Embedded finance compliance involves ensuring that financial services integrated within non-financial platforms adhere to regulatory standards, minimizing legal and operational risks. Fintech risk assessment focuses on evaluating potential technological, financial, and cybersecurity threats unique to financial technology innovations. Explore further to understand how these frameworks safeguard financial ecosystems while promoting innovation.

Why it is important

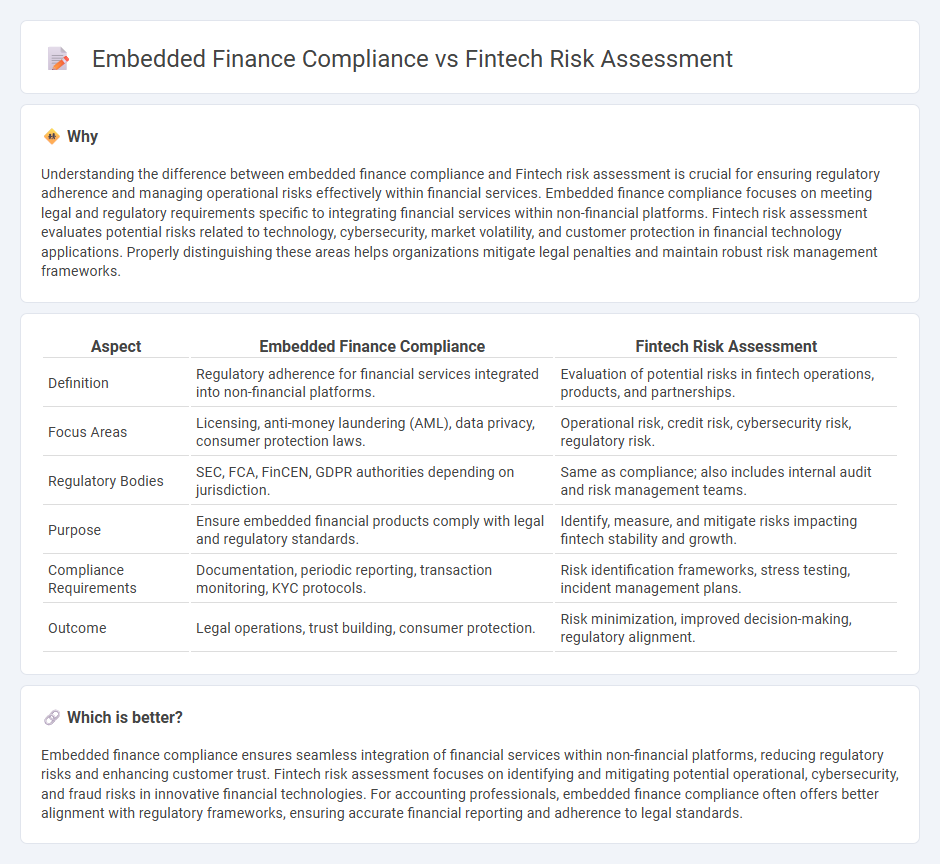

Understanding the difference between embedded finance compliance and Fintech risk assessment is crucial for ensuring regulatory adherence and managing operational risks effectively within financial services. Embedded finance compliance focuses on meeting legal and regulatory requirements specific to integrating financial services within non-financial platforms. Fintech risk assessment evaluates potential risks related to technology, cybersecurity, market volatility, and customer protection in financial technology applications. Properly distinguishing these areas helps organizations mitigate legal penalties and maintain robust risk management frameworks.

Comparison Table

| Aspect | Embedded Finance Compliance | Fintech Risk Assessment |

|---|---|---|

| Definition | Regulatory adherence for financial services integrated into non-financial platforms. | Evaluation of potential risks in fintech operations, products, and partnerships. |

| Focus Areas | Licensing, anti-money laundering (AML), data privacy, consumer protection laws. | Operational risk, credit risk, cybersecurity risk, regulatory risk. |

| Regulatory Bodies | SEC, FCA, FinCEN, GDPR authorities depending on jurisdiction. | Same as compliance; also includes internal audit and risk management teams. |

| Purpose | Ensure embedded financial products comply with legal and regulatory standards. | Identify, measure, and mitigate risks impacting fintech stability and growth. |

| Compliance Requirements | Documentation, periodic reporting, transaction monitoring, KYC protocols. | Risk identification frameworks, stress testing, incident management plans. |

| Outcome | Legal operations, trust building, consumer protection. | Risk minimization, improved decision-making, regulatory alignment. |

Which is better?

Embedded finance compliance ensures seamless integration of financial services within non-financial platforms, reducing regulatory risks and enhancing customer trust. Fintech risk assessment focuses on identifying and mitigating potential operational, cybersecurity, and fraud risks in innovative financial technologies. For accounting professionals, embedded finance compliance often offers better alignment with regulatory frameworks, ensuring accurate financial reporting and adherence to legal standards.

Connection

Embedded finance compliance ensures that financial services integrated into non-financial platforms adhere to regulatory standards, minimizing legal and operational risks. Fintech risk assessment evaluates potential threats related to technology, data security, and regulatory breaches within these embedded financial solutions. Together, they form a comprehensive framework that safeguards accounting accuracy, protects sensitive financial data, and enforces compliance in embedded finance ecosystems.

Key Terms

Risk Scoring (Fintech risk assessment)

Risk scoring in fintech risk assessment quantifies potential financial threats by analyzing variables such as transaction anomalies, credit history, and behavioral patterns, facilitating more precise decision-making. Embedded finance compliance necessitates stringent adherence to regulatory standards and continuous monitoring to mitigate risks inherent in integrating financial services within non-financial platforms. Explore detailed strategies and tools to optimize risk scoring and compliance frameworks in dynamic fintech environments.

AML/KYC (Embedded finance compliance)

Fintech risk assessment primarily targets identifying and mitigating financial threats through robust anti-money laundering (AML) and know your customer (KYC) protocols, ensuring secure transactional environments. Embedded finance compliance integrates AML/KYC processes directly into non-financial platforms, enhancing seamless regulatory adherence within everyday user interactions. Explore deeper insights into how these approaches uniquely safeguard financial ecosystems in embedded finance and fintech sectors.

Transaction Monitoring (Relevant to both)

Fintech risk assessment emphasizes identifying and mitigating fraud, money laundering, and credit risks through robust transaction monitoring systems that analyze patterns and flag suspicious activities efficiently. Embedded finance compliance integrates transaction monitoring within third-party platforms, ensuring adherence to regulations like AML and KYC while maintaining seamless user experiences. Explore how advanced transaction monitoring bridges fintech risk management and embedded finance compliance for enhanced security and regulatory adherence.

Source and External Links

Fintech Risk Management - This article discusses strategies for fintech risk management, including frameworks for identifying, assessing, and mitigating risks, along with the role of technology in enhancing risk detection and compliance.

Fintech Risk Management: Strategies For Success - This blog provides a comprehensive overview of fintech risks, including regulatory, operational, cybersecurity, and vendor risks, and outlines strategies for successful risk management.

A Fintech Risk Assessment Model - This publication proposes a structured fintech risk assessment model that includes processes like risk identification, qualitative and quantitative analysis, and risk monitoring across different domains.

dowidth.com

dowidth.com