links

What is the Revaluation Model? - The Revaluation Model is an accounting approach under IFRS for measuring long-lived assets at their fair value at the date of revaluation, less depreciation and impairment, contrasting with the historical cost model.

Revaluation model definition - This model allows businesses to carry fixed assets at revalued amounts requiring periodic revaluations to keep carrying amounts close to fair values, typically every 3-5 years under IFRS.

Revaluation Model for PP&E and Intangible Assets - Under IAS 16 and IAS 38, the revaluation model requires consistent application to asset classes and mandates that carrying values reflect fair value adjusted for depreciation and impairment, with frequent enough revaluations to avoid material differences from fair value.

dowidth.com

dowidth.com