Environmental Social Governance (ESG) accounting focuses on quantifying a company's sustainability and ethical impact through metrics like carbon footprint, social responsibility initiatives, and governance practices. Managerial accounting, meanwhile, centers on internal financial analysis for decision-making, budgeting, and performance evaluation. Explore how integrating ESG metrics with managerial accounting can drive more responsible and effective business strategies.

Why it is important

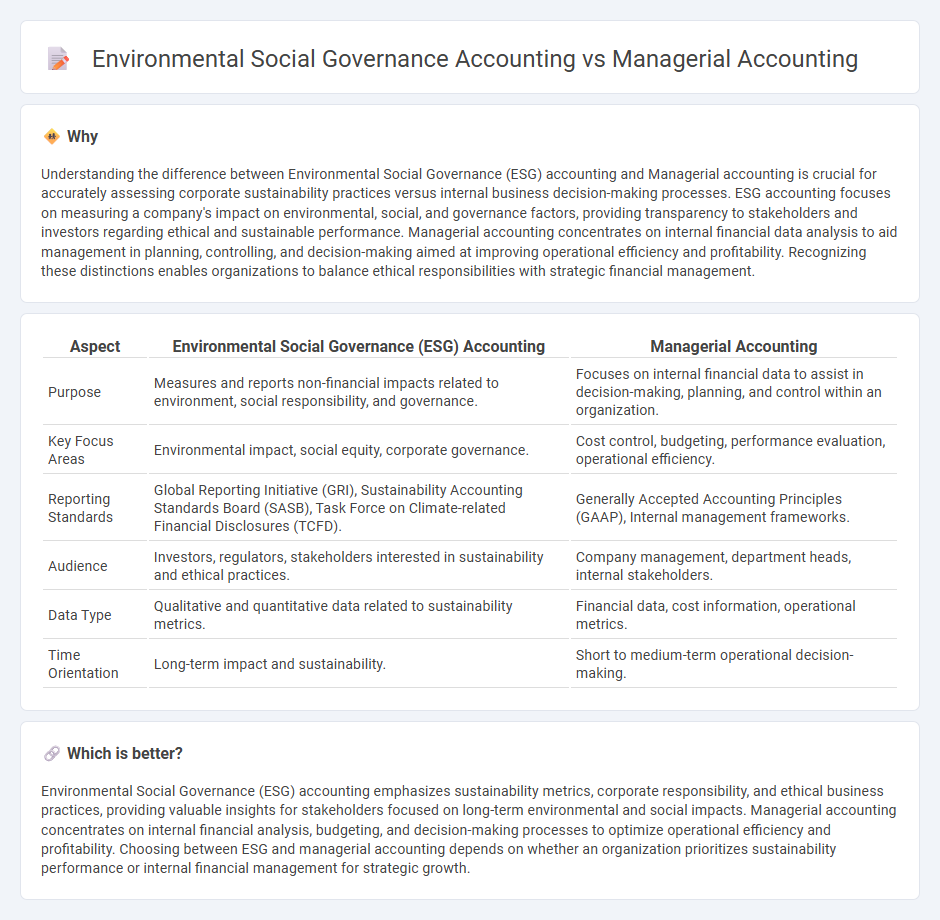

Understanding the difference between Environmental Social Governance (ESG) accounting and Managerial accounting is crucial for accurately assessing corporate sustainability practices versus internal business decision-making processes. ESG accounting focuses on measuring a company's impact on environmental, social, and governance factors, providing transparency to stakeholders and investors regarding ethical and sustainable performance. Managerial accounting concentrates on internal financial data analysis to aid management in planning, controlling, and decision-making aimed at improving operational efficiency and profitability. Recognizing these distinctions enables organizations to balance ethical responsibilities with strategic financial management.

Comparison Table

| Aspect | Environmental Social Governance (ESG) Accounting | Managerial Accounting |

|---|---|---|

| Purpose | Measures and reports non-financial impacts related to environment, social responsibility, and governance. | Focuses on internal financial data to assist in decision-making, planning, and control within an organization. |

| Key Focus Areas | Environmental impact, social equity, corporate governance. | Cost control, budgeting, performance evaluation, operational efficiency. |

| Reporting Standards | Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), Task Force on Climate-related Financial Disclosures (TCFD). | Generally Accepted Accounting Principles (GAAP), Internal management frameworks. |

| Audience | Investors, regulators, stakeholders interested in sustainability and ethical practices. | Company management, department heads, internal stakeholders. |

| Data Type | Qualitative and quantitative data related to sustainability metrics. | Financial data, cost information, operational metrics. |

| Time Orientation | Long-term impact and sustainability. | Short to medium-term operational decision-making. |

Which is better?

Environmental Social Governance (ESG) accounting emphasizes sustainability metrics, corporate responsibility, and ethical business practices, providing valuable insights for stakeholders focused on long-term environmental and social impacts. Managerial accounting concentrates on internal financial analysis, budgeting, and decision-making processes to optimize operational efficiency and profitability. Choosing between ESG and managerial accounting depends on whether an organization prioritizes sustainability performance or internal financial management for strategic growth.

Connection

Environmental Social Governance (ESG) accounting integrates sustainability metrics into financial reporting, enabling organizations to measure social and environmental impacts alongside economic performance. Managerial accounting provides internal financial insights that support strategic decision-making, which increasingly incorporates ESG criteria for risk management and value creation. The connection lies in leveraging managerial accounting data to quantify ESG initiatives, aligning operational goals with responsible business practices and transparent stakeholder communication.

Key Terms

**Managerial accounting:**

Managerial accounting centers on providing detailed financial and operational information to internal management for effective decision-making, budgeting, and performance evaluation. It emphasizes cost analysis, forecasting, and resource allocation to optimize business operations and profitability. Explore deeper insights into how managerial accounting drives strategic management and enhances organizational efficiency.

Cost analysis

Managerial accounting emphasizes cost analysis to optimize internal budgeting, resource allocation, and performance measurement, using detailed financial data to drive operational efficiency. Environmental, Social, and Governance (ESG) accounting integrates cost analysis with sustainability metrics, assessing environmental impact, social responsibility, and governance practices to support long-term value creation and ethical business strategies. Explore in-depth differences and applications between managerial accounting and ESG accounting for strategic decision-making.

Budgeting

Managerial accounting emphasizes budgeting by providing detailed financial plans aimed at optimizing internal resource allocation and cost control for improved business performance. Environmental, Social, and Governance (ESG) accounting integrates sustainability metrics into budgeting processes, ensuring that financial decisions align with ecological impact, social responsibility, and corporate governance standards. Explore how these accounting approaches can transform budgeting strategies to create both financial and sustainable value.

Source and External Links

Managerial Accounting: Key Techniques and Decision-Making Tools - Managerial accounting involves the identification, measurement, analysis, and interpretation of accounting information to support internal decision-making, focusing on areas like product lines, cost accounting, and operations, differing from financial accounting which targets external reporting standards like GAAP.

Managerial Accounting: Everything You Need To Know - It is a role where accountants use financial data to assist business decisions related to cost management, budgeting, performance monitoring, and strategic planning, emphasizing internal support rather than external financial reporting.

Managerial Accounting Made Easy - NetSuite - Managerial accounting applies principles like causality and analogy to analyze company operations and performance, often through scenario planning and segmentation, providing actionable insights for planning, controlling, and strategy development.

dowidth.com

dowidth.com