Digital asset taxation involves the IRS treating cryptocurrencies as property, subjecting transactions to capital gains taxes based on asset holding periods and transaction types. Stock option taxation depends on the option type--non-qualified stock options trigger ordinary income tax on the spread at exercise, while incentive stock options may qualify for favorable capital gains tax treatment if holding requirements are met. Explore detailed tax rules and reporting requirements for both digital assets and stock options to optimize your financial strategies.

Why it is important

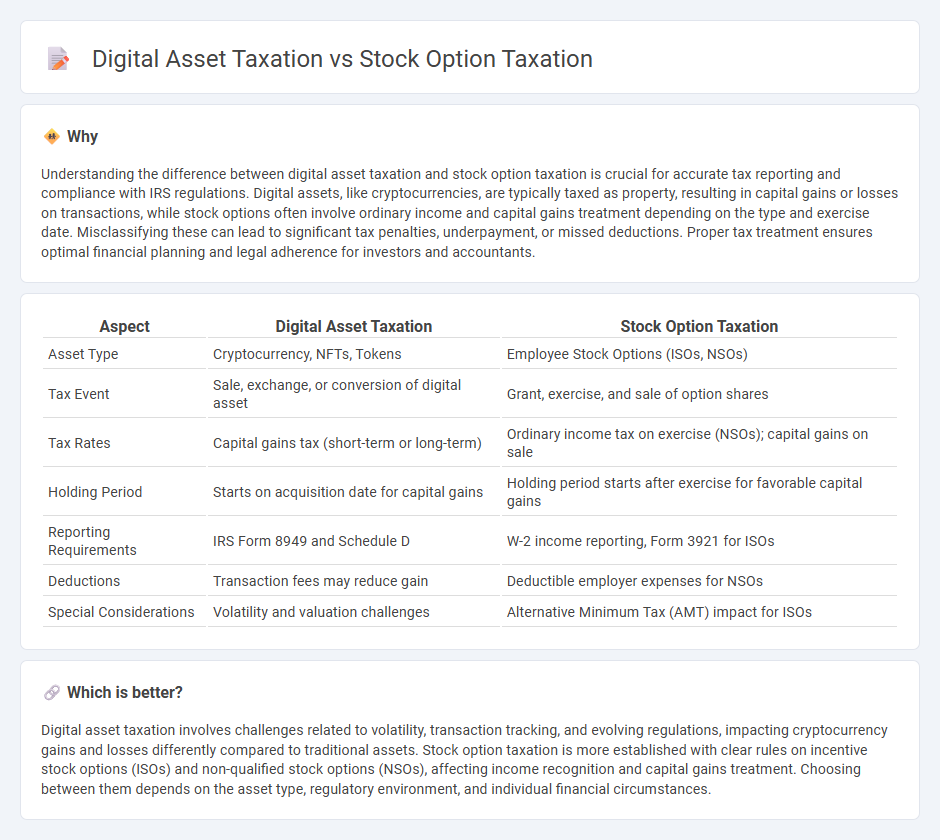

Understanding the difference between digital asset taxation and stock option taxation is crucial for accurate tax reporting and compliance with IRS regulations. Digital assets, like cryptocurrencies, are typically taxed as property, resulting in capital gains or losses on transactions, while stock options often involve ordinary income and capital gains treatment depending on the type and exercise date. Misclassifying these can lead to significant tax penalties, underpayment, or missed deductions. Proper tax treatment ensures optimal financial planning and legal adherence for investors and accountants.

Comparison Table

| Aspect | Digital Asset Taxation | Stock Option Taxation |

|---|---|---|

| Asset Type | Cryptocurrency, NFTs, Tokens | Employee Stock Options (ISOs, NSOs) |

| Tax Event | Sale, exchange, or conversion of digital asset | Grant, exercise, and sale of option shares |

| Tax Rates | Capital gains tax (short-term or long-term) | Ordinary income tax on exercise (NSOs); capital gains on sale |

| Holding Period | Starts on acquisition date for capital gains | Holding period starts after exercise for favorable capital gains |

| Reporting Requirements | IRS Form 8949 and Schedule D | W-2 income reporting, Form 3921 for ISOs |

| Deductions | Transaction fees may reduce gain | Deductible employer expenses for NSOs |

| Special Considerations | Volatility and valuation challenges | Alternative Minimum Tax (AMT) impact for ISOs |

Which is better?

Digital asset taxation involves challenges related to volatility, transaction tracking, and evolving regulations, impacting cryptocurrency gains and losses differently compared to traditional assets. Stock option taxation is more established with clear rules on incentive stock options (ISOs) and non-qualified stock options (NSOs), affecting income recognition and capital gains treatment. Choosing between them depends on the asset type, regulatory environment, and individual financial circumstances.

Connection

Digital asset taxation and stock option taxation both involve complex valuation methods and reporting requirements governed by tax authorities to ensure compliance. Both types of taxation require precise calculation of fair market value at specific points in time, often triggering taxable events upon exercise, sale, or transfer. Understanding the interplay between these tax rules is essential for accurate financial reporting and minimizing tax liabilities in investment portfolios.

Key Terms

Capital Gains

Stock option taxation primarily involves capital gains calculated from the difference between the exercise price and the fair market value at the time of sale, with qualified stock options often benefiting from favorable long-term capital gains rates. Digital asset taxation, governed by IRS guidelines for cryptocurrencies and NFTs, treats gains as capital gains when assets are sold or exchanged, with holding periods influencing short-term versus long-term capital gains tax classification. Explore further to understand specific tax implications and reporting requirements for both asset types.

Vesting

Stock option taxation centers on the vesting event as the critical point where options become taxable, often at ordinary income rates based on the fair market value of shares acquired. Digital asset taxation during vesting--such as in token grants or blockchain-based equity--varies by jurisdiction but generally treats vested tokens as taxable income, with potential capital gains implications upon disposal. Explore further details on how vesting impacts tax strategies and reporting complexities in both asset classes.

Cost Basis

Stock option taxation hinges on the determination of cost basis at the time of exercise, which directly affects capital gains calculation upon sale. Digital asset taxation, conversely, requires meticulous tracking of cost basis for each transaction, considering acquisition price plus any fees, impacting gains or losses recognition. Explore detailed strategies to optimize cost basis management for both stock options and digital assets.

Source and External Links

How Stock Options Are Taxed and Reported - This guide explains how stock options are taxed, focusing on ISOs and NSOs, including tax implications at exercise and sale, and the role of AMT for ISOs.

How Stock Options Are Taxed: ISO vs NSO Tax Treatments - This resource compares the tax treatments of ISOs and NSOs, highlighting differences in tax liability at exercise and sale, and the potential for AMT with ISOs.

Incentive Stock Options - This provides an overview of ISOs, including how they are taxed at different stages of ownership and sale, emphasizing long-term capital gains for qualifying dispositions.

dowidth.com

dowidth.com