Fractional CFOs provide part-time financial leadership focused on strategic planning and long-term growth for small to mid-sized businesses, offering flexible, cost-effective expertise without a full-time commitment. Interim CFOs serve as temporary, full-time executives managing critical financial operations during transitions, crises, or leadership gaps to maintain stability and continuity. Explore the distinct advantages and use cases of fractional versus interim CFO roles to determine the best fit for your organization's financial needs.

Why it is important

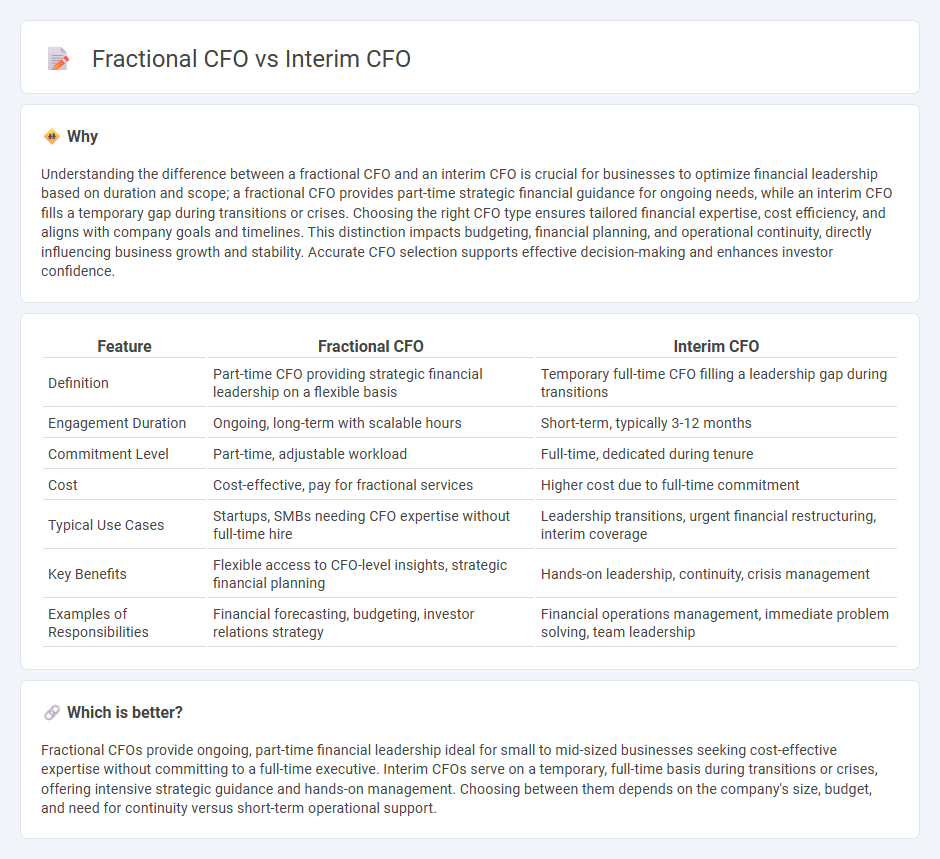

Understanding the difference between a fractional CFO and an interim CFO is crucial for businesses to optimize financial leadership based on duration and scope; a fractional CFO provides part-time strategic financial guidance for ongoing needs, while an interim CFO fills a temporary gap during transitions or crises. Choosing the right CFO type ensures tailored financial expertise, cost efficiency, and aligns with company goals and timelines. This distinction impacts budgeting, financial planning, and operational continuity, directly influencing business growth and stability. Accurate CFO selection supports effective decision-making and enhances investor confidence.

Comparison Table

| Feature | Fractional CFO | Interim CFO |

|---|---|---|

| Definition | Part-time CFO providing strategic financial leadership on a flexible basis | Temporary full-time CFO filling a leadership gap during transitions |

| Engagement Duration | Ongoing, long-term with scalable hours | Short-term, typically 3-12 months |

| Commitment Level | Part-time, adjustable workload | Full-time, dedicated during tenure |

| Cost | Cost-effective, pay for fractional services | Higher cost due to full-time commitment |

| Typical Use Cases | Startups, SMBs needing CFO expertise without full-time hire | Leadership transitions, urgent financial restructuring, interim coverage |

| Key Benefits | Flexible access to CFO-level insights, strategic financial planning | Hands-on leadership, continuity, crisis management |

| Examples of Responsibilities | Financial forecasting, budgeting, investor relations strategy | Financial operations management, immediate problem solving, team leadership |

Which is better?

Fractional CFOs provide ongoing, part-time financial leadership ideal for small to mid-sized businesses seeking cost-effective expertise without committing to a full-time executive. Interim CFOs serve on a temporary, full-time basis during transitions or crises, offering intensive strategic guidance and hands-on management. Choosing between them depends on the company's size, budget, and need for continuity versus short-term operational support.

Connection

Fractional CFOs and interim CFOs both serve as strategic financial leaders on a temporary or part-time basis, addressing the needs of businesses without requiring a full-time executive. Fractional CFOs typically provide ongoing, part-time support across multiple companies, optimizing financial operations and strategy. Interim CFOs step in during transitional periods, such as executive vacancies or mergers, offering full-time leadership until a permanent CFO is appointed.

Key Terms

Tenure

Interim CFOs typically serve on a short-term basis, often during transitional periods such as mergers, acquisitions, or unexpected leadership gaps, focusing on immediate financial challenges. Fractional CFOs provide part-time, ongoing financial leadership over an extended tenure, supporting strategic planning and long-term growth without a full-time commitment. Explore the distinctions between interim and fractional CFOs to determine the optimal fit for your organization's financial needs.

Engagement Scope

Interim CFOs typically manage full-scale financial leadership during transitional periods, handling comprehensive financial strategy, reporting, and team oversight. Fractional CFOs offer part-time, strategic financial guidance tailored to specific business needs without the commitment of full-time employment. Explore the distinct engagement scopes and benefits of each role to determine the best fit for your organization.

Cost Structure

Interim CFOs typically engage in short-term leadership roles during transitions, incurring higher costs due to temporary executive compensation and possible onboarding expenses. Fractional CFOs offer part-time services spread over extended periods, enabling businesses to optimize their cost structure by paying only for necessary financial expertise without full-time salary commitments. Explore detailed cost comparisons to determine the ideal financial leadership model for your organization.

Source and External Links

Interim CFO: The Guardian of Continuity - This webpage explains the role of an interim CFO who ensures continuity and smooth financial operations during temporary absences or transitions.

Interim CFO vs. Fractional CFO: What's the Difference? - This article discusses how interim CFOs provide temporary financial leadership during significant changes, offering a fresh perspective and unbiased guidance.

How to Hire an Interim CFO: A Comprehensive Guide - This guide outlines the importance of interim CFOs in addressing financial challenges and transitions, emphasizing their role in elevating financial strategy.

dowidth.com

dowidth.com